IBM (IBM.US) stock rose over 4.0% on Thursday after the iconic technology company posted upbeat quarterly results and lifted its full-year financial outlook despite an increasing headwind from the surging U.S. dollar.

-

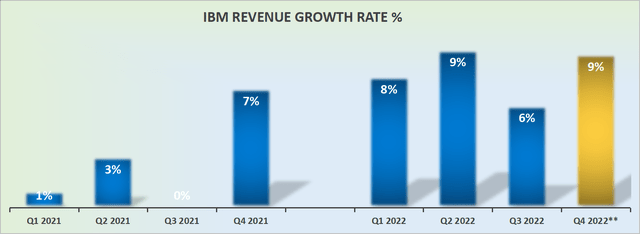

Company earned $1.81 per share, a 2% decrease from last year, however it topped analysts’ projections of $1.78 per share. Revenues jumped 6% from last year to $14.1 billion, well above market expectations of $13.5 billion.

-

Revenues from Red Hat, the cloud computing group which was acquired by IBM in 2019 for $34 billion increased 12%, while software revenues surged 7.5% to $5.8 billion. Consulting revenues increased 5.4% to $4.7 billion.

-

"Based on our revenue performance in the first three quarters, we now see constant-currency revenue growth above our mid-single-digit model for the year," said CFO Jim Kavanaugh.

Source: seekingalpha.com

Source: seekingalpha.com

-

IBM estimates that foreign-exchange rates should result in 7% less revenue than it otherwise would generate in the full year. Company reiterated its financial outlook from July of around $10 billion in free cash flow.

According to the issued ratings of 8 analysts, the consensus rating for IBM (IBM.US) stock is Moderate Buy based on the current 3 hold ratings, 1 strong sell, 1 moderate buy and 3 strong buy. Source: Barchart

IBM (IBM.US) stock rose sharply during today's session and is currently testing a major resistance zone around $128.45, which is marked with previous price reactions and 38.2% Fibonacci retracement of the upward wave started at the beginning of the pandemic. If buyers manage to break above, upward movement may accelerate towards next resistance at $137.50 which coincides with 23.6% retracement. On the other hand, if sellers regain control, then another downward impulse towards local support at $123.40 may be launched. Source: xStation5

Palo Alto เข้าซื้อกิจการ CyberArk! ก้าวสู่การเป็นผู้นำใหม่ในวงการไซเบอร์ซีเคียวริตี้

เหลือเวลาไม่กี่วัน รับหุ้น GRAB ฟรี ⏳

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

ข่าวเด่นวันนี้