The S&P Global US Services PMI was revised higher to 44.70 in December from a preliminary reading of 44.40, above market expectations of 44.4. Reading continues to point to a sixth straight month of falling services activity and the second-fastest since May of 2020. Lower business activity was commonly attributed to a further reduction in new orders, as client demand weakened due to the impact of higher interest rates and inflation on customer spending. New export orders also declined amid global economic uncertainty and high inflation in key export markets. Meanwhile, job creation was only marginal overall as cost saving initiatives and lay-offs weighed on hiring.

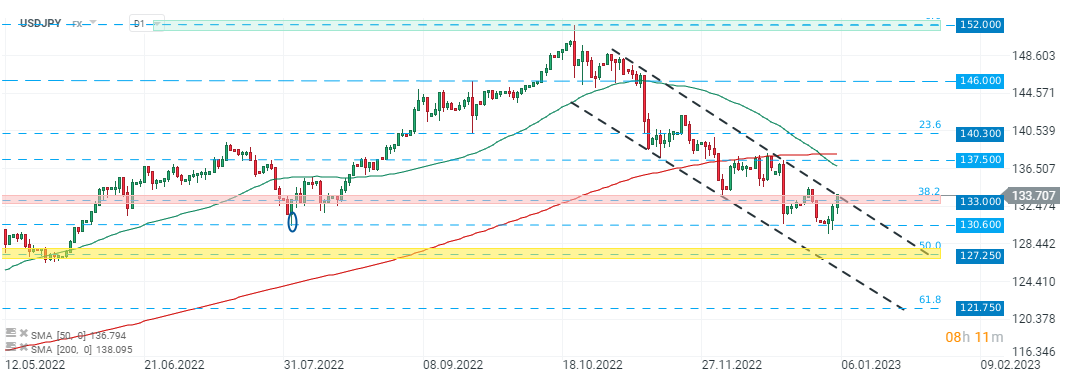

USDJPY pair broke above major resistance at 133.00. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report