-

US indices had another downbeat session in a row. S&P 500 dropped 0.78%, Dow Jones moved 0.88% lower and Nasdaq declined 0.56%. Russell 2000 dropped 0.62%

-

Indices from Asia-Pacific followed into footsteps of their US peers and also moved lower. Nikkei dropped 1.5%, S&P/ASX 200 moved 1.7% lower while Kospi plunged 2%. Indices from China traded up to 1.5% lower

-

DAX futures point to a lower opening of the European cash session

-

According to Wall Street Journal, G7 will outline a plan to cap Russian oil prices on Friday

-

China has put Chengdu city with 21 million population under lockdown amid spike in local Covid-19 cases

-

Taiwan Defense Ministry said it has shot down Chinese drone near Kinmen islands

-

A Singaporean-flagged tanker ran aground in the Suez Canal. However, ship was refloated within hours and supply chain disruptions, like those from 2021, were avoided

-

According to Reuters report, OPEC sees oil market surplus at 400k bpd in 2022, instead of 900k bpd that was reported by media yesterday

-

United States put restrictions on sales of Nvidia's data center chips used in artificial intelligence to China and Russia

-

Chinese manufacturing PMI (Caixin) dropped from 50.4 to 49.5 in August (exp. 50.2)

-

Australian private capital expenditure dropped 0.3% QoQ in Q2 2022 (exp. 1.5% QoQ)

-

Cryptocurrencies are pulling back amid an overall increase in risk aversion. Bitcoin drops 0.9% and tests $20,000 area while Ethereum trades 1.3% lower

-

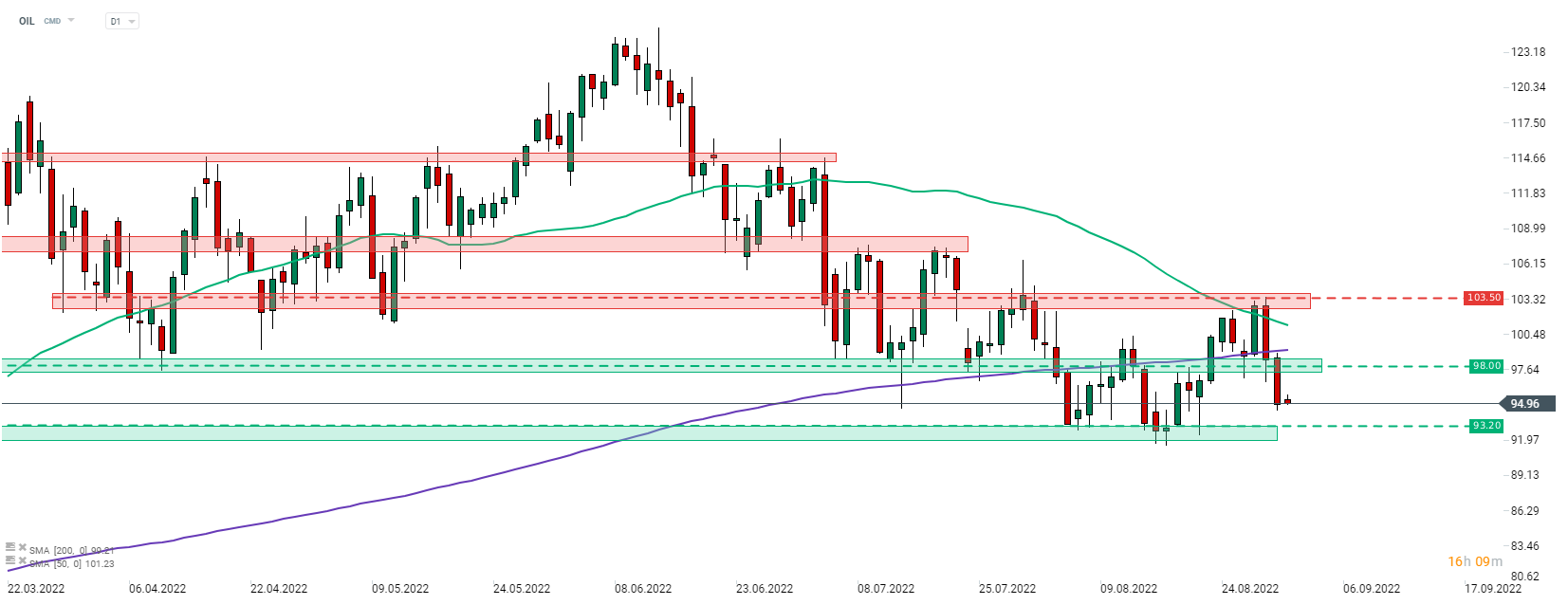

Oil is trading little change on Thursday morning with Brent trading near $95 per barrel

-

Precious metals trade lower amid USD strengthening - silver drops 1.2% while gold trades 0.2% lower

-

USD and AUD are the best performing major currencies while NZD and EUR lag the most

Brent (OIL) plunged back below 200-session moving average yesterday and continued to move lower afterwards. Declines were halted near the $95 per barrel for now and oil is trading little changed today. Source: xStation5

Brent (OIL) plunged back below 200-session moving average yesterday and continued to move lower afterwards. Declines were halted near the $95 per barrel for now and oil is trading little changed today. Source: xStation5

ข่าวเด่นวันนี้

3 ตลาดสำคัญที่ต้องจับตาในสัปดาห์นี้

ก๊าซธรรมชาติลด 6% ตามพยากรณ์อากาศใหม่

Geopolitical Briefing : Iran ยังเป็นปัจจัยเสี่ยงอยู่หรือไม่?