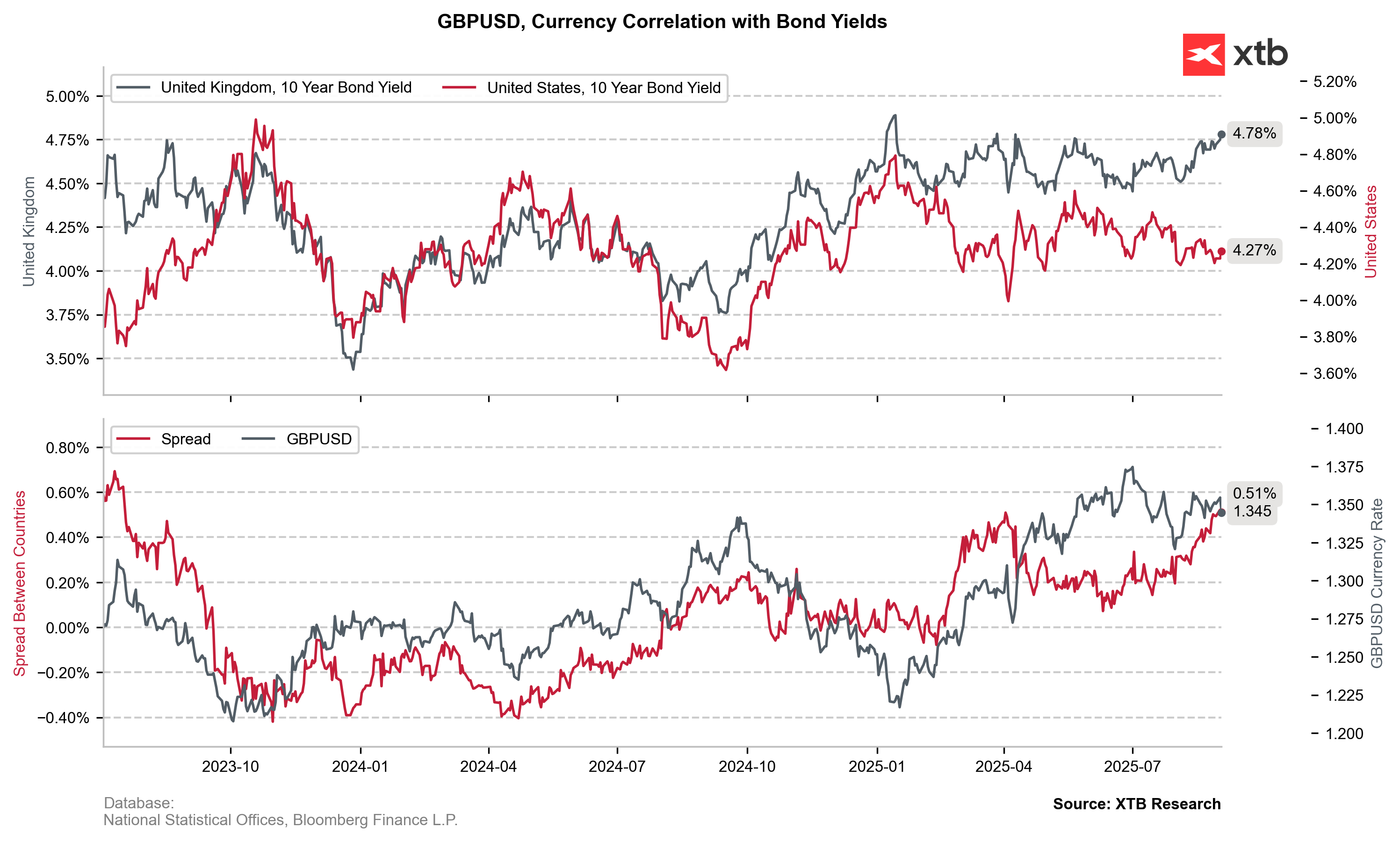

The GBPUSD collapsed sharply following a sell-off in the UK government bond market, which pushed 30-year yields to their highest level since 1998 (5.66%).

At the start of the session, GBPUSD was the least volatile G10 pair, with the pound showing strong resilience to the broad rebound in the dollar. The bond sell-off dragged the rate down to its lowest level since August 7 (just below 1.339). Buyers managed to recoup part of the losses, pulling GBPUSD back to 1.34, slightly above the lower boundary of the current consolidation. Source: xStation5

Yields on 30-year UK government bonds (“Gilts”). Source: Bloomberg Finance LP

Long-term borrowing costs in the UK have risen to their highest level since 1998, reflecting investor concerns about the country’s economic outlook, including persistent inflation, rising public debt, and doubts about the government’s ability to reconcile fiscal rules with economic growth.

Moreover, markets increasingly see the risk that Chancellor Rachel Reeves will be forced into tax hikes or deeper spending cuts in the Autumn Budget, with bond yields signaling tighter financing conditions.

Reeves’ recent comments included, among other things, a windfall tax on banks, but financing still-weak public services and infrastructure projects will likely require deeper reforms and new revenue sources – topics the Labour Party avoided during the last campaign. Incumbent Prime Minister Keir Starmer has pledged to lead Labour into the next election.

The pound resumed gains in mid-July alongside growing expectations for a September rate cut in the U.S. and further inflationary pressures in the UK, which boosted British medium-term government bonds. Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales