The US dollar is one of the best performing G10 currencies around two hours ahead of the release of US core PCE data for January. PCE is the Fed's preferred inflation measure and data for January will be released at 1:30 pm GMT. Personal income and spending data for January will be released simultaneously. However, it should be noted that as US CPI data for January has been already released, and set expectations for PCE, today's PCE print may not have as much impact on the markets. A point to note is that headline PCE is expected to remain unchanged at 5.0% YoY and it would be the first non-deflationary after three months of lower readings. Core PCE is seen ticking lower from 4.4 to 4.3% YoY. Also, January is expected to be a month that sees a decent jump in personal spending, after December's drop, which is a positive signal regarding conditions of US consumers.

1:30 pm GMT - US data pack for January.

- Headline PCE. Expected: 5.0% YoY. Previous: 5.0% YoY

- PCE Core. Expected: 4.3% YoY. Previous: 4.4% YoY

- Personal Income. Expected: 0.9% MoM. Previous: 0.2% MoM

- Personal Spending. Expected: 1.2% MoM. Previous: -0.2% MoM

While US core PCE reading for January is a key macro release of the day, it may not be the main source of USD volatility today. A number of Fed members are set to deliver speeches in the afternoon. Among today's speakers one can find some of Fed's biggest hawks, like Mester or Bullard, so there is a chance for remarks that could boost USD and pressure Wall Street.

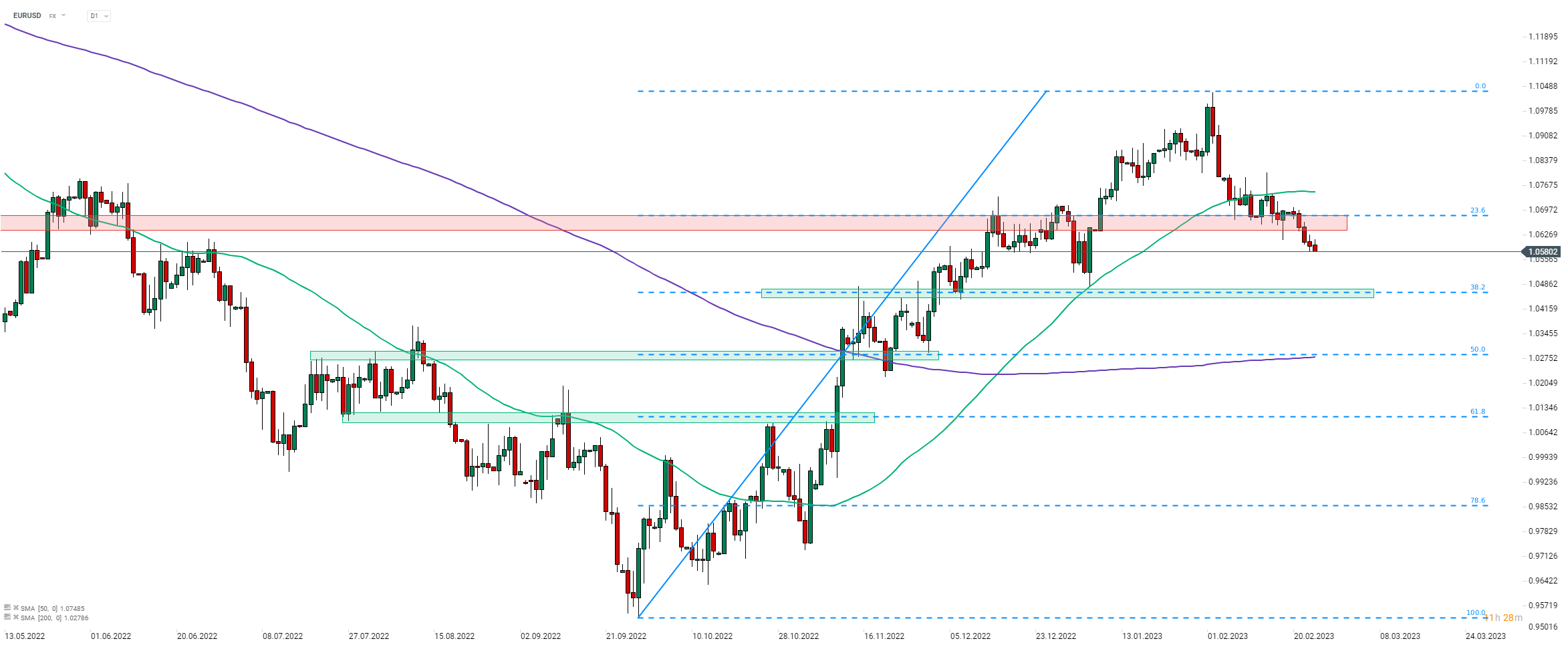

EURUSD

EURUSD has been struggling recently amid outperformance of the US dollar. Pair pulled back around 4% since the beginning of the month and is heading for the first monthly drop since September 2022. A strong US data, combined with hawkish comments from Fed speakers later today, could provide more fuel for EURUSD sell-off. In such a scenario, the next support level to watch can be found at 38.2% retracement of a recent upward impulse (1.0460 area). Source: xStation5

EURUSD has been struggling recently amid outperformance of the US dollar. Pair pulled back around 4% since the beginning of the month and is heading for the first monthly drop since September 2022. A strong US data, combined with hawkish comments from Fed speakers later today, could provide more fuel for EURUSD sell-off. In such a scenario, the next support level to watch can be found at 38.2% retracement of a recent upward impulse (1.0460 area). Source: xStation5

US100

Nasdaq-100 (US100) has been underperforming as of late. However, a recent pullback may have found a bottom as the index began to struggle with pushing below the 38.2% retracement of recent upward correction (12,100 pts area). The 200-period moving average (purple line, H4 interval) can be found slightly below the aforementioned retracement and further boosts significance of 12,100 pts zone as a support. A better-than-expected US data today could be negative for Wall Street as it would give the Fed more room to continue tightening. Source: xStation5

Nasdaq-100 (US100) has been underperforming as of late. However, a recent pullback may have found a bottom as the index began to struggle with pushing below the 38.2% retracement of recent upward correction (12,100 pts area). The 200-period moving average (purple line, H4 interval) can be found slightly below the aforementioned retracement and further boosts significance of 12,100 pts zone as a support. A better-than-expected US data today could be negative for Wall Street as it would give the Fed more room to continue tightening. Source: xStation5

BREAKING: US100 พุ่งแรง หลังรายงาน NFP สหรัฐแข็งแกร่งกว่าคาด

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

สรุปตลาดเช้า: ดอลลาร์ติดกับดัก ตลาดจับตา NFP คืนนี้ 🏛️

ข่าวเด่นวันนี้