Text of Powell's testimony has just been released and did not cause any moves on the market. Here are the key remarks from Powell:

-

US short-term interest rate futures drop after Fed Chair Powell says rates may need to go higher & faster

-

Fed policy rate futures price in a greater likelihood of a half-point rate hike in March.

-

Restoring price stability will almost certainly necessitate us maintaining a restrictive policy stance for some time.

-

The ultimate level of interest rates is likely to be higher than previously predicted.

-

We will continue to make decisions meeting by meeting, based on the totality of incoming data and its implications for the growth and inflation outlook

-

If the totality of the incoming data indicates that faster tightening is required, we are prepared to accelerate rate hikes

Very hawkish declarations, but also Fed left open the door for a quick exit if the data clearly deteriorates. Nevertheless, in the first reaction we see drops on the US100, strengthening of the dollar and raising expectations of 50 bp in March (although at the moment without NFP and inflation data it seems unlikely).

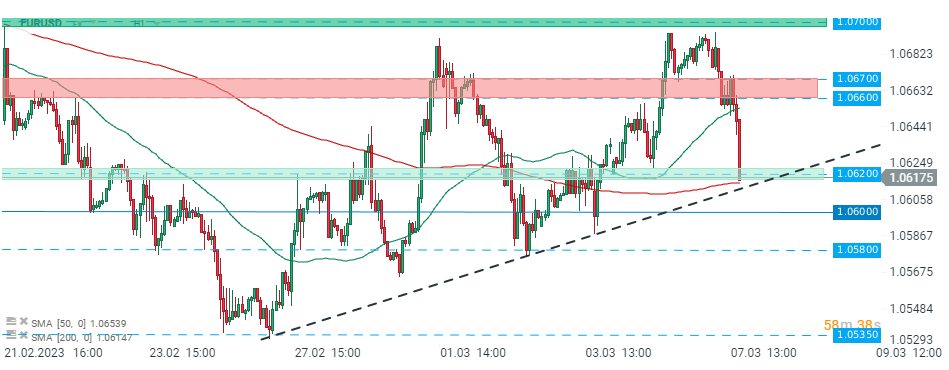

EURUSD pair fell sharply and is testing support at 1.0620. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)