The Australian Dollar (AUD) is facing a downturn for the second consecutive session. Today, AUD is the weakest currency among G10 currencies, influenced by weaker-than-expected inflation data from Australia. The Monthly Consumer Price Index (CPI) for December reported a decrease to 3.4%, a significant drop from November's 4.3%. This slowing inflation rate has led traders to anticipate two potential rate cuts from the Reserve Bank of Australia (RBA) in 2024.

01:30, Australia - Inflation data:

- Weighted average CPI (Q4): current 4.4% y/y; forecast 4.5% y/y; previously 5.2% y/y;

- Weighted average CPI: current 3.40% y/y; forecast 3.70% y/y; previous 4.30% y/y;

- Trimmed Mean CPI (Q4): current 4.2% y/y; forecast 4.3% y/y; previous 5.2% y/y;

- Trimmed Mean CPI (k/k) (Q4): current 0.8%; forecast 0.9%; previous 1.2%;

- CPI (k/k) (Q4): current 0.6%; forecast 0.8%; previously 1.2%;

- CPI (Q4): current 4.1% y/y; forecast 4.3% y/y; previous 5.4% y/y;

In response to the latest Australian inflation data, the likelihood of the RBA maintaining interest rates unchanged at its upcoming meeting, however, the likelihood of an earlier rate cut later in the year has increased. The Trimmed Mean CPI, a core measure of inflation closely watched by the RBA, also showed a decline to 4.2%, down from 5.2% and below the expected 4.3%.

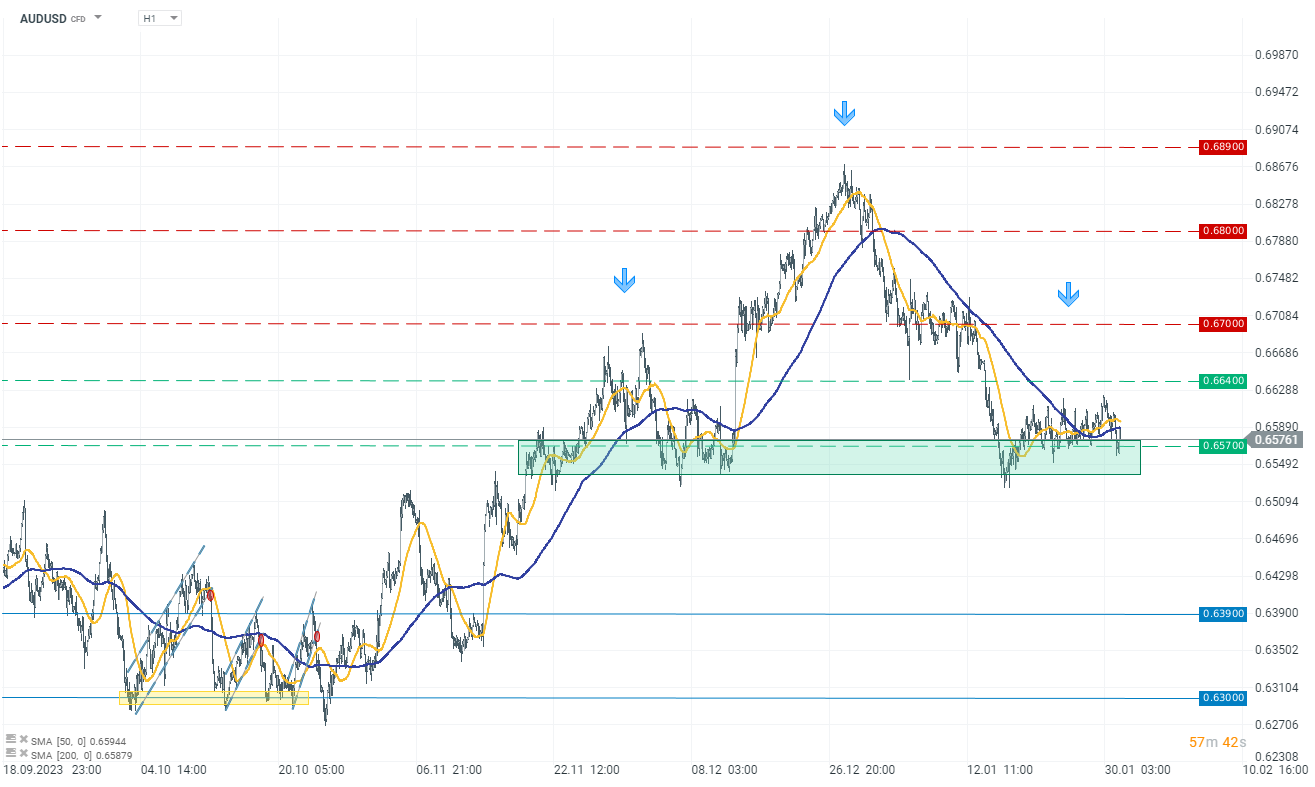

The Australian Dollar reacted negatively to these developments, with the AUDUSD pair declining by 0.40% at 0.6576.

Source: xStation 5

Source: xStation 5

📊 Chart of the Day: คู่เงิน USD/JPY ผันผวนสูงก่อนประกาศ CPI สหรัฐฯ

สรุปข่าวเช้า

BREAKING: จำนวนผู้ยื่นขอสวัสดิการว่างงานในสหรัฐฯ ปรับตัว สูงกว่าที่คาดเล็กน้อย

เศรษฐกิจอังกฤษชะงักงัน ภาษีการค้ากดดันหุ้นยักษ์ใหญ่ ขณะที่คริปโตเริ่มทรงตัว