World Liberty Financial (WLFI) begins trading today on major cryptocurrency exchanges, including Binance, OKX, and Bybit. The token, originally sold last year as a governance instrument, is now available for open trading.

WLFI is a project directly tied to the U.S. presidential family, including Donald Trump. Early investors are allowed to sell only 20% of their holdings — a deliberate supply management strategy aimed at limiting short-term selling pressure. Trading opened around $0.31 but later fell to $0.24, implying a fully diluted market capitalization of $24 billion. That places WLFI 26th among all crypto projects by market cap.

Estimates suggest the Trump family has already earned around $500 million from the broader World Liberty suite of products, which includes stablecoins, crypto mining, and digital asset funds. Despite criticism over potential conflicts of interest stemming from Trump’s regulatory influence, the project has attracted a wave of retail investors hoping for quick profits.

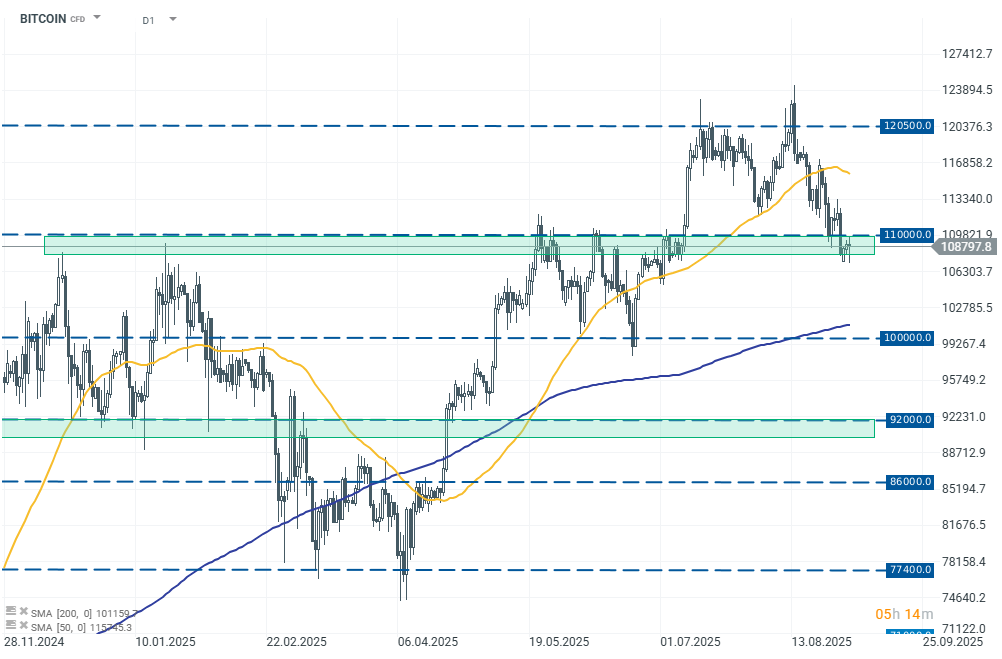

Broader crypto market sentiment remains mixed, though the recent sell-off appears to be slowing. Bitcoin is consolidating near the $108,000 support level.

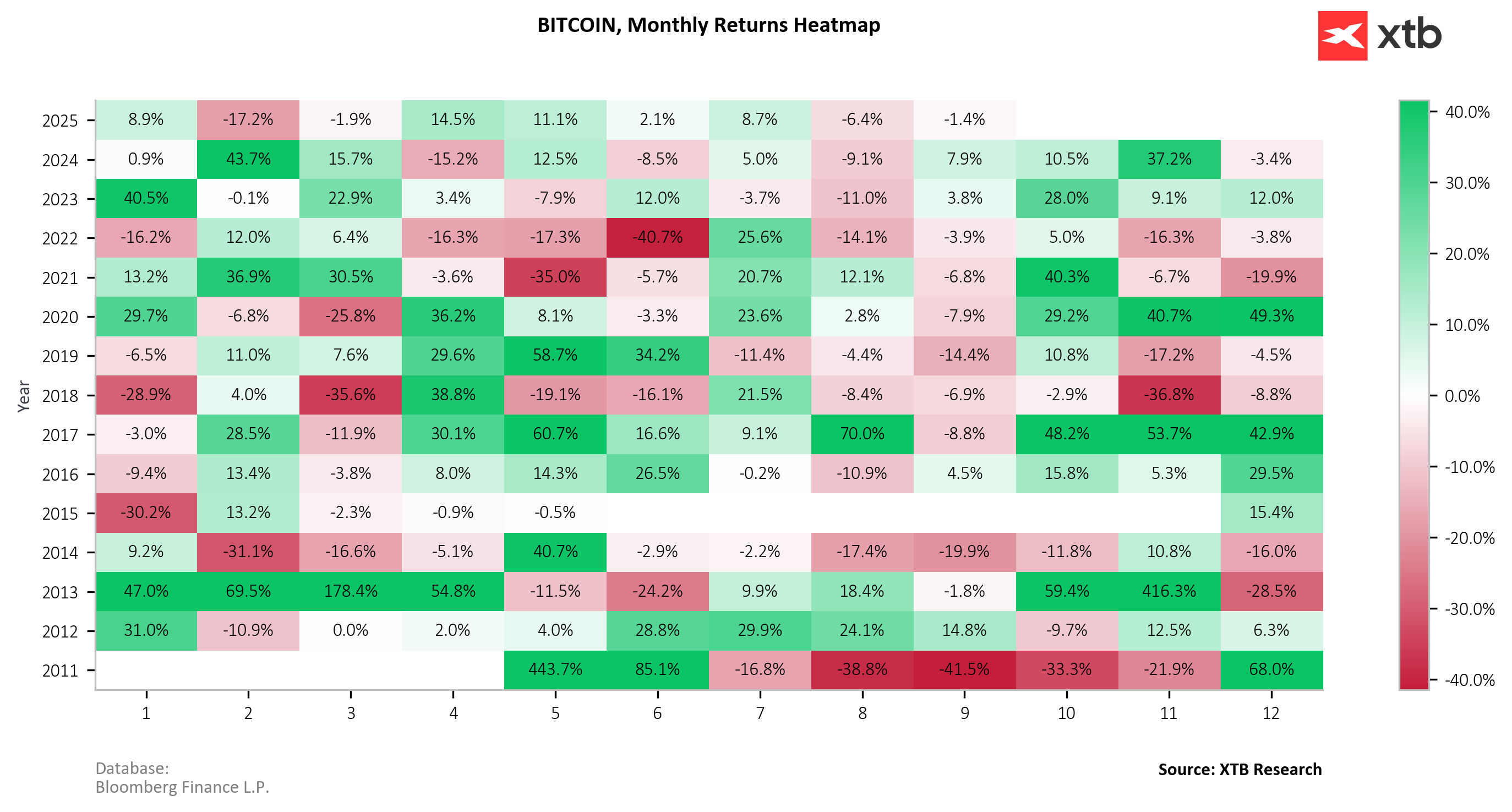

Historically, September has been a weak month for the market, often marked by declines — though exceptions exist, such as last year when Bitcoin gained 7.9% after sell-offs ended in the first week of September.

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30