US natural gas prices were dropping at the end of the previous week and the move was deepened at the beginning of this week with a bearish price gap. Price has recovered off the daily lows but continues to trade below the range of a recent consolidation.

Drop in prices is driven primarily by concerns over excessive supply in the United States as well as in Europe as winter period draws to a close. Natural gas stockpiles in Europe are over-60% full while the 5-year average for the period is just 44%. Situation in the United States looks similar with inventories sitting well above the 5-year average. However, it should be noted that stockpiles should be even higher given such a mild winter as we experienced this year.

US natural gas stockpiles sit well above the 5-year average. Source: Bloomberg, XTB Research

Taking a look at key US heating regions, we can see that weather in the United States remains relatively mild for this period of the year. End-of-February period will likely mark an end to a period when "extreme weather anomalies" may occur. Source: Bloomberg

Taking a look at key US heating regions, we can see that weather in the United States remains relatively mild for this period of the year. End-of-February period will likely mark an end to a period when "extreme weather anomalies" may occur. Source: Bloomberg

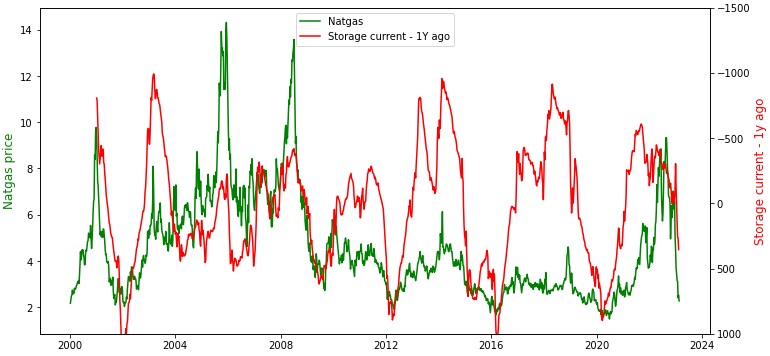

Analyzing deviation of inventories from 5-year average we do not see any extremely high levels. Nevertheless, comparing stockpiles to levels from a year ago, we can see quite a significant increase. So-called 'comparative stockpiles' justify further drops on the NATGAS market. Simultaneously, this data is far off showing a contrarian signal that could be used by bulls.

Comparative inventories keep rising (inverted axis). Nevertheless, they would need to climb to 600-800 area (last year's levels) for a strong contrarian signal to be generated. Source: Bloomberg, XTB Research

Comparative inventories keep rising (inverted axis). Nevertheless, they would need to climb to 600-800 area (last year's levels) for a strong contrarian signal to be generated. Source: Bloomberg, XTB Research

However, price alone suggests that natural gas may be oversold already as suggested by 1- and 5-year standard deviations. Source: Bloomberg, XTB Research

NATGAS broke below the lower limit of a trading range but remains close to it. It should be noted that historically painting a move's low during consolidation was also marked with some false, lower breakouts. Nevertheless, fundamentals remain strongly negative for prices therefore a move lower and forming a new bottom as low as in the $2 per MMBTu area cannot be ruled out. Source: xStation5

NATGAS broke below the lower limit of a trading range but remains close to it. It should be noted that historically painting a move's low during consolidation was also marked with some false, lower breakouts. Nevertheless, fundamentals remain strongly negative for prices therefore a move lower and forming a new bottom as low as in the $2 per MMBTu area cannot be ruled out. Source: xStation5

ข่าวเด่นวันนี้

🚨 ทองคำร่วง 3% ขณะที่ตลาดเตรียมตัวเข้าสู่ช่วงหยุดตรุษจีน

ราคาช็อกโกแลต (Cocoa) ร่วง 2.5% แตะระดับต่ำสุดตั้งแต่ตุลาคม 2023 📉

ก๊าซธรรมชาติ (NATGAS) ผันผวนน้อย หลังรายงานการเปลี่ยนแปลงสต็อกของ EIA