Shares of the manufacturer and tester of integrated circuits used in the automotive, aerospace and energy industries, Aehr Test Systems (AEHR.US) are losing more than 18% today, after the US market opened. The company beat earnings per share and revenue forecasts, the market is worried about revised revenue forecasts for 2024, which suggest a slowdown in the electric vehicle market.

Aehr Test (AEHR.US) Q4 2023 results

-

Earnings per share: $0.23 vs. $0.19 forecasts. (about 20% above expectations)

- Revenue: $21.43 million vs. 20.89 million forecasts (about 2.5% above expectations)

The company presented a 45% increase in Q4 2023 revenue to $21.4 million and an increase in net income. However, it softened full-year revenue forecasts in 2024 to $75-85 million (15% to 30% y/y growth), citing order delays and increased production capacity for devices built from silicon carbide. The company remains optimistic about future demand in various markets, including industrial power conversion and telecommunications, and is well positioned with cost-effective solutions for firing so-called semiconductor wafers. It also suggested that there is steady demand for silicon carbide solutions beyond the EV market, suggesting broader expansion opportunities.

Highlight from Aehr earnings call

- Despite the challenges, the growth in demand for silicon carbide chips is significant. Industry and power conversion are key

- Aehr Test Systems is working with silicon carbide and gallium nitride power semiconductor customers, expecting new orders in 2024

- The company is developing new WaferPak designs and a high-power configuration of its own FOX manufacturing system for silicon photonic devices.

- With no debt and $50.5 million in cash, the company can scale its operations and R&D investments without significant downside risk

- The company is struggling with chip burn-in challenges for DRAM due to cost inefficiencies

- Aehr remains confident of further growth and is focusing operations in key markets to develop niches and further improve profitability. Among other things, the company is analyzing expansions into the Chinese market and intellectual property rights

Company's gross margin is currently over 51% with a C/Z ratio of around 26 and a return on invested capital (ROIC) of over 20%. However, the less than 1% EVA ratio suggests that the company is incurring a lot of costs (WACC) during its expansion.

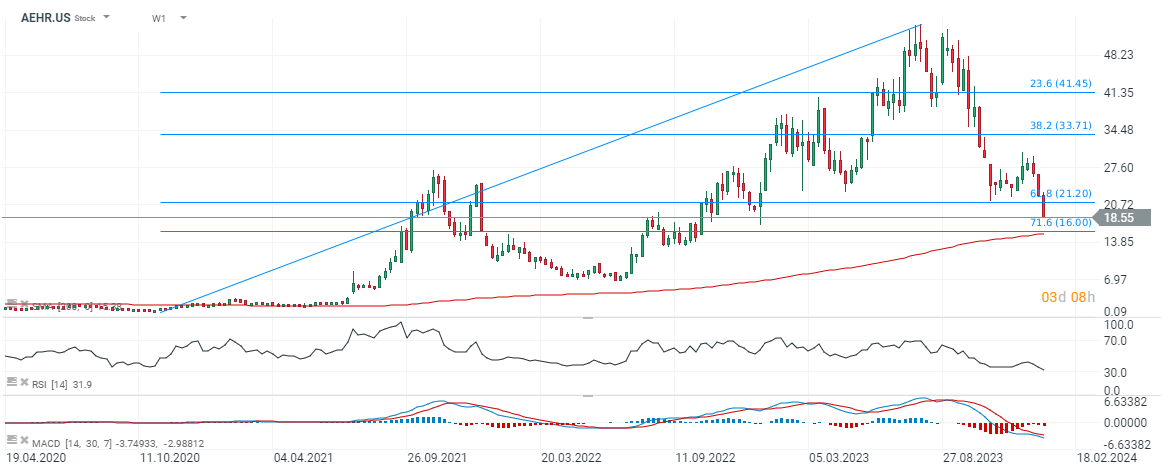

AEHR.US stock chart (Interval W1)

AEHR shares are down more than 60% from their peaks in the fall of 2023, with euphoria turning to panic after the company signaled a clear weaker environment for further growth. The main risk to further upside remains the recession. The stock could bounce towards $21, where we see the 61.8 Fibonacci retracement of 2020 upward wave. Source: xStation5

Stock of the Week: Broadcom ขับเคลื่อนโดย AI ทำสถิติใหม่ 🚀

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด

📀 Coinbase และ MicroStrategy พุ่งแรง หลังทรัมป์ท้าทายธนาคารบนวอลล์สตรีท

สรุปตลาด: หุ้นยุโรปและสหรัฐพยายามรีบาวด์ฟื้นตัว 📈