-

US indices traded mostly higher yesterday. S&P/ASX 200 gained 0.36%, Dow Jones moved 0.23% higher and Nasdaq added 0.35%. Russell 2000 dropped 0.79%

-

Upbeat moods could be spotted during the Asian session as well. Nikkei jumped 1.3%, S&P/ASX 200 traded 0.7% higher and Kospi gained 2.0%. Indices from China traded up to 1.0% higher

-

DAX futures point to a higher opening of the European cash session today

-

FOMC minutes showed that Fed sees possibility of an even tighter monetary policy if inflation stays at elevated levels

-

Bloomberg reports that United States and its allies are discussing capping Russian oil price in the $40-60 range

-

Beijing authorities announced that citizens who want to use in-person sports centers or entertainment venues will have to be vaccinated. A big jump in new Covid cases was reported in Shanghai

-

API report pointed to a 3.82 million barrel build in US oil inventories (exp. -1.1 mb)

-

Cryptocurrencies are trading mixed, although the overall scale of moves is relatively small. Bitcoin drops 0.3% while Ethereum gains 0.4%

-

Energy commodities trade slightly higher. Brent and WTI gain around 0.8% each, with Brent climbing back above $100 per barrel

-

Precious metals gain with silver being a top performer (+0.8%). Gold and platinum trade 0.5% higher

-

AUD and NZD are the best performing major currencies while USD, CHF and JPY are top laggards

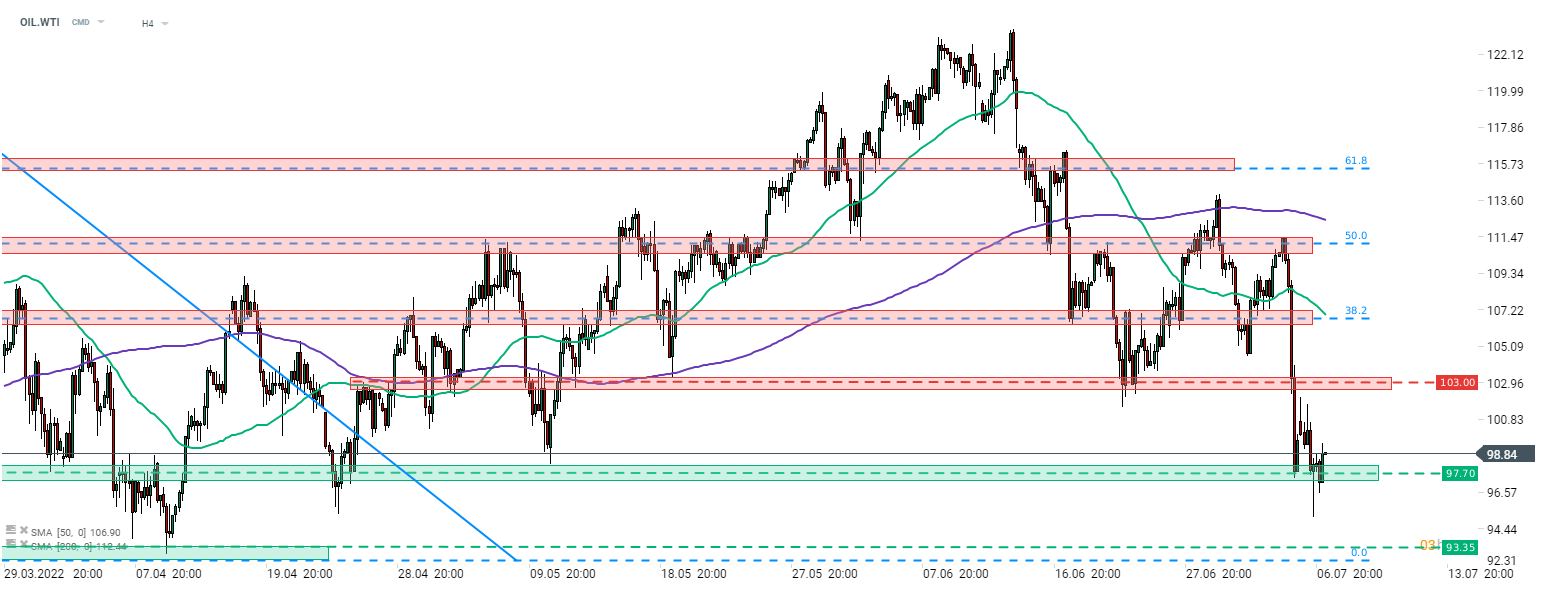

Oil halted recent sell-off but bulls struggle to launch a bigger recovery move. Taking a look at the WTI (OIL.WTI) chart, we can see that an attempt to launch such a move from the $97.70 area is made but the recovery lacks momentum. Source: xStation5

Oil halted recent sell-off but bulls struggle to launch a bigger recovery move. Taking a look at the WTI (OIL.WTI) chart, we can see that an attempt to launch such a move from the $97.70 area is made but the recovery lacks momentum. Source: xStation5

Silver พุ่ง 3% ในวันนี้ 📈

ข่าวเด่นวันนี้

3 ตลาดสำคัญที่ต้องจับตาในสัปดาห์นี้

ก๊าซธรรมชาติลด 6% ตามพยากรณ์อากาศใหม่