- Wall Street opens higher

- Indices are supported by a weaker dollar

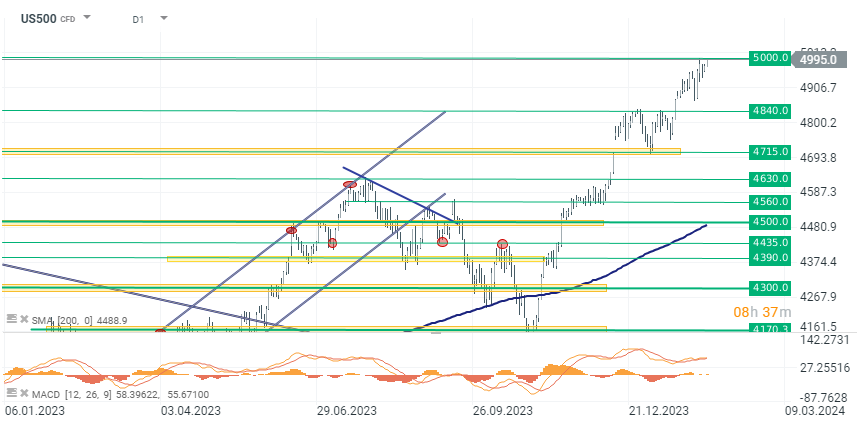

The middle of the week brings further gains in the US stock market. Futures are gaining at the beginning of the session, with the US500 nearing the historic barrier of 5000 points. The rise in stocks is, of course, supported by the earnings season. We are already past the most important publications, and it's clear that companies have not disappointed investors. With a few exceptions, financial reports have been solid, as are the outlooks for 2024. The better sentiment is also maintained by the dollar's return to declines. Nevertheless, the yields of 10-year Treasury bonds are slightly rebounding and returning to around 4.10%.

Today, the dollar is moderately weaker, with the USDIDX index losing 0.10%. The declines occurred in reaction to the 61.8% Fibonacci retracement of the last downward move, which may indicate supply pressure at least in the short term. Source: xStation 5

The US500 index is approaching the historic level of 5,000 points. In today's trading, the US500 gains 0.35% to 4990 points at the time of publication. Four sessions earlier, we already observed the first testing of the 500 points level. If today's sentiment does not worsen, we may experience another testing. Source: xStation 5

Corporate News

Tesla (TSLA.US) employees are facing the possibility of job cuts, as US managers reportedly have been required to evaluate whether each of their team members' roles is critical. Managers are being asked to determine the necessity of each position, with this move occurring amidst a slowdown in sales growth as the carmaker invests in its next wave of growth.

Alibaba (BABA.US) stock dropped approximately 4% premarket on Wednesday following its third-quarter revenue miss, as per some estimates. Other Chinese stocks also saw declines, with JD.Com, Bilibili, and Baidu falling around 4%, 5%, and 2%, respectively. Alibaba's non-GAAP earnings per ADS slightly decreased by 2% year-over-year to RMB18.97 ($2.67), surpassing estimates. Company revenue only grew about 5% to RMB260.35 billion ($36.67 billion). Additionally, Alibaba had to abandon its plans to spin off its cloud business due to U.S. restrictions on advanced computing chip exports.

Ares Capital (ARCC.US) reported better-than-expected Q4 earnings. The company's Q4 core EPS of $0.63 exceeded the average analyst estimate of $0.60, marking a rise from $0.59 in Q3 and maintaining the level of Q4 2022. As of early February 2024, Ares's investment backlog was $770 million with a pipeline of $340 million, following new investment commitments of approximately $705 million made since the start of the year.

Taiwan Semiconductor (TSM.US) reported a significant increase in its January revenue, reaching approximately NT$215.79 billion, which marks a 7.9% rise from the previous year and a substantial 22.4% increase from December. This announcement follows TSMC's recent news on Tuesday that it plans to construct a second chip fabrication facility in Japan, with assistance from Sony (SONY), Denso, Toyota (TM), and the Japanese government.

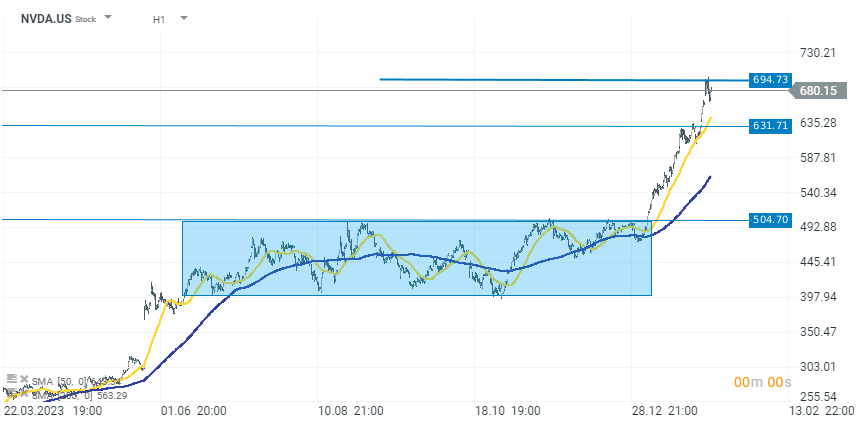

Morgan Stanley has increased Nvidia's (NVDA.US) price target, anticipating further gains in artificial intelligence for the semiconductor giant. Analyst maintaining an Overweight rating on Nvidia, raised the price target to $750 from $603, indicating an approximately 10% upside from current levels. Morgan Stanley has also revised revenue estimates for 2024 and 2025, now expecting Nvidia’s full-year data center revenue to reach $88 billion in 2024, up from the previous estimate of $80 billion and $46.7 billion in 2023.

Source: xStation 5

Source: xStation 5

Palo Alto เข้าซื้อกิจการ CyberArk! ก้าวสู่การเป็นผู้นำใหม่ในวงการไซเบอร์ซีเคียวริตี้

BREAKING: US100 พุ่งแรง หลังรายงาน NFP สหรัฐแข็งแกร่งกว่าคาด

เหลือเวลาไม่กี่วัน รับหุ้น GRAB ฟรี ⏳

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡