- US stocks launched session in mixed moods

- FOMC minutes in the evening

- Target (TGT.US) under pressure despite solid quarterly figures

US indices launched today's session in mixed moods as investors await the release of the Federal Reserve’s latest meeting minutes for further clarity on the central banks tapering timeline. In turn, many economists believe that more information regarding the reduction of the asset purchase program will not be announced until next week at the Jackson Hole symposium.

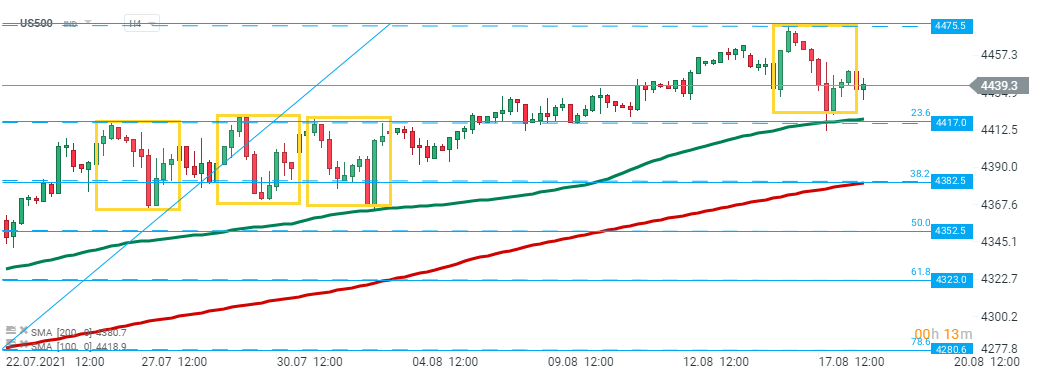

US500 pulled back from fresh all-time high at 4475.5 pts and is currently approaching major support at 4417 pts which is marked with lower limit of the 1:1 structure, 50 SMA (green line) and 23.6 Fibonacci retracement off the last upward wave. Breaking below it may trigger a bigger downward move. Source: xStataion5

US500 pulled back from fresh all-time high at 4475.5 pts and is currently approaching major support at 4417 pts which is marked with lower limit of the 1:1 structure, 50 SMA (green line) and 23.6 Fibonacci retracement off the last upward wave. Breaking below it may trigger a bigger downward move. Source: xStataion5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appTarget (TGT.US) stock fell more than 2% in premarket despite the fact that the retailer posted upbeat quarterly figures. Company earned $3.64 per share and topped market estimates by 15 cents, while revenue slightly beat Wall Street projections. Comparable store sales rose 8.9%, slightly above the 8.8% consensus estimate.

Target (TGT.US) stock recently pulled back from all-time high at $267.25 and broke below long-term upward trendline. Yesterday the price broke below local support at $254.85. If current sentiment prevails then the next target for bears is located at $243.40 which coincides with 200 SMA (red line) and 23.6 Fibonacci retracement of the last upward wave. Source: xStation5

Target (TGT.US) stock recently pulled back from all-time high at $267.25 and broke below long-term upward trendline. Yesterday the price broke below local support at $254.85. If current sentiment prevails then the next target for bears is located at $243.40 which coincides with 200 SMA (red line) and 23.6 Fibonacci retracement of the last upward wave. Source: xStation5

Lowe’s (LOW.US) stock rose more than 4% in premarket after the home improvement company posted solid quarterly figures. Company earned $4.25 per share, beating analysts’ projections of $4.01. Revenue also topped market estimates. Meanwhile, same-store sales drop of 1.6% was less than the 2.2% decline expected by. Company also lifted its full-year guidance, as spending by builders and professionals rose.

ViacomCBS (VIAC.US) stock gained nearly 3.0% in premarket after Wells Fargo (WFC.US) upgraded its investment stance on the media giant to ‘overweight’ from ‘equal weight’. Bank believes that Viacom is poised to benefit from industry consolidation and it is also impressed by the upcoming programming slate for the company’s Paramount+ streaming service..

Moderna (MRNA.US), BioNTech (BNTX.US) shares rose approximately 1.0% in premarket ahead of an expected announcement by the White House calling for a booster shot for Americans already fully vaccinated against Covid-19.