Futures linked to major Wall Street indices bounced off daily lows , while dollar erased some of the early gains following publication of FED's Chair Powel prepared remarks for Sweden's Riksbank symposium on central bank independence, organized by Riksbank.

Remarks showed that Powell will not discuss the state of the US economy or the prognosis for monetary policy, therefore markets attention will turns on Thursday's CPI inflation reading.

Below are key takeaways from Powell remarks:

-

Without congressional laws, it is inappropriate for us to use our monetary or supervisory tools to promote a greener economy.

-

The Fed must resist temptation to broaden its scope to address other important social issues.

-

The Fed has narrow responsibilities regarding climate-related financial risks.

As for inflation, the market expects a reading of 6.5%, while in November it was 7.1%YoY. Can inflation surprise with a lower reading? Here attention may focus not only on energy prices (in December fuel prices were lower than in December 2021), but also on food, which maintains a significant contribution to inflation (approx. 1.5-1.6 percentage points in recent months) . If the contribution of food inflation drops significantly, then this will be a sign of potential deeper declines in the coming months.

The latest contribution of energy prices is 1.0 pp, while food prices are 1.5 pp. Source: Bloomberg

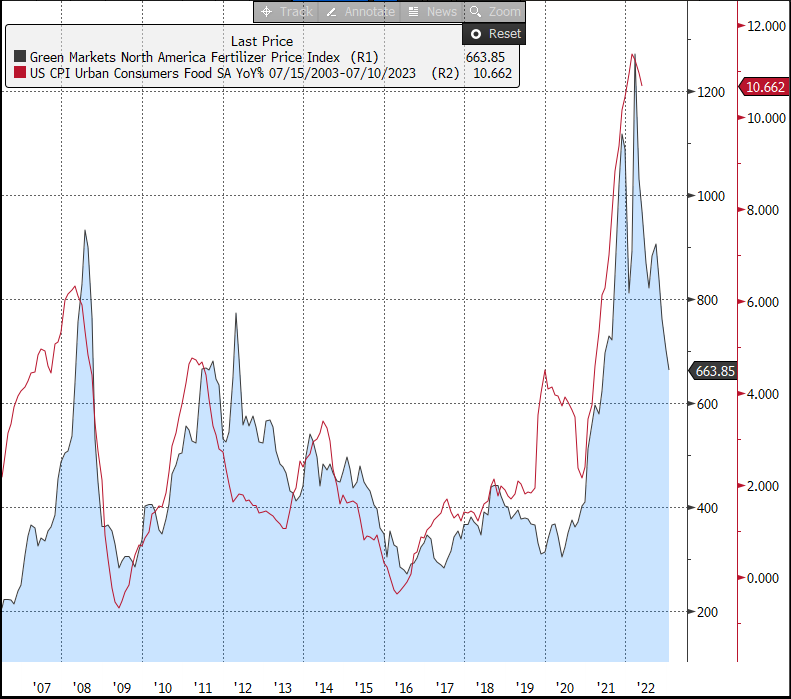

Food inflation is still over 10% y/y! However, the prices of fertilizers, which affect the prices of agricultural commodities and, of course, food, suggest that food inflation is coming to a halt. Source: Bloomberg

Food inflation is still over 10% y/y! However, the prices of fertilizers, which affect the prices of agricultural commodities and, of course, food, suggest that food inflation is coming to a halt. Source: Bloomberg US500 again approaches major resistance at 3900 pts. Source: xStation5

US500 again approaches major resistance at 3900 pts. Source: xStation5Daily summary: Wall Street and precious metals try to rebound 📈Microsoft down 12%

US Open🚨US100 slides almost 2% amid 11% Microsoft shares crash📉

BigTech support US100📈Microsft, Tesla and Meta Platforms publish Q4 results!

Daily Summary – Bessent Rescues the Dollar, Fed Delivers Hawkish Pivot