Summary:

-

Talk of new parliamentary session not starting till Oct 14th

-

Would reduce chances to prevent no-deal Brexit

-

GBP falling lower across the board

There’s been some selling seen in the pound after a couple of recent developments on the Brexit front with an acrimonious outcome looking more likely by the day. First off, reports that Parliament could be suspended in the coming days hit the wires with rumours swirling around Westminster that a privy council are set to head to Balmoral to meet the Queen and make the request. Shortly afterwards, speculation grew further when additional reports suggested this means that Boris Johnson is planning on beginning a new session of parliament some 5 weeks later than previously thought, with a fresh Queen’s speech on or around 14th October.

This seems like a pre-emptive strike from Boris against those seeking to block a no-deal Brexit and once more it seems that the opposition are in danger of fluffing a big opportunity to have an impact. If the government is successful in this then a no-deal Brexit wouldn’t be taken off the table until the 11th hour at the earliest and this keeps a significant downside risk to the pound in play. It is also worth pointing out that this reduces the chances of getting a deal passed through parliament with the timescale for any bill to pass greatly reduced.

Having said that, as far as the markets are concerned there’s a fair bit of bad news already “baked-in” to the pound and it is telling that after the knee jerk move lower in recent trade, the selling we’ve seen is far from panic stations - so far anyway. The currency has been increasingly sensitive to any developments on this front in recent sessions and this doesn’t look likely to end anytime soon with traders and algorithms both very keen to jump on the back of the latest headlines.

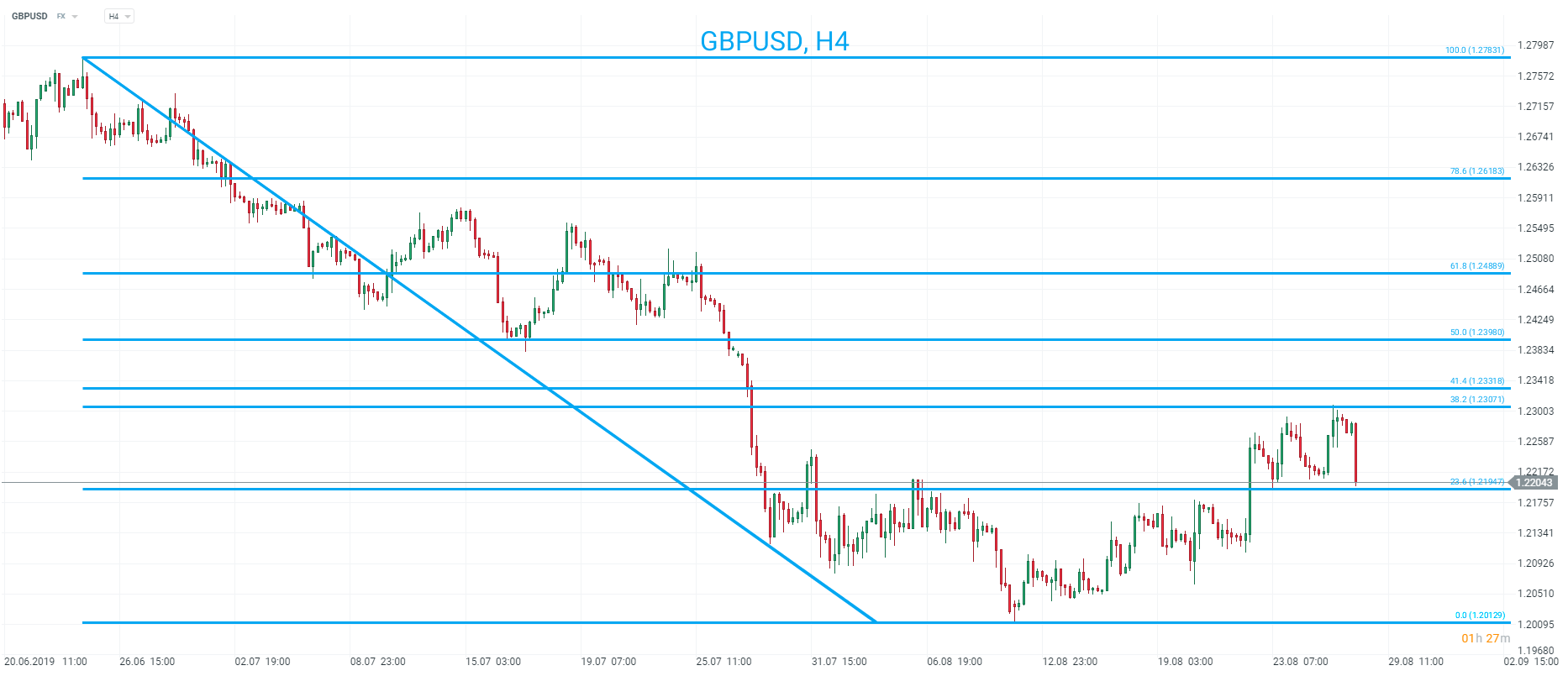

The pound had recovered a fair chunk of the declines seen since the June high, with price hitting the 38.2% fib at 1.2307 yesterday. However, the market is coming under pressure on these latest headlines and has fallen back near the 23.6% fib at 1.2195. Source: xStation

The pound had recovered a fair chunk of the declines seen since the June high, with price hitting the 38.2% fib at 1.2307 yesterday. However, the market is coming under pressure on these latest headlines and has fallen back near the 23.6% fib at 1.2195. Source: xStation

Market Wrap: Energy Stocks Retreat as Hopes for End to Iran War Grow 🌍 (10.03.2026)

EURUSD gains 0.2% on unexpectedly bigger trade surplus in Germany 🇩🇪 📈

Morning wrap (10.03.2026)

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher