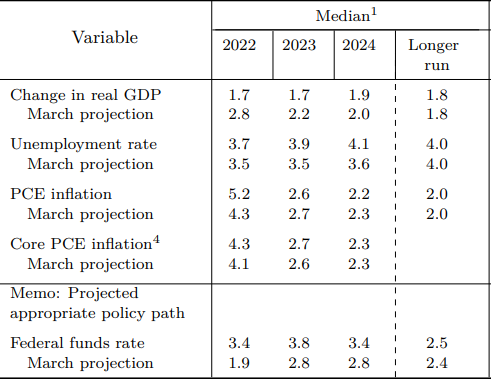

Main currency pair is hovering near 20-year lows less than an hour before the Fed announces its next monetary policy decision (7:00 pm BST). Both - economists and money markets - expect the US central bank to deliver another 75 basis point rate hike. However, hawkish bets increased following the US CPI report for August released last week and some called for a 100 basis point rate move. While this is not the base case scenario, a surprise can never be ruled out. Regardless of whether Fed hikes by 75 or 100 basis points, a lot of attention will be paid to economic forecasts. The most recent set of forecasts from June saw PCE inflation at 5.2% this year and it is almost certain to be revised higher. Also the median forecast for Fed funds rate at the end of 2022 was 3.4%. This is also likely to change given that 3.4% is less than 100 bp above current rate and, if Fed surprises to the upside, rates may jump to 3.25-3.50% range already today.

FOMC economic projections from June. Source: Federal Reserve

FOMC economic projections from June. Source: Federal Reserve

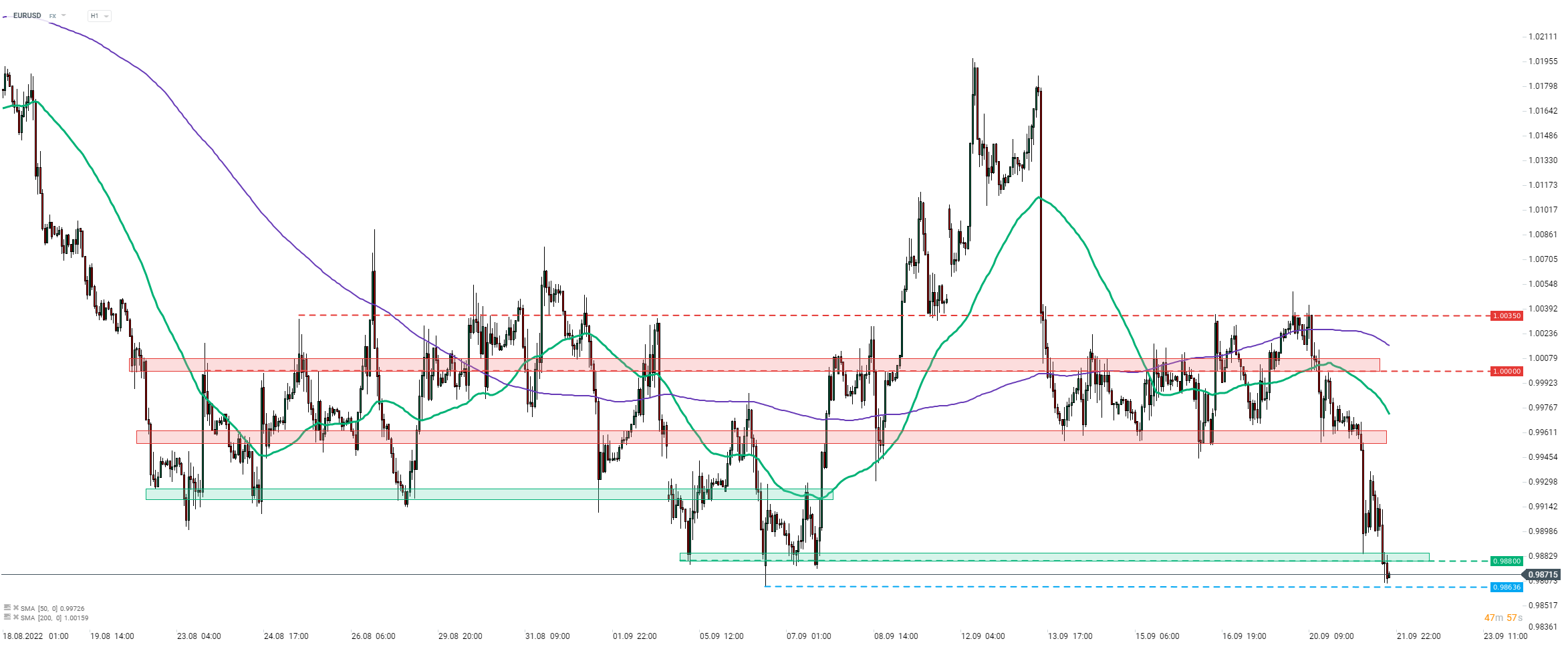

EURUSD dropped below the 0.99 mark today and continued the move lower through the 0.9880 support zone. A low from early September at 0.9863 is within reach and a break below would put the main currency pair at fresh 20-year lows. Source: xStation5

EURUSD dropped below the 0.99 mark today and continued the move lower through the 0.9880 support zone. A low from early September at 0.9863 is within reach and a break below would put the main currency pair at fresh 20-year lows. Source: xStation5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts