US CPI data release is one of key two markets events for USD traders today, with the other one being FOMC minutes in the evening. Inflation data for March will be released at 1:30 pm BST and is expected to show acceleration in the headline measure. However, core measure is expected to slow slightly. Let's take a quick look at expectations ahead of the release

What market expects?

- Headline CPI is expected to accelerate from 3.2 to 3.4% YoY in March, with monthly inflation slowing to 0.3% MoM from 0.4% MoM in February

- Core CPI is expected to decelerate from 3.8 to 3.7% YoY in March, with monthly core inflation slowing to 0.3% MoM from 0.4% MoM in February

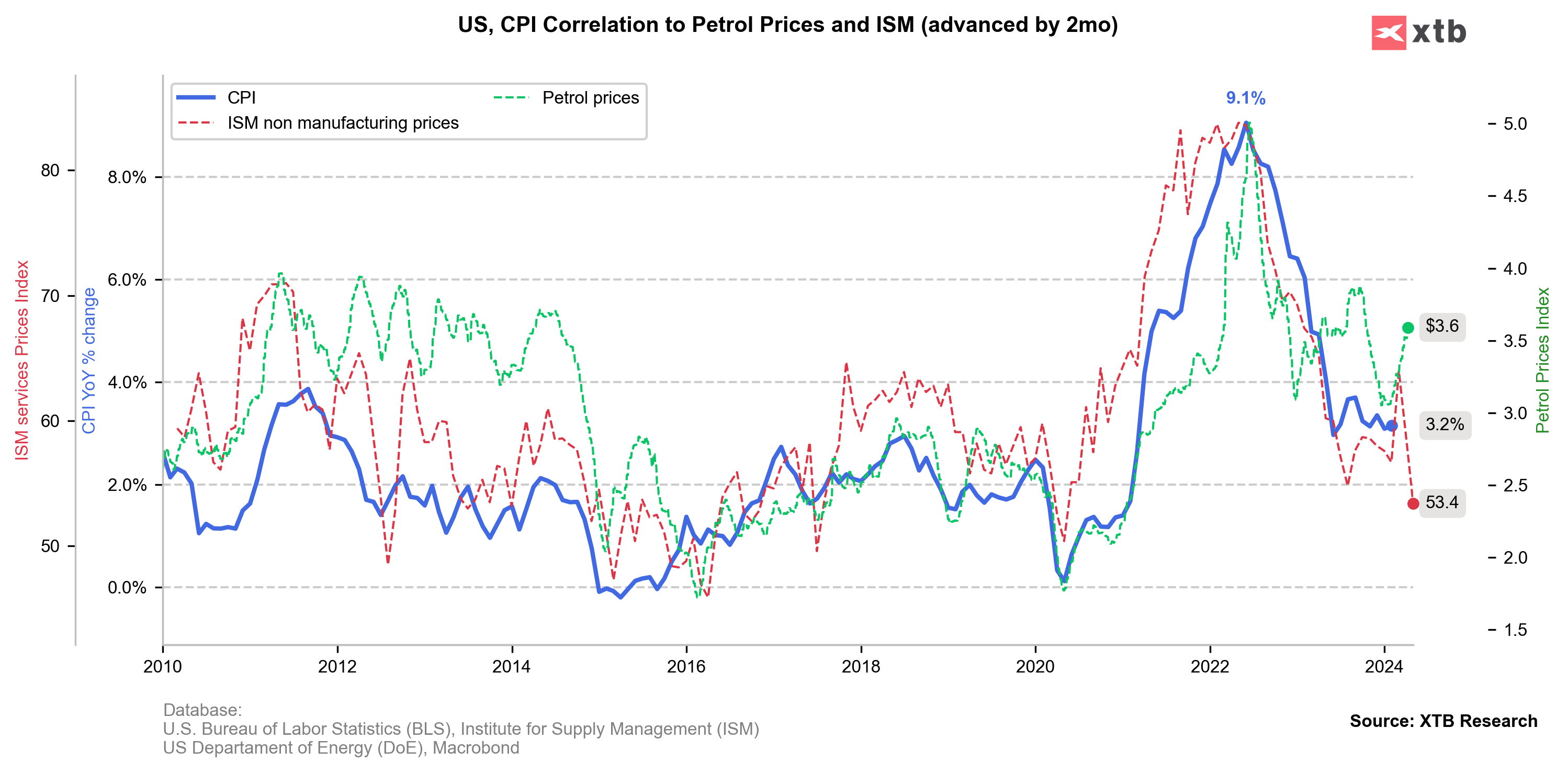

- Manufacturing ISM Prices Paid subindex jumped from 52.5 to 55.8 in March

- Non-manufacturing ISM Prices Paid subindex plunged from 58.6 to 53.4 in March

- Petrol prices jump in March as oil prices increased

- Wage growth in NFP report moderated further, from 4.3 to 4.1% YoY in March. However, this was due to base effects as monthly wage growth accelerated from 0.1% MoM in February to 0.3% MoM in March

- A 0.6% MoM increase is expected in energy prices component of CPI report as higher gasoline prices likely offset drop in natural gas due to milder weather,

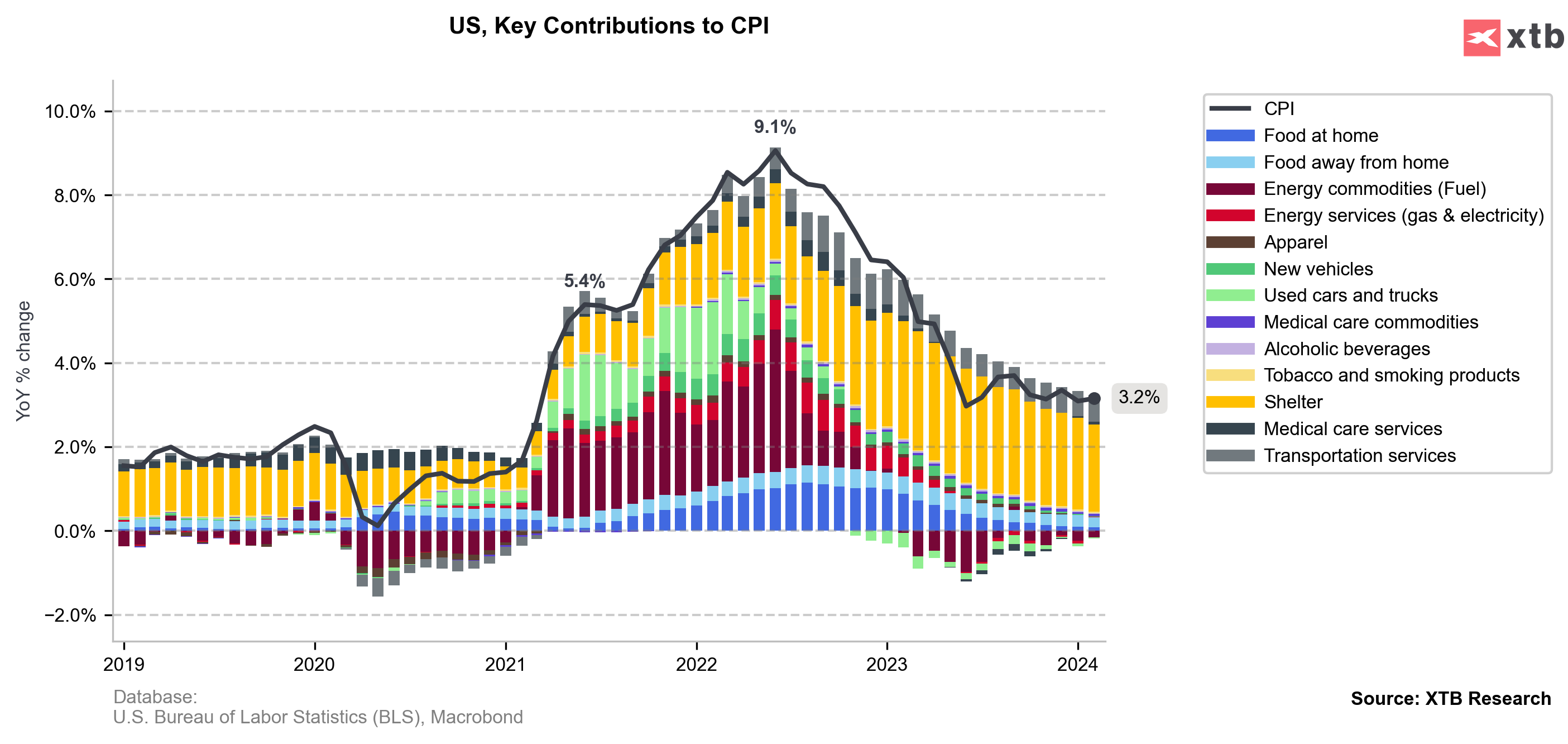

- Shelter component is expected to remain a key contributor to overall inflation. However, shelter inflation is expected to continue to moderate further throughout the year

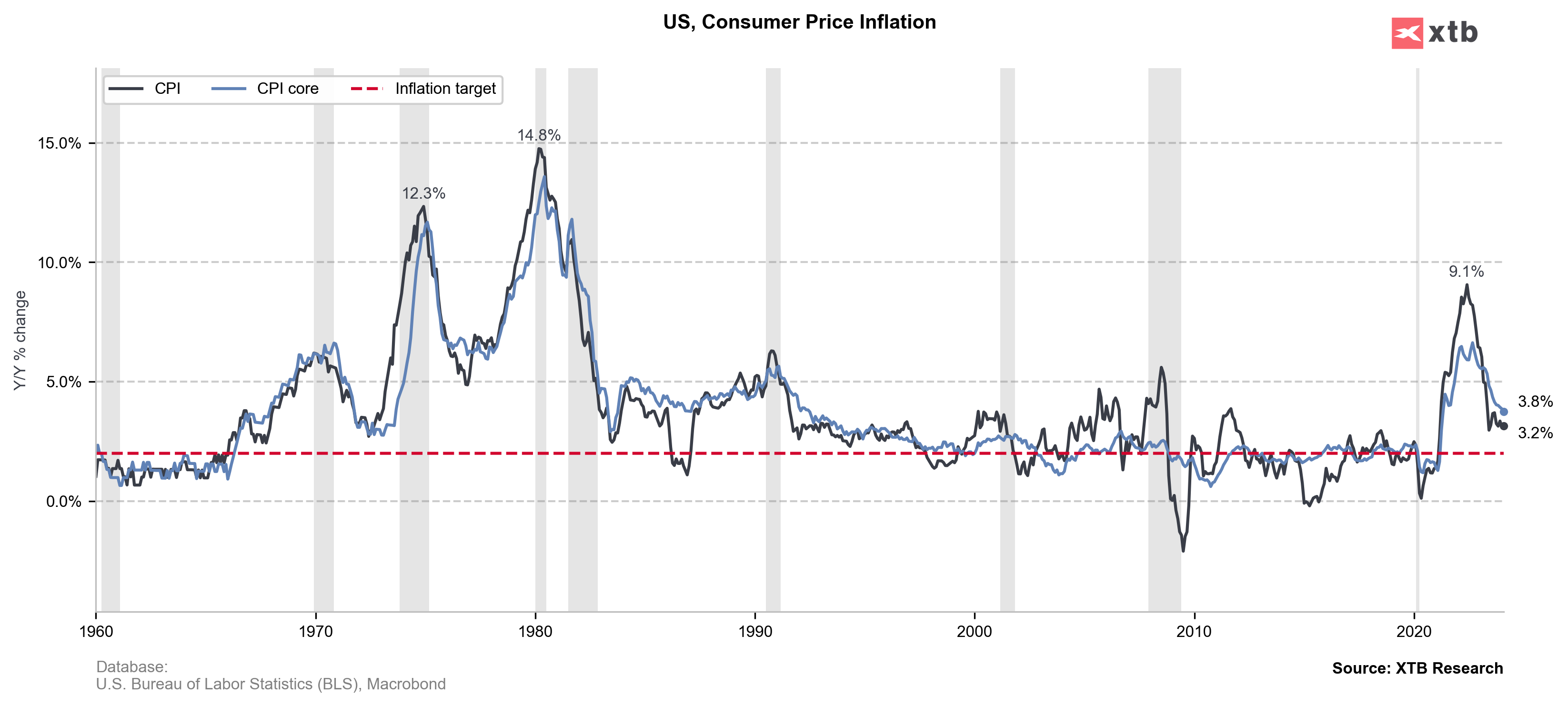

Inflation reports for December 2023, as well as January and February 2024 turned out to be hawkish surprises. In each case, headline and core data on an annual and monthly basis exceeded expectations, preventing Fed from beginning cutting rates. An expected slowdown in monthly headline and core CPI is welcome, and a dovish surprise would reignite hopes for rate cuts in the first half of 2024. Nevertheless, inflation is still expected to remain above Fed's target so a confirmation in the coming months would be needed.

US inflation slowed but still remains above Fed's target. Source: Bloomberg Finance LP, XTB Research

US inflation slowed but still remains above Fed's target. Source: Bloomberg Finance LP, XTB Research

Shelter remains a key contributor to US CPI inflation, but leading indicators point to further slowdown in it this year. Source: Bloomberg Finance LP, XTB Research

Shelter remains a key contributor to US CPI inflation, but leading indicators point to further slowdown in it this year. Source: Bloomberg Finance LP, XTB Research

Will the report give Fed more confidence to cut rates?

As usual, CPI report will be closely watched by market participants. This is especially true given that Fed continues to signal it does not have enough confidence to cut rates yet. As inflation stays above the target and readings for the first two months were quite hawkish, a dovish CPI print for March may not be enough to give US central bank enough confidence to cut rates at its next meeting in May. Money markets currently see an only 5% chance of a 25 basis point rate cut in May. Expectations for June cut have dropped considerably recently but it still remains a likely option with 60% chance priced in. A slower than expected acceleration in headline inflation or an unexpected slowdown would be welcome, but a follow-up confirmation in April data would be need to boost chances for quicker beginning of rate cuts.

However, traders should keep in mind that US CPI report is not the only not noteworthy release scheduled for today. FOMC minutes will be released in the evening at 7:00 pm GMT. While it is unlikely to provide any major surprises, as a lot have been said in economic projections from that meeting, it may offer some wording changes to statement and it could trigger some market moves.

While non-manufacturing ISM data suggests a strong disinflationary impulse in March, petrol prices climbed higher and are sending a conflicting signal. Source: Bloomberg Finance LP, XTB Research

While non-manufacturing ISM data suggests a strong disinflationary impulse in March, petrol prices climbed higher and are sending a conflicting signal. Source: Bloomberg Finance LP, XTB Research

USD trades flat ahead of inflation data

Trading on the global financial markets have been calm so far today. USD dollar is trading mixed against G10 peers, being neither leader nor a laggard within the group. Gold is pulling back slightly while US index futures trade a touch higher.

USDJPY tested resistance zone ranging below 151.90 mark earlier today, but failed to break above. Pair pulled back slightly but continues to trade near recent local highs. Another hawkish surprise in US inflation data may provide fuel for a breakout above this crucial area, which has been limited upside on the pair for around 3 weeks now. On the other hand, a lower than expected reading could trigger a deeper pullback from this important technical resistance, confirming the ongoing sideways move. In such a scenario, the support levels to watch can be found in the 151.50 and 151.20 areas.

Source: xStation5

Source: xStation5

BREAKING: US100 พุ่งแรง หลังรายงาน NFP สหรัฐแข็งแกร่งกว่าคาด

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

สรุปตลาดเช้า: ดอลลาร์ติดกับดัก ตลาดจับตา NFP คืนนี้ 🏛️

ข่าวเด่นวันนี้