-

US indices finished yesterday's trading lower as US dollar strengthened following a much better-than-expected housing market data for May

-

S&P 500 and Russell 2000 dropped almost 0.5%, Dow Jones traded 0.7% lower and Nasdaq dropped around 0.2%

-

Indices from Asia-Pacific traded mostly lower today - S&P/ASX 200 dropped 0.4%, Kospi traded 0.8% lower, Nifty 50 traded flat while indices from China traded up to 2% lower. Nikkei was the outperformer with a 0.7% gain

-

DAX futures point to a slightly higher opening of the European cash session today

-

According to US President Biden, China is in position where it desires to resume good relations with the United States

-

BoJ minutes showed that Japanese policymakers still see current monetary policy easing should be maintained and that there was no need to revise yield curve control mechanism

-

Goldman Sachs made upward revision to its stock market forecasts and now expects S&P 500 to reach 4,700 pts mark within the next 12-months

-

Meanwhile, Morgan Stanley is cautious on stock in the second half of 2023, citing fading fiscal support, less liquidity and lower inflation as main concerns

-

Chinese financial media suggest that People's Bank of China may decide on further rate cuts this year

-

ECB Simkus said that he would not be surprised if rates in the euro area were hiked in September

-

ECB Vujcic warned that while Bank will continue to work to bring inflation down, soft landing is not always achievable

-

China extended tax exempts for purchases of New Energy Vehicles (i.e. EVs) until the end of 2025 while taxes in 2026-2027 period will be cut in half

-

Cryptocurrencies trade higher with Bitcoin jumping 2.4%, Dogecoin trading 2.2% higher, Ethereum adding 2% and Ripple moving 1.7% higher

-

Energy commodities attempt to recover from yesterday's losses - oil trades 0.9% higher while US natural gas prices increased 0.2%

-

Precious metals trade mostly lower - silver drops 0.1%, platinum declines 0.3% and gold trades flat

-

NZD and CAD are the best performing major currencies while JPY and CHF lag the most

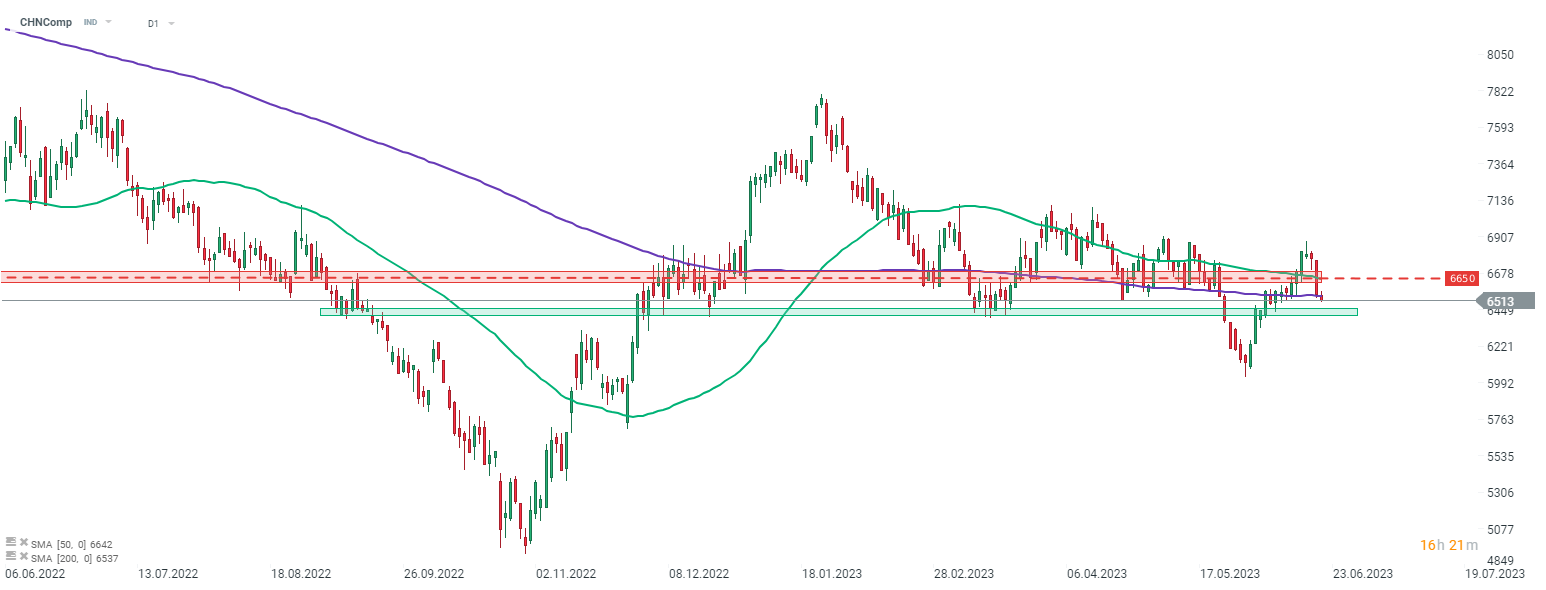

CHNComp is making a break below the 200-session moving average as indices from Asia-Pacific followed US peers lower. Source: xStation5

CHNComp is making a break below the 200-session moving average as indices from Asia-Pacific followed US peers lower. Source: xStation5

🚨📉 ด่วน: ตัวเลข CPI สหรัฐฯ ต่ำกว่าคาดการณ์!

🧾 สรุปตลาด: ดอลลาร์เร่งตัวก่อนตัวเลข CPI ผลประกอบการจากยักษ์ใหญ่ฝรั่งเศสออกมา “ผสมผสาน”

สรุปข่าวเช้า

US100 ร่วง 1.5% 📉