Employment report for March from ADP, scheduled for release at 1:15 pm BST, is one of two key US data pieces set to be released today (the other one being services ISM at 3:00 pm BST). Report will be one of the final hints ahead of the NFP report for March, scheduled for this Friday, 1:30 pm BST. The report will be watched closely as the US labor market may be reaching a turning point. While up to this point any deterioration was mostly limited to leading indicators, like ISM employment subindices. However, hard data started to show worrying signs recently as well. Namely, data on job openings (JOLTS) released yesterday showed a big drop. A drop in the number of job openings is a strong signal that the US economy is indeed slowing and that the impact of this slowdown may soon be visible on the labor market.

Market reaction to ADP release today may be limited as attention is mostly on Friday's NFP. Markets could, however, react should we see a big deviation from an expected gain of 200k. Direction of market reaction will depend on how data may impact Fed's decisions. Having said that, a strong ADP report would be seen as hawkish as it would hint that there are no reasons for policy pivot yet. A hawkish reaction would see USD gain and indices drop. On the other hand, a dovish weaker-than-expected print may trigger a bullish reaction on indices and a pullback on USD.

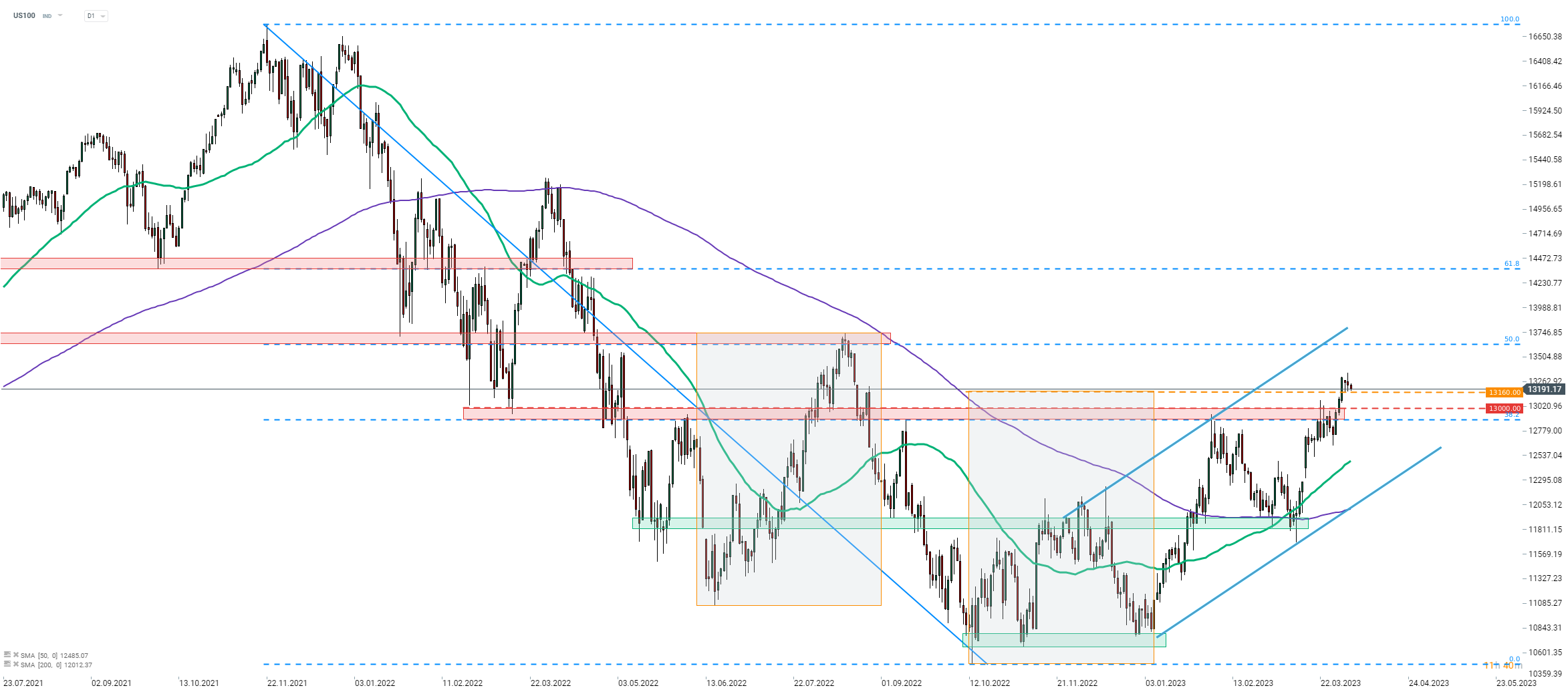

Nasdaq-100 (US100) is trading in an interesting technical spot. Index broke above the upper limit of the Overbalance structure at 13,160 pts recently and reached the highest level since August 2022. However, bulls failed to extend the move following the break and a small pullback can be observed this week. Source: xStation5

Nasdaq-100 (US100) is trading in an interesting technical spot. Index broke above the upper limit of the Overbalance structure at 13,160 pts recently and reached the highest level since August 2022. However, bulls failed to extend the move following the break and a small pullback can be observed this week. Source: xStation5

Economic calendar: US CPI Inflation the Most Important Report of the Week 🔎

Market wrap (09.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)