NATGAS rallied yesterday, supported by:

- Smaller-than-expected natural gas inventory build reported by EIA. Inventories rose 99 bcf while the market expected 110 bcf increase. Gain, however, was in-line with 5-year average

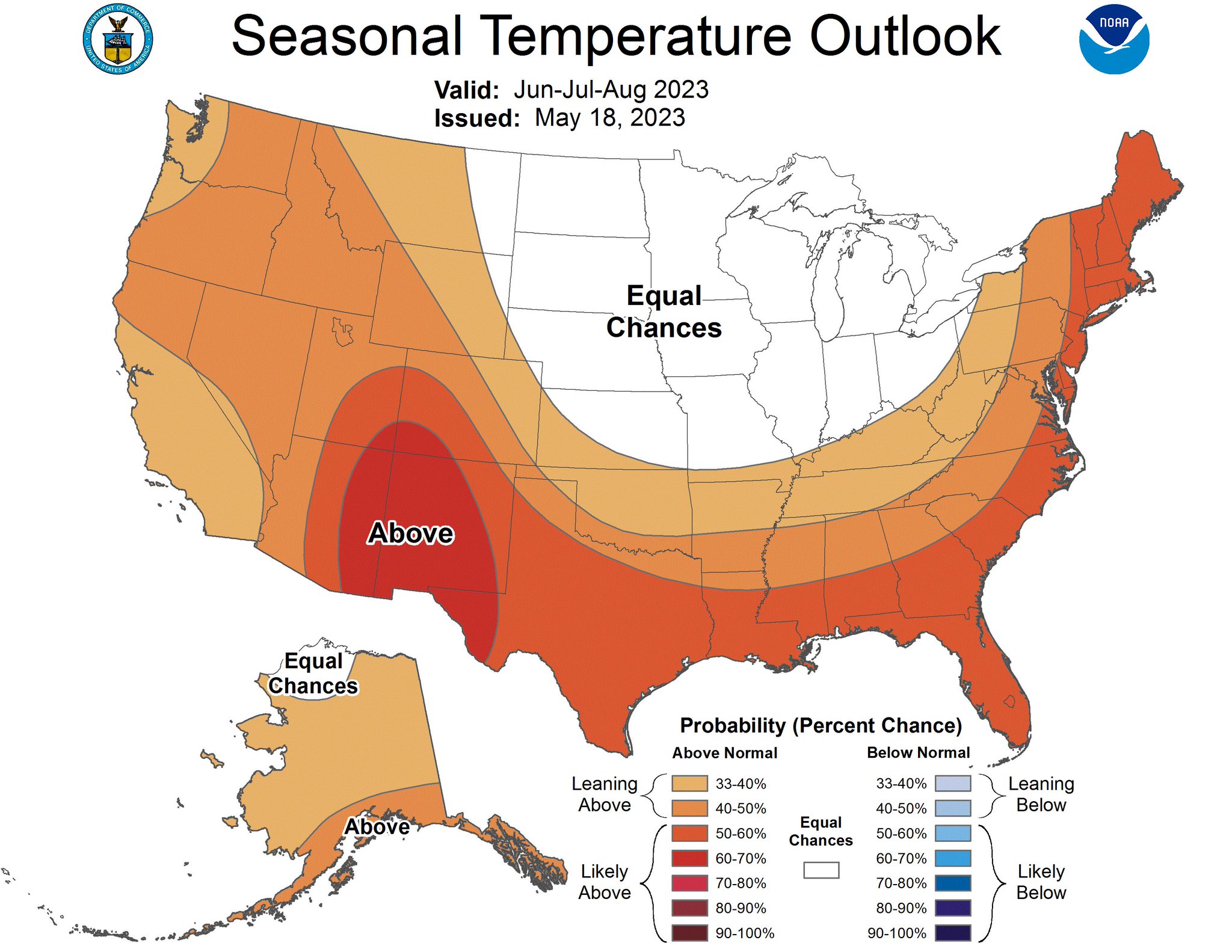

- New weather forecast for summer period from NOAA was released and it show potential for a very high temperatures in key states in terms of demand for air conditioning

Moreover, some factors that could also trigger upward pressure surfaced recently:

- Gas output in Canada is dropping hard. Drilling activity in Canada started to decline much earlier than in the United States. This suggests that US output may also drop significantly in coming weeks given recent declines in the number of active gas rigs

- Comparative inventories are at cyclical highs, what may be seen as a contrarian signal

- Freeport LNG terminal exports up to 2.3 billion cubic feet of gas per day, reaching new record levels

Of course, one should keep in mind that contract rollover will occur next week (currently around +$0.12 per MMBTu). Given current NATGAS prices, it would result in a test of the $2.70 per MMBTu area. Prices jumped around $0.15 per MMBTu following the latest rollover but launched another downward impulse later on. One cannot rule out the situation of sellers returning to the market after the contract rolls over and prices at near-term contract are once again attractive for bears. On the other hand, seasonal patterns suggest that NATGAS may be set to rebound after reaching local low in mid-June.

Source: NOAA

Natural gas inventories increase in line with seasonal patterns. Comparative inventories are at extremely high levels (inverted axis), signaling a potential local low on natural gas prices. Nevertheless, prices traded sideways for as much as 6 months after similar situations back in 2017 and 2020. Source: Bloomberg, XTB

Natural gas inventories increase in line with seasonal patterns. Comparative inventories are at extremely high levels (inverted axis), signaling a potential local low on natural gas prices. Nevertheless, prices traded sideways for as much as 6 months after similar situations back in 2017 and 2020. Source: Bloomberg, XTB

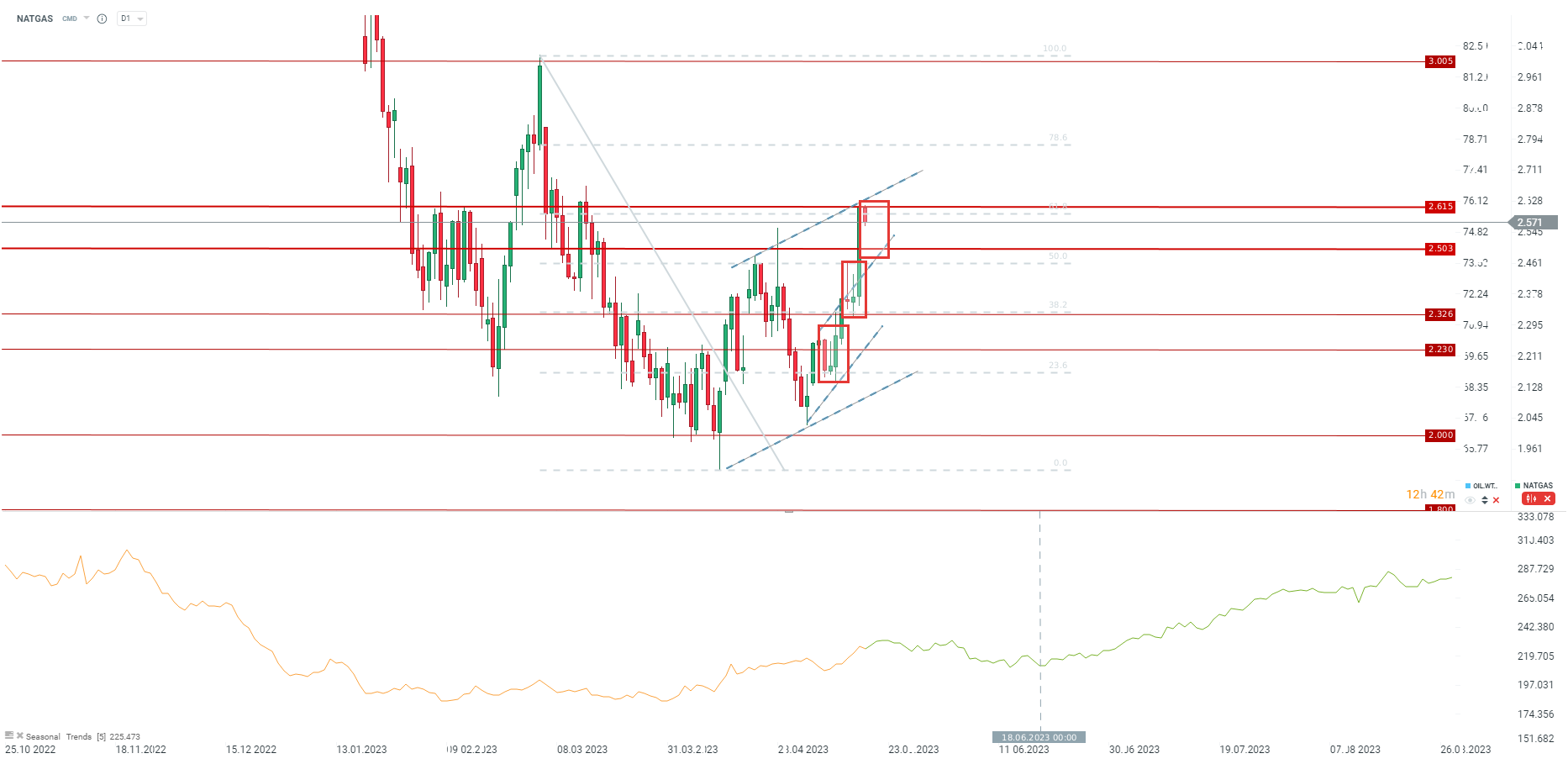

NATGAS pulls back from the $2.6 per MMBTu area. Range of the largest correction in the current upward impulse suggests a possibility of price dropping to around $2.4 per MMBTu. On the other hand, such a correction may not occur ahead of contract rollover (May 23, 2023). Seasonal patterns suggest a potential for range trading until June 3, followed by small correction and significant gains starting from around June 18 when demand for air conditioning increases due to the beginning of summer period. Source: xStation5

NATGAS pulls back from the $2.6 per MMBTu area. Range of the largest correction in the current upward impulse suggests a possibility of price dropping to around $2.4 per MMBTu. On the other hand, such a correction may not occur ahead of contract rollover (May 23, 2023). Seasonal patterns suggest a potential for range trading until June 3, followed by small correction and significant gains starting from around June 18 when demand for air conditioning increases due to the beginning of summer period. Source: xStation5

💰 เติมพลังพอร์ต รับสิทธิ์ Cashback ทันที

กราฟประจำวัน: AUDUSD ปรับตัวขึ้น 📈 หลัง RBA ประกาศขึ้นดอกเบี้ยเกินคาด

สรุปเช้า: ธนาคารกลางออสเตรเลีย (RBA) ขึ้นอัตราดอกเบี้ย

ข่าวเด่นวันนี้