- European indices finished today's session lower, snapping a four-day winning streak, with German DAX dropped 1.0%, led by an over 6% loss in Mercedes Benz after the carmaker cut prices on some of its EQE and EQS models in China due to changing market demand for top-end electric vehicles.

-

Polish officials said yesterday's missile strike on its territory appears to be an accident by Ukraine

-

ECB may favor 50 basis point rate hike in December rather than 75 basis point, according to Bloomberg sources

-

Downbeat sentiment prevails on Wall Street, where Dow Jones is trading slightly below the flat line, while S&P500 and NASDAQ fell 0.65% and 1.25% respectively as investors digested Target's poor quarterly results and gloomy financial outlook. These figures also pushed down other retailers, including Macy's, Kohl's, Nordstrom, and Gap, deep in the red.

-

On the data front, US retail sales unexpectedly rose 1.3% MoM in October which suggests that US consumers continued to spend despite the weakening economy. However after adjusting for inflation, retail sales reached high in March 2021 & are down 0.3% over the last year. Among other economic releases, industrial production unexpectedly declined.

-

FED Daly said interest rates in the range of 4.75%-5.25% seem appropriate. Holding off future rate hike isn't an option for now;

-

Fed George believes it would make sense to slow pace of rate hikes next year

-

Goldman Sachs now sees the Fed hiking to 5.00-5.25%. Previously banks analysts expected a peak at 4.75-5.00%

-

OIL.WTI fell over 2.0% as flows through the Druzhba pipeline which carries Russian oil to Hungary had resumed following a brief outage. Meanwhile, EIA data showed US crude stocks fell more than expected while gasoline and distillate inventories rose.

-

Gold pulled back from recent high around $1786 and is currently trading around $1772.0 area, while silver again failed to break above key resistance at $22.00 as the dollar attempted to erase some of the recent losses.

-

Downbeat moods prevail on the cryptocurrency market. Bitcoin again moved towards $16400 level, while Ethereum is testing key support at $1200.

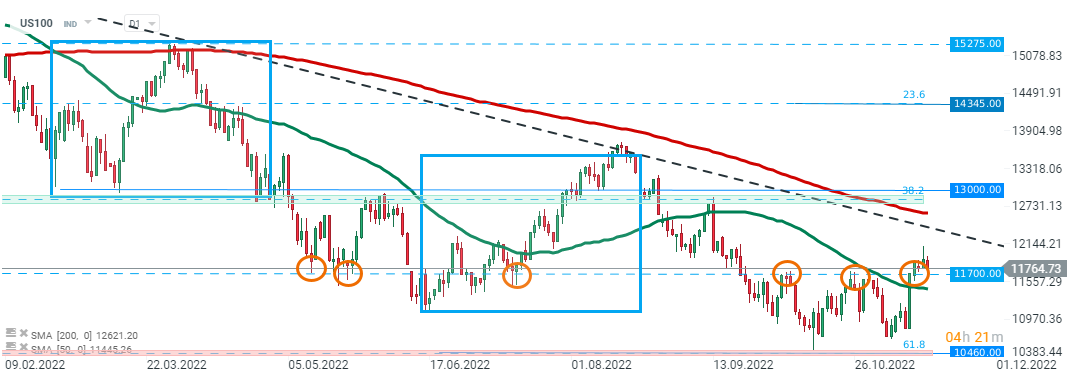

Despite slightly negative sentiment US100 still manages to trade above key support at 11700 pts, which is marked with previous price reactions. As long as the index sits above this level, another upward impulse may be launched towards the downward trendline. On the other hand, should a break lower occur, downward move may deepen towards recent lows at 10460 pts. Source: xStation5

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

Kongsberg Gruppen after earnings: The company catches up with the sector