Core PCE prices in the US which exclude food and energy fell to 0.2% month-over-month in September, following 0.3 % gain in August and in line with market expectations of a 0.2% rise. Year-on-year, core PCE inflation stands at 3.6 %, the same as in the previous month and below analysts’ estimates of 3.7%.

Personal income declined to -1.0% MoM in September, from -0.2% drop in August and compared to market expectations of a -0.1% decrease.

Personal spending increased to 0.6% from a month earlier in September, following upwardly revised 1.0% rise in August and compared with market consensus of a 0.5% increase.

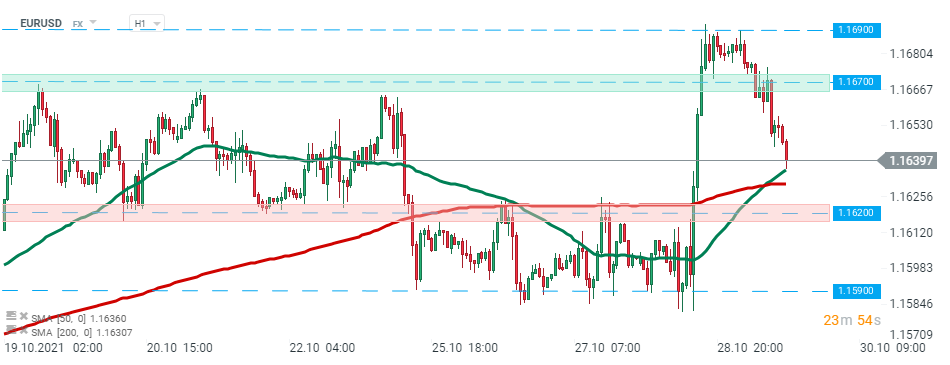

EURUSD saw a relatively small reaction to today’s data releases. The most popular currency pair continued to trade around 1.1640 level. Source: xStation5

EURUSD saw a relatively small reaction to today’s data releases. The most popular currency pair continued to trade around 1.1640 level. Source: xStation5

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)