Today, the minutes from the latest Bank of Japan (BoJ) meeting were published. However, the minutes did not provide any additional interesting information that could impact the forex market. As a result, volatility on the Japanese Yen (JPY) is limited today. Nevertheless, the current levels above 150 JPY per USD are again raising doubts among leading Japanese policymakers, increasing the likelihood of intervention if the JPY continues to weaken.

Below is a brief summary of the key conclusions from the BoJ minutes from January 22-23, 2024 Meeting:

-

Board members agreed that the stage of sustainably achieving the 2% inflation target has not been reached yet.

-

The members were of the view that the likelihood of hitting the 2% inflation target is gradually increasing. If a virtuous cycle of wages and inflation is confirmed, the BoJ would consider ending negative interest rates permanently and other unconventional easing measures.

-

A few members suggested it would be appropriate to stop purchasing ETFs and J-REITs if the achievement of the inflation target seems foreseeable.

-

Some members emphasized that the BoJ is not under pressure to accelerate rate hikes at the pace observed in Western countries.

Despite the release of these minutes, there was no significant reaction in the forex market, and the Japanese Yen (JPY) remains stable. However, recent development on the forex market has increased the frequency of verbal intervention from Japan's main policymakers. Recently, former top foreign exchange official Eisuke Sakakibara suggests that Japanese authorities might intervene if the yen falls to 155-160 against the dollar. He predicts the yen will strengthen to 130 by the end of this year or early 2025, expecting an inflationary period ahead. Japan’s chief of FX, Masato Kanda, indicated that the recent yen weakness is more due to speculation than fundamentals. He stated that the authorities are prepared to intervene against excessive fluctuations.

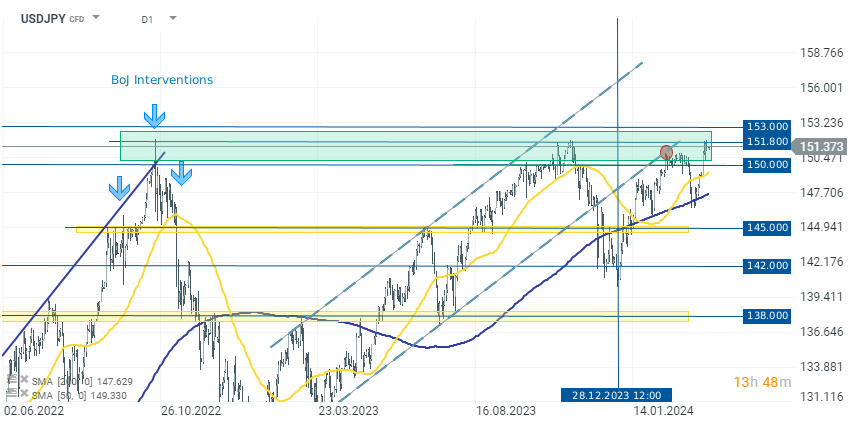

USDJPY (D1 interval)

As we can see, USDJPY is currently above the level of 151, which is in the historical intervention zone of the BoJ (marked on the chart in green). We are also observing initial attempts to strengthen the JPY through verbal interventions. Further depreciation of the JPY, and thus an increase in the USDJPY rate to 153,000 or even 155,000, may lead to intensified verbal interventions from Japan's main policymakers and even a higher probability of intervention in the forex market by the BoJ.

Source: xStation 5

«أرامكو» تدفع مؤشر «تاسي» لأعلى إغلاق في 3 أسابيع وسط أداء قوي لأسهم البتروكيميائيات

أسواق الإمارات تتفتح على تراجع وسط تصاعد التوترات الإقليمية وضغوط الأسواق العالمية

التقويم الاقتصادي: التضخم وفقًا لمؤشر أسعار المستهلك الأمريكي هو أهم تقرير لهذا الأسبوع 🔎

حصاد الأسواق (09.03.2026)