US dollar has been one of the best performing G10 currencies for the major part of the day. Strengthening of USD has been triggered by rather hawkish FOMC minutes release yesterday and supported further by a streak of better-than-expected US data today. ADP data showed a massive beat, lay-offs in Challenger report dropped to a 7-month low and services ISM jumped, driven by strong readings of employment and new orders subindices. However, USD started to give back some gains after the European stock market session closed.

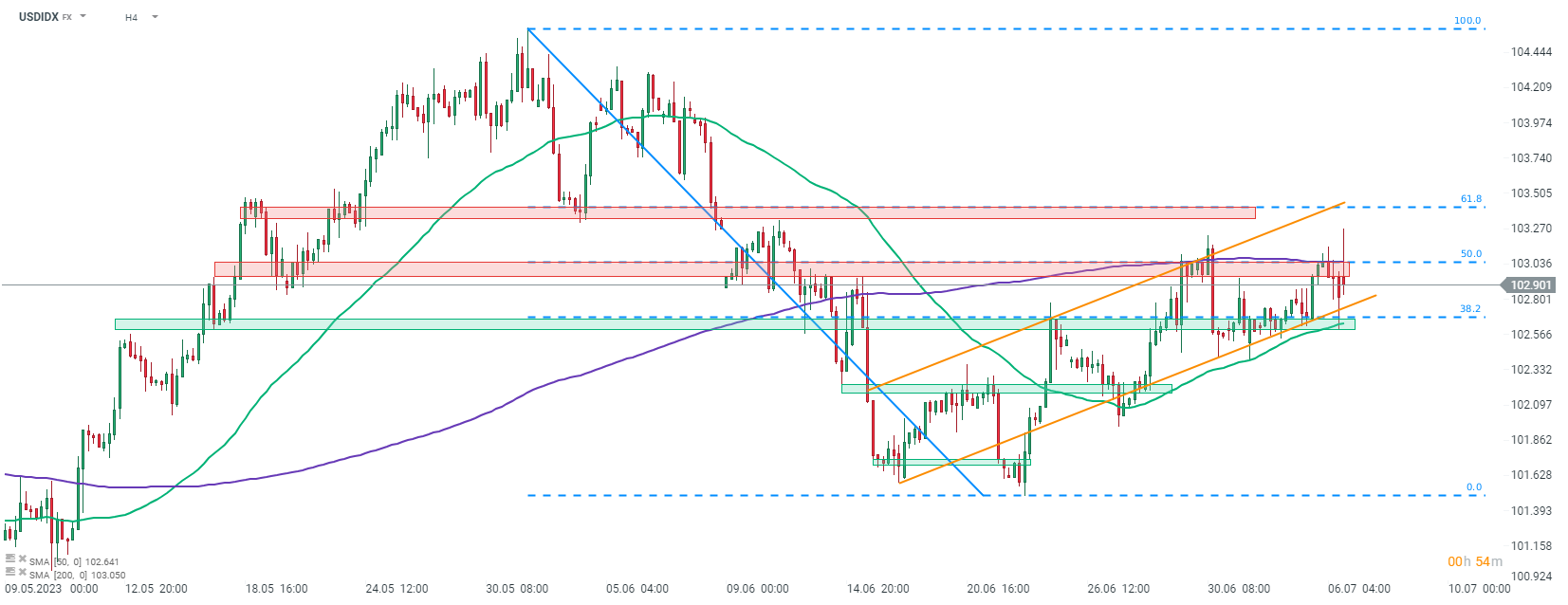

Taking a look at US dollar index chart at the H4 interval, we can see that the index has been trading in a short-term upward channel recently. After a period of trading near the lower limit of the channel, the index managed to bounce higher yesterday. However, advance was halted near midpoint of the channel, at the resistance zone marked with 200-period moving average (purple line) ad 50% retracement of the downward move launched at the end of May. Another attempt to break above this zone was made today and it also failed, leading to a pullback. NFP release tomorrow at 1:30 pm BST could be another driver of USD moves and should we see a strong jobs data, like in today's ADP release, greenback may be set to resume gains.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)