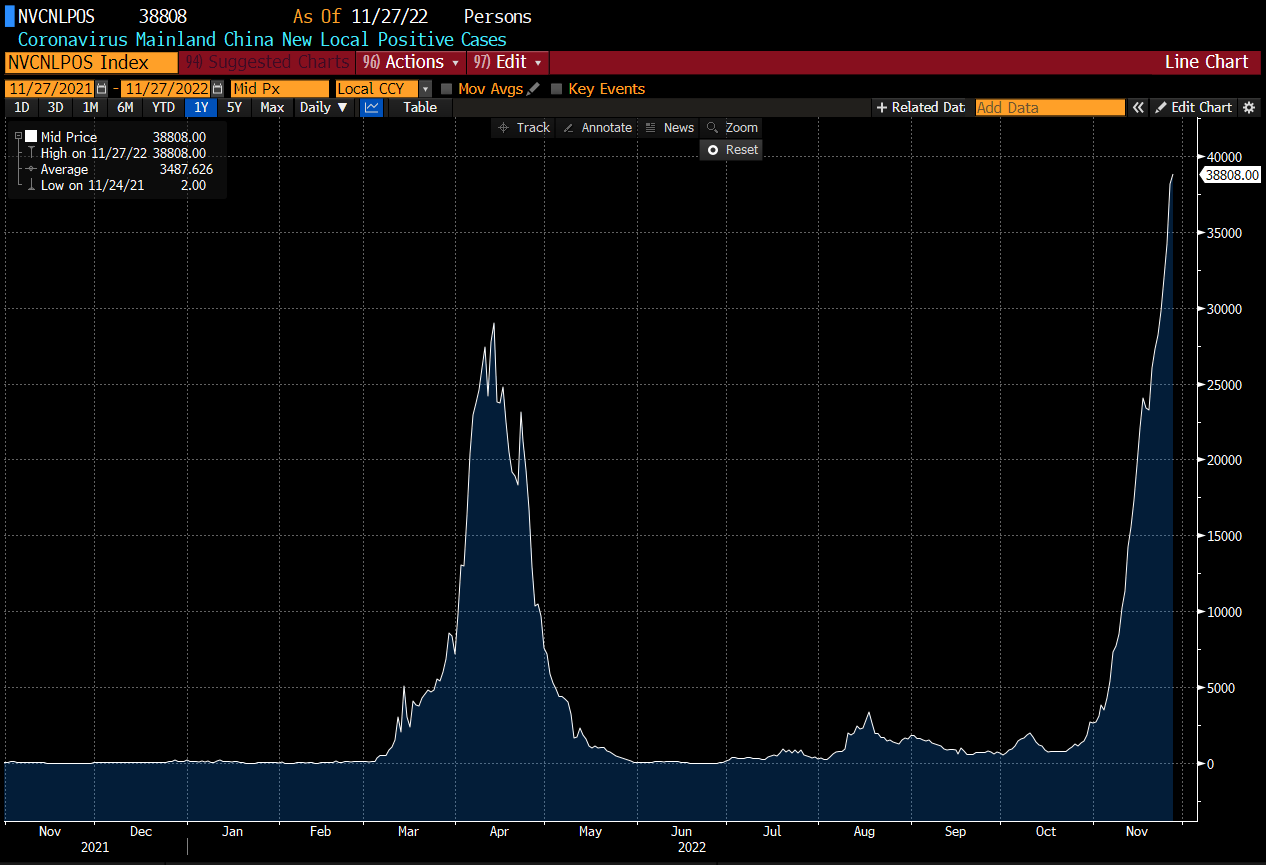

WTI oil is at its lowest level since late December 2021, and Brent is at its lowest levels since January this year. Thus, it can be said that oil has neutralized all of this year's growth in the face of very large demand problems in China. The wave of protests in China only reinforces fears of reduced economic activity. The number of new cases in China is growing faster than in the first half of this year, which could not only lead to even lower growth for Q4 than in Q2, but if the situation does not improve, even a decline in GDP on an annualized basis is not ruled out. As you can see, demand issues are currently more important to investors than supply constraints. Moreover, the recent falling inflation in the US has not boosted sentiment in the oil market.

Number of new local Covid cases in China. Source: Bloomberg

WTI crude oil is at its lowest since December 27, 2021. If the situation does not improve, the key support zone is around $60-65 per barrel. Source: xStation5

🔴LIVE: 3 ปัจจัยที่กำลังขับเคลื่อนตลาด

สรุปข่าวเช้า: ไฟเขียวซื้อน้ำมันรัสเซียได้ 30 วัน

โคเนื้อฟิวเจอร์สลง หลัง JBS ปิดโรงงาน ราคาข้าวโพด-ตะวันออกกลางกดดัน 📌

เข้าร่วม Workshop ปลดล็อกเคล็ดลับเทรดทอง