- European shares end higher on Monday

- DAX above 16,100 pts

- Continuation of the downward trend on the EURUSD

- US stocks cut some gains

The vast majority of European indices ended the day in positive territory. The German DAX even managed to break above the level of 16,100 points and hit an all-time high. However, volatility leaves much to be desired, and today's upward impulse did not lead to a significant acceleration of the uptrend, on the contrary, the index remains in consolidation. On corporate news, Philips erased 10.6% this session following news that US regulators probed the Dutch firm’s laboratories amid suspicions that the company’s ventilators could contain hazardous materials. On the pandemic front, traders monitored the reintroduction of public health restrictions in Austria and the Netherlands. Meanwhile, ECB Persistent Lagarde noted supply chain pressure and rising energy costs are hurting Eurozone growth but highlighted that cutting back stimulus should not be rushed.

The US indices started the day above Friday's close, but the selling side quickly took the initiative and wiped out early gains. Nevertheless, declines also seem to be slowing down and major indices are trying to resume upward move. Currently, the Nasdaq is losing just 0.2%, the S&P500 is flat and the Dow Jones is gaining 0.1%. On the corporate front, Boeing shares were up more than 5% after the company received an order from Emirates for two 777 Freighters, valued at more than $704 million. On the other hand, Tesla stocks fell 4% after Elon Musk and Bernie Sanders shared some tweets and the US senator demanded the wealthy pay their "fair share" of taxes.In the following days, investors will focus on retail sales and industrial production data and earnings from retail giants including Walmart and Home Depot.

Today we have not seen any major moves in the oil and precious metals markets. WTI crude oil is trading above $ 80 a barrel while gold is hovering just above the $ 1,860 level. Industrial metals took a hit early in the session. Sentiment towards base metals deteriorated following a release of monthly activity data from China for October. Industrial production and retail sales turned out to be better-than-expected while urban investments disappointed.

During Monday's session we could observe mixed sentiment in the Forex market. In the evening hours the dollar appreciates 0.5% against the euro. In turn, the franc fell 0.27%, and the yen is weakening 0.18% against the US currency. On the upside, the AUD rose 0.3% and CAD added 0.2% In contrast, GBP and NZD appear to be muted.

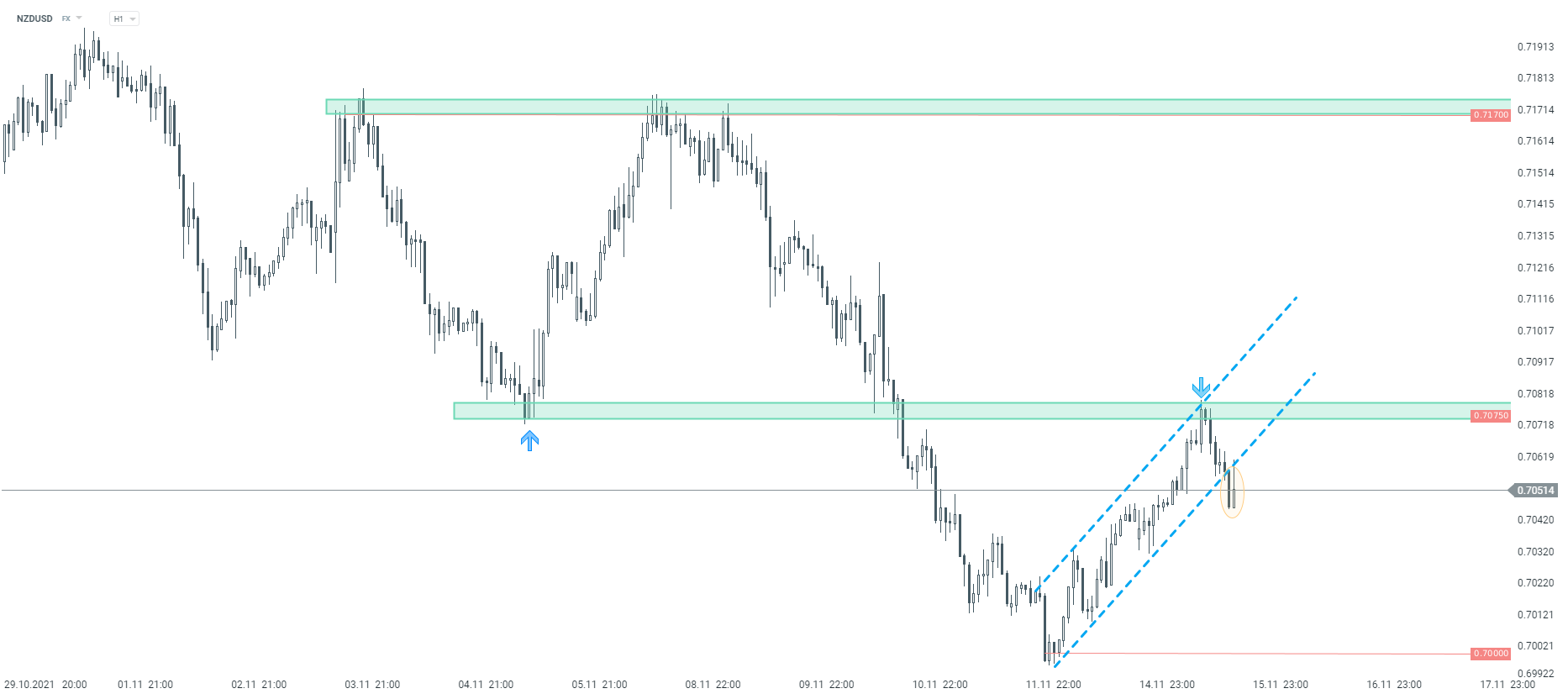

NZDUSD pair bounced off the key short-term resistance zone at 0.7075. Moreover, looking at the chart in a closer perspective, pair broke below the lower limit of the local ascending channel, which may indicate continuation of the downward movement. Source: xStation5

NZDUSD pair bounced off the key short-term resistance zone at 0.7075. Moreover, looking at the chart in a closer perspective, pair broke below the lower limit of the local ascending channel, which may indicate continuation of the downward movement. Source: xStation5

Palo Alto เข้าซื้อกิจการ CyberArk! ก้าวสู่การเป็นผู้นำใหม่ในวงการไซเบอร์ซีเคียวริตี้

BREAKING: US100 พุ่งแรง หลังรายงาน NFP สหรัฐแข็งแกร่งกว่าคาด

เหลือเวลาไม่กี่วัน รับหุ้น GRAB ฟรี ⏳

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡