During today's session, the quotations of contracts based on American NATGAS are gaining nearly 5% in response to incoming weather forecasts in the USA, indicating a return of the heatwave in the country. This could result in an increase in demand for electrical energy used for air conditioning.

Moreover, daily gas production and consumption data in the Lower 48 zone (continental United States) indicate a daily decline in gas production by 0.61% compared to yesterday's production, with a simultaneous increase in consumption by 2.45% on a daily basis.

The latest weather forecasts indicate an expansion of the heatwave zone in the USA to the western part of the country and a deepening of the higher temperature zone on the eastern coast. Source: NOAA

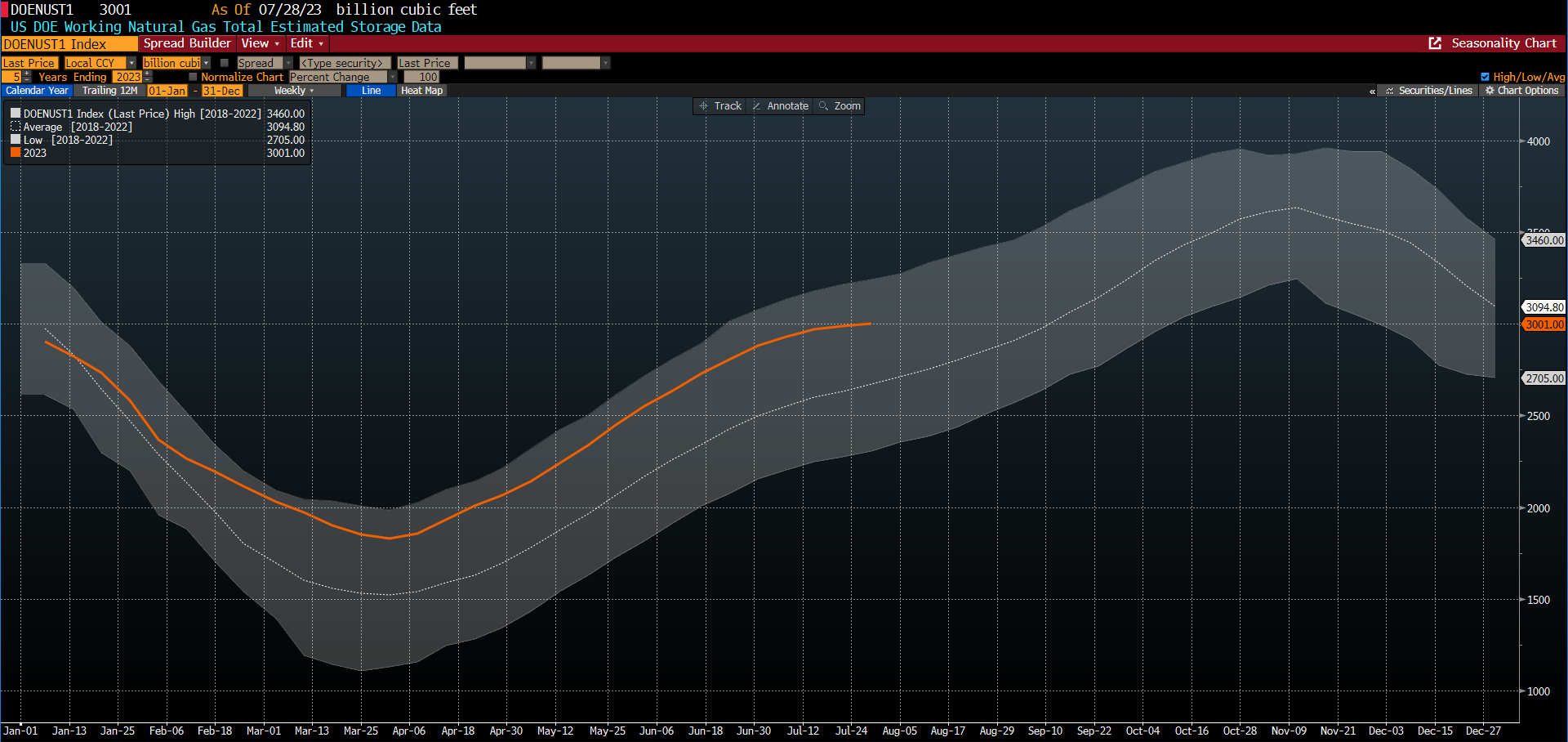

On the other hand, it's worth remembering that compared to the data for the last five years, current inventories of this commodity in the USA are above the five-year average, which may act as a counterbalance for market bulls. Source: Bloomberg Finance L.P.

On the other hand, it's worth remembering that compared to the data for the last five years, current inventories of this commodity in the USA are above the five-year average, which may act as a counterbalance for market bulls. Source: Bloomberg Finance L.P.

NATGAS is gaining nearly 5% today and is testing the limit set by the 100-day exponential moving average (purple curve). Source: xStation 5

NATGAS is gaining nearly 5% today and is testing the limit set by the 100-day exponential moving average (purple curve). Source: xStation 5

Silver พุ่ง 3% ในวันนี้ 📈

ข่าวเด่นวันนี้

3 ตลาดสำคัญที่ต้องจับตาในสัปดาห์นี้

ก๊าซธรรมชาติลด 6% ตามพยากรณ์อากาศใหม่