Crude oil futures are gaining on Monday following the escalation of the Middle East conflict over the weekend and the announcement that Libya's eastern government will halt all oil exports and production. Libya currently exports more than $30 billion in oil annually. By 2023, the country will export an average of 1.2 million barrels of oil per day.

Weekend escalation

Hezbollah fired hundreds of rockets and drones toward Israel early Sunday morning. The attack came after the Israeli military carried out a preemptive raid on Lebanon using some 100 jets to thwart an allegedly larger attack by Hezbollah. Hezbollah, backed by Iran, announced the end of its military operation for the day, but said it would continue its military operations against Israel until a cease-fire in Gaza is agreed to

Suspension of exports

Libya's eastern government announced a halt to all oil exports and production, declaring a state of force majeure for all oil fields, terminals and oil facilities. The decision was made in response to moves by rival Tripoli to replace the central bank's leadership, exacerbating a domestic dispute over central bank independence and control over oil revenues. The decision to halt exports came amid already existing production problems this month, caused by failures at some oilfields.

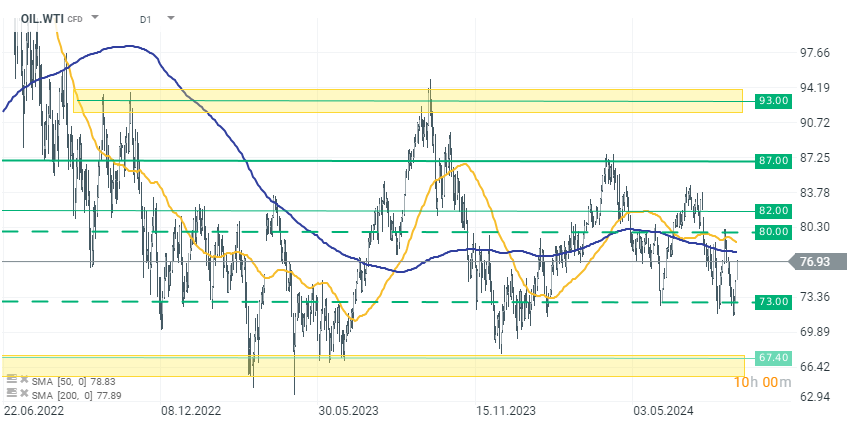

OIL WTI (D1 interval)

The price of WTI crude oil is gaining rapidly, extending the gains in Friday's session. The rebound from around $73 per barrel took the price to levels around $77 per barrel. If the escalation of the conflict in the Middle East continues and the situation in Libya does not calm down, testing the levels of $80 is within the range of the current upward movement.

Source: xStation 5

ข่าวเด่นวันนี้

🚨 ทองคำร่วง 3% ขณะที่ตลาดเตรียมตัวเข้าสู่ช่วงหยุดตรุษจีน

ราคาช็อกโกแลต (Cocoa) ร่วง 2.5% แตะระดับต่ำสุดตั้งแต่ตุลาคม 2023 📉

ก๊าซธรรมชาติ (NATGAS) ผันผวนน้อย หลังรายงานการเปลี่ยนแปลงสต็อกของ EIA