The US dollar is trading lower against the majority of other major currencies ahead of the release of key jobs data. US index futures are trading little changed on the day. NFP report for August can seal the deal on QE taper but a strong reading would be needed. Meanwhile, ADP data released on Wednesday missed expectations significantly and showed a mere 374k jobs gain (exp. 615k). The two reports have often diverged in the previous months then there is still scope for a bullish surprise. Data is likely to be debated extensively next week as a number of Fed members is scheduled to speak. 6 US central bankers are set to deliver speeches on Wednesday alone!

Market expectations

-

Non-farm payrolls. Expected: 750k. Previous: 943k

-

Unemployment rate. Expected: 5.2%. Previous: 5.4%

-

Wage growth. Expected: 4% YoY. Previous: 4% YoY

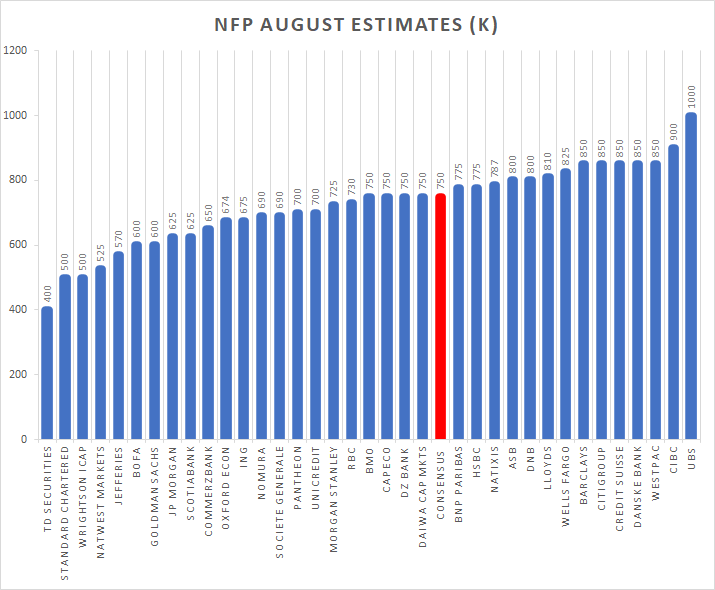

August NFP forecast compilation from Newsquawk. As one can see, the range of estimates (400-1000k) is wide. Interestingly, neither of institutions included in the ranking expects as weak reading as ADP data showed (374k). Source: Newsquawk Twitter

August NFP forecast compilation from Newsquawk. As one can see, the range of estimates (400-1000k) is wide. Interestingly, neither of institutions included in the ranking expects as weak reading as ADP data showed (374k). Source: Newsquawk Twitter

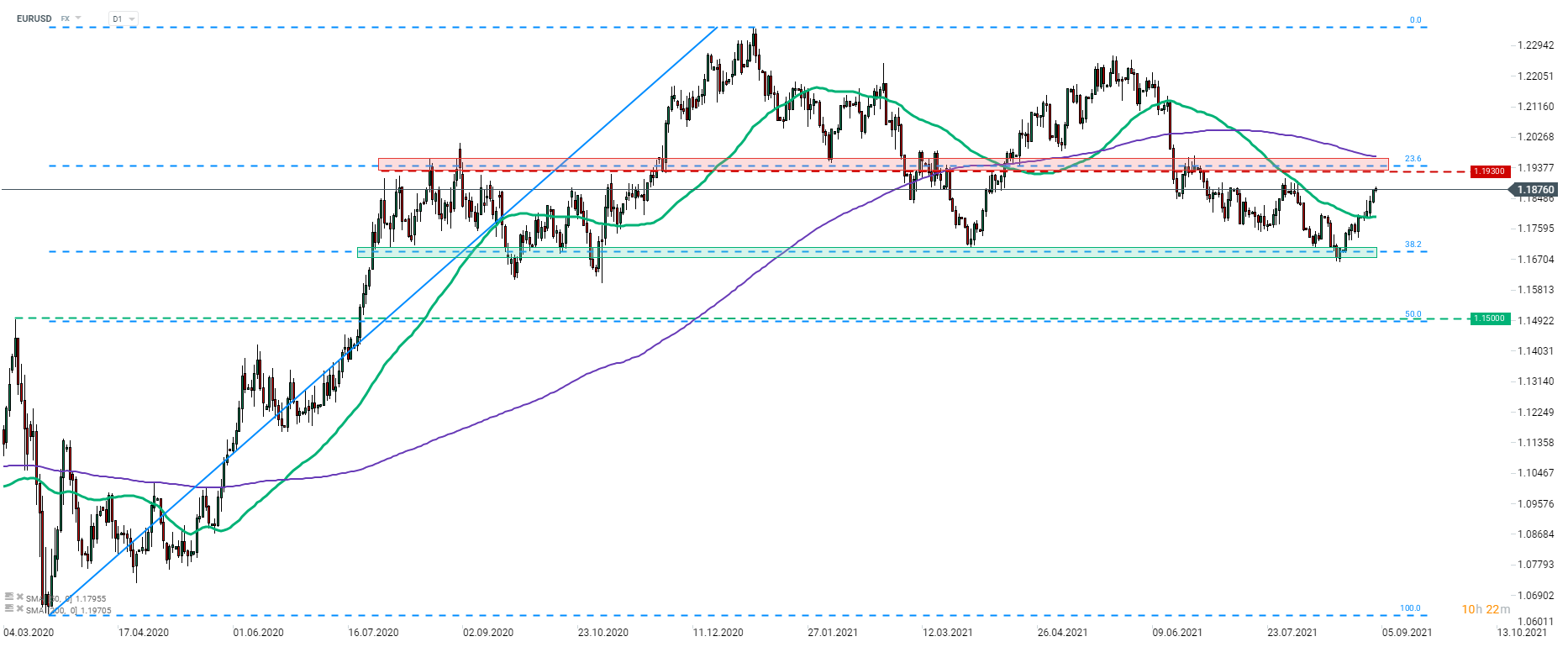

EURUSD continues to climb higher on USD weakness. The pair is slowly approaching the resistance zone at 1.1930, marked with previous price reactions and the 23.6% retracement of upward impulse launched in March 2020. Source: xStation5

EURUSD continues to climb higher on USD weakness. The pair is slowly approaching the resistance zone at 1.1930, marked with previous price reactions and the 23.6% retracement of upward impulse launched in March 2020. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)