Bank of Japan is scheduled to announce its monetary policy decision during the next Asia-Pacific session. Timing is tentative but announcement is usually made around 3:00 am GMT. Bank is not expected to change the level of interest rates but it does not mean that it won't do any move.

Expectations

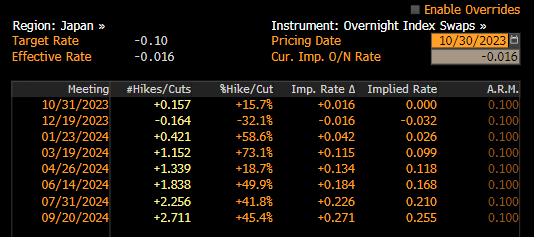

Bank of Japan is expected to keep its main interest rate unchanged at -0.10% at tomorrow's meeting. Such is a view of economists surveyed by Bloomberg and Reuters as well as pricing on the money markets. Swaps price in just 15% chance of a 10 basis point rate hike. The first full hike is currently priced in for March 2024. There is a growing feeling that the Bank of Japan may decide to make a move quicker than that. However, while rate hike at the coming meeting is unlikely, the Bank of Japan may announce some other actions.

Source: Bloomberg Finance LP

Yields keep pushing higher

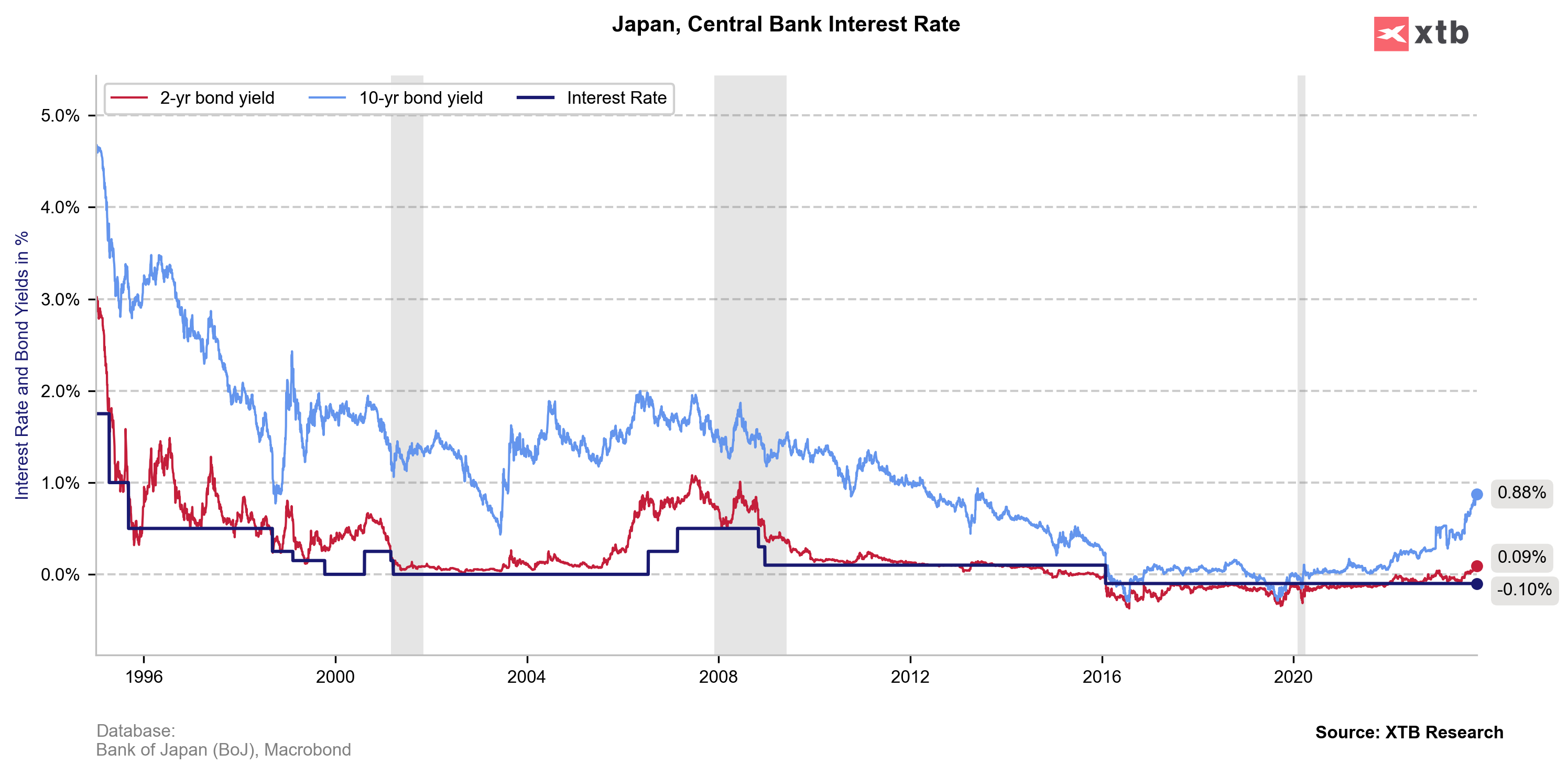

An increase in yields can be seen all around the world and Japan is no exception. Bank of Japan maintained a 0% target on 10-year government yield with a 50 bps tolerance band. However, continued increase in yields caused BoJ to relax the band and allow for upside deviations of up to 100 bp. 10-year yield is currently sitting slightly below 0.90%. Maintaining such a band in a rising yield environment is costly and it cannot be ruled out that it will be relaxed further to allow long-term yields to rise above 1%.

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

A look at JPY

Japanese yen has been under pressure recently. USDJPY is trading near 150.00 - a level that was associated with Bank of Japan interventions. Tests of this level have been met with rapid reversals in the past therefore it could be a nice spot for a pullback. A hawkish surprise from Bank of Japan - for example relaxing band around target yield - should be JPY-positive, especially if it is accompanied with a hawkish guidance on rates. In such a scenario, USDJPY could see a strong pullback from current levels towards the lower limit of the channel. On the other hand, failure to deliver a hawkish message would likely trigger JPY weakness with pair pushing above 150.00 area.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)