Wall Street indices are taking a hit today, with tech sector driving the sell-off. Nasdaq-100 (US100) is down 2% on the day and drops to the lowest level in 2 weeks. Reason behind the deterioration in sentiment are media reports saying that United States has warned its allies that it will apply the most severe trade restrictions on companies that continue to provide China with advanced semiconductor technology. US considers using foreign direct product rule that allows it to impose controls on products that have US technology in it. The move would primarily be target at Dutch ASML and Japanese Tokyo Electron, which manufacture machinery used in semiconductor making.

However, US semiconductor sector is also taking a hit, with shares of majority of US chip companies trading lower.

- Nvidia (NVDA.US) drops over 5%

- AMD (AMD.US) plunges over 7%

- Broadcom (AVGO.US) declines 5%

- Micron Technology (MU.US) drops 4%

- Super Micro Computer (SMCI.US) trades over 5% lower

- ARM (ARM.US) plunges 7%

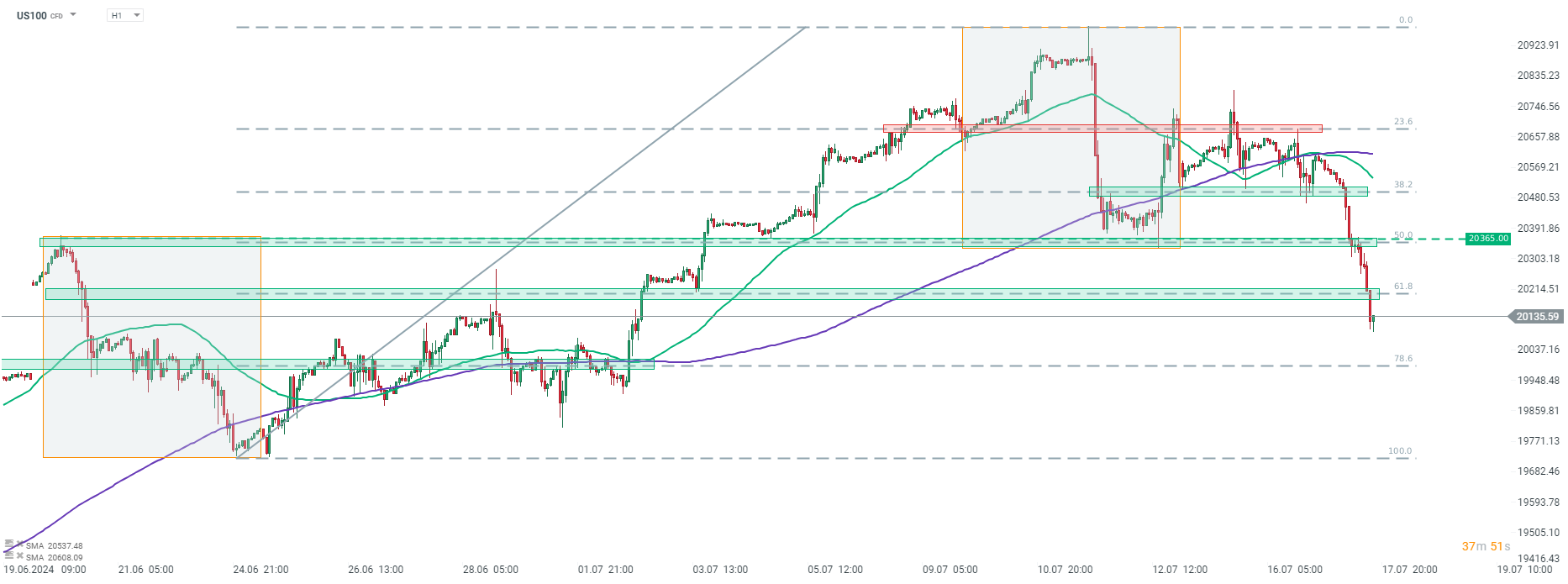

US100 plunges to the lowest level since July 2, 2024. Index plunged below the lower limit of market geometry and the 50% retracement of the upward impulse launched in late-June today, and declines accelerated later on. Sellers pushed price below another important short-term support zone later on - 61.8% retracement in 20,200 pts area. The next potential support is marked with 78.6% retracement in the psychological 20,000 pts area. However, declines have been halted for now and an attempt to launch a recovery move can be observed.

US100 at H1 interval. Source: xStation5

US100 at H1 interval. Source: xStation5

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️