GOLD maintained a clear upward trend at the beginning of the week after the dollar slowed its rebound following the Fed's decision. Prices reached a historic high of over $3,700 per ounce, benefiting from the expected series of interest rate cuts in the US and growing macroeconomic uncertainty in key global economies. In addition, long-term bond yields in the US, UK, and France are rising, prompting investors to increase their exposure to safe-haven assets. Central banks are accelerating their balance sheet expansion, and gold ETF inventories are at their highest since the end of 2022. Seasonally, September and October are conducive to dynamic movements in the gold market, especially when profit-taking follows the Fed's decision.

GOLD and SILVER are among the best-performing commodities today, outshining OIL.WTI and NATGAS, which are typically more volatile on an intraday basis, based on historical data.

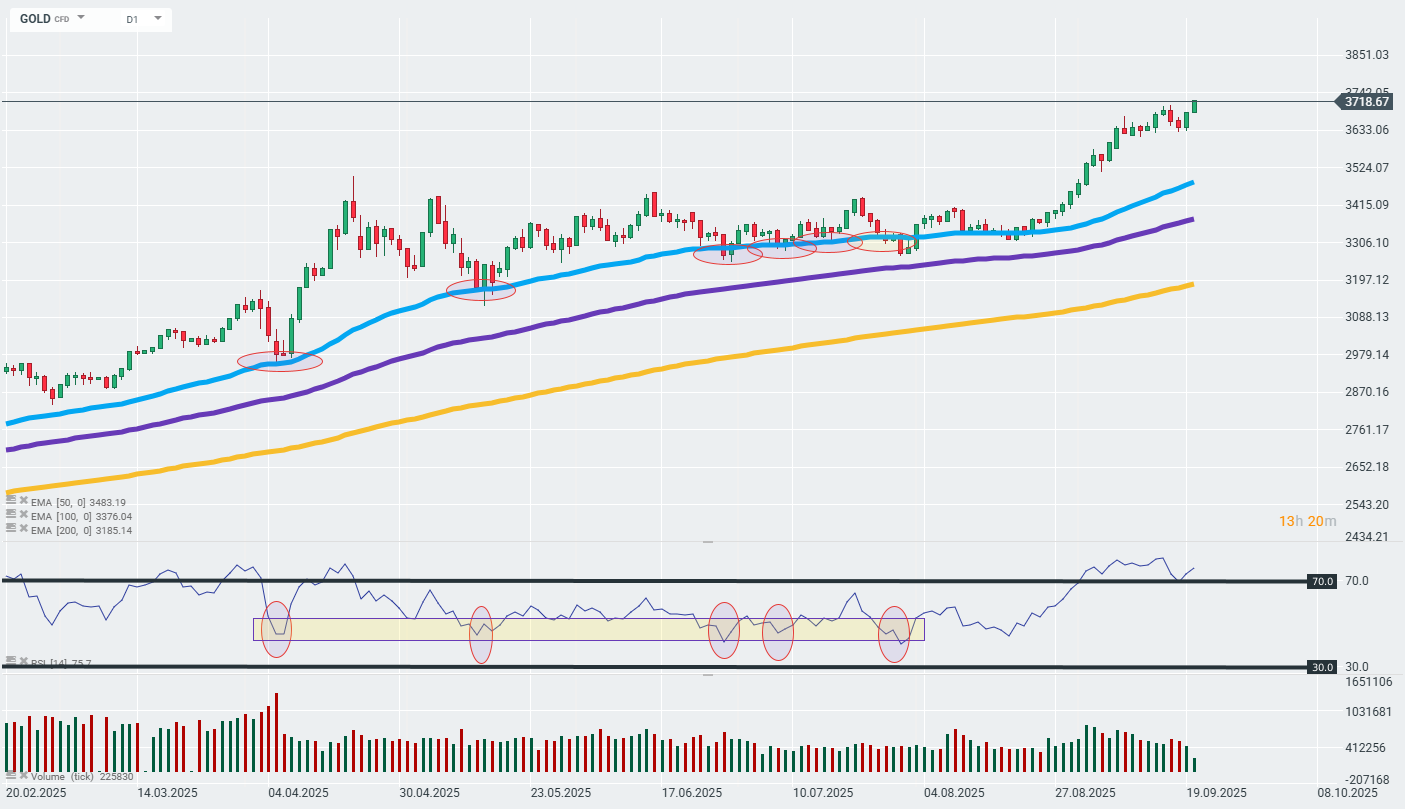

The gold (GOLD) contract is hitting new historic highs today and maintaining a dynamic, long-term upward trend on the instrument. The most important support point remains the 50-day EMA (blue curve in the chart below), which since April this year has repeatedly been the point of activation of demand for the current trend, after which GOLD returned to growth. As long as the instrument remains above this barrier, the overall trend remains unchanged.

Source: xStation a

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause