US PPI inflation report and housing market data for January was released today at 1:30 pm GMT. PPI report was expected to show a deceleration in headline and core producers' price growth, while housing market data was expected to show a small increase in building permits as well as flat housing starts compared to December.

Actual report turned out to be quite a big surprise - headline PPI barely slowed, core PPI accelerated and housing market data turned out to be much worse than expected. Based on market reaction, a beat in PPI data seem to outweigh misses in housing market numbers - USD surged following the release while US index futures dropped.

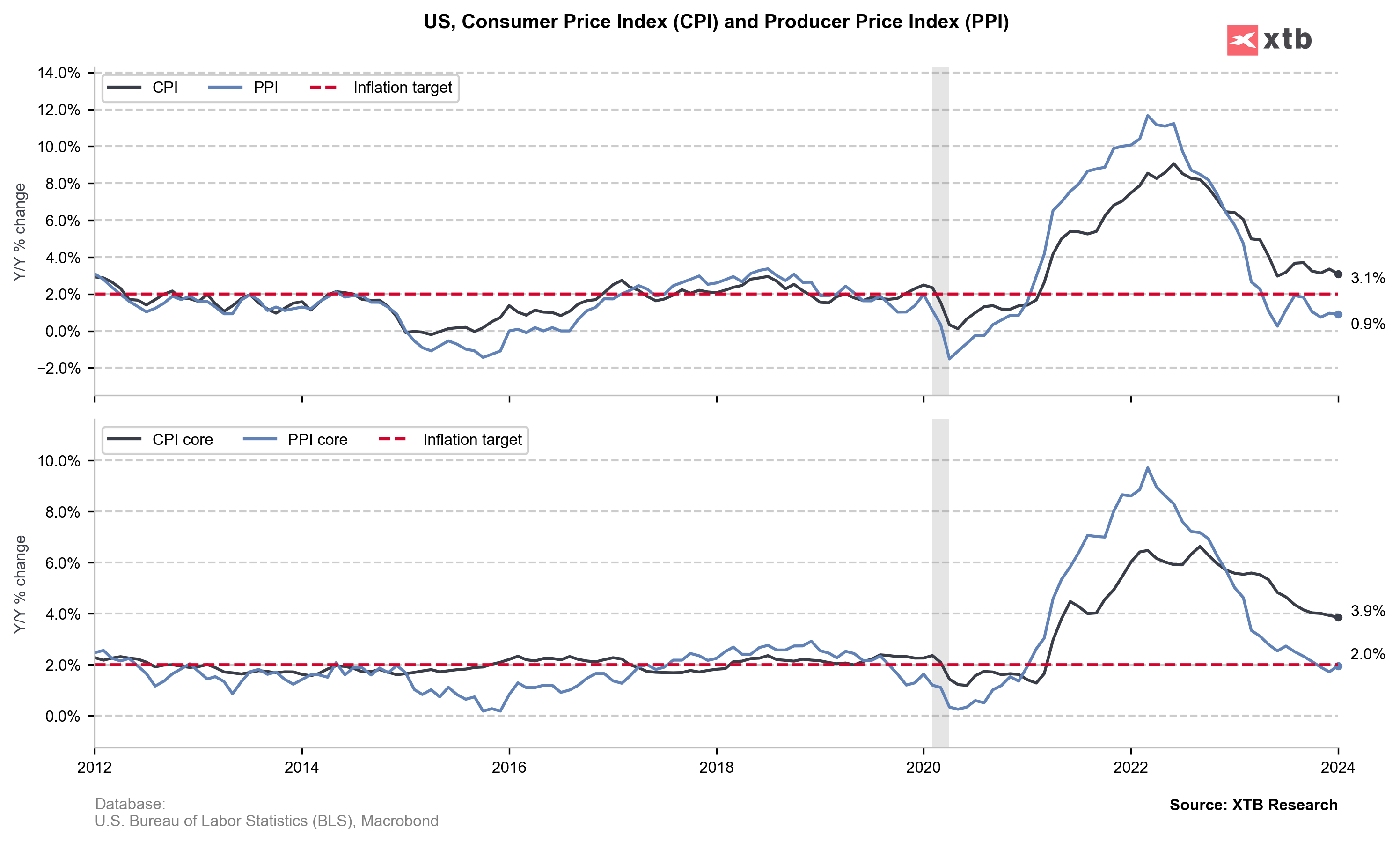

US, PPI inflation for January

- Headline (monthly): 0.3% MoM vs 0.1% MoM expected (-0.2% MoM previously)

- Headline (annual): 0.9% MoM vs 0.6% YoY expected (1.0% YoY previously)

- Core (monthly): 0.5% MoM vs 0.1% MoM expected (-0.1% MoM previously)

- Core (annual): 2.0% MoM vs 1.6% YoY expected (1.8% YoY previously)

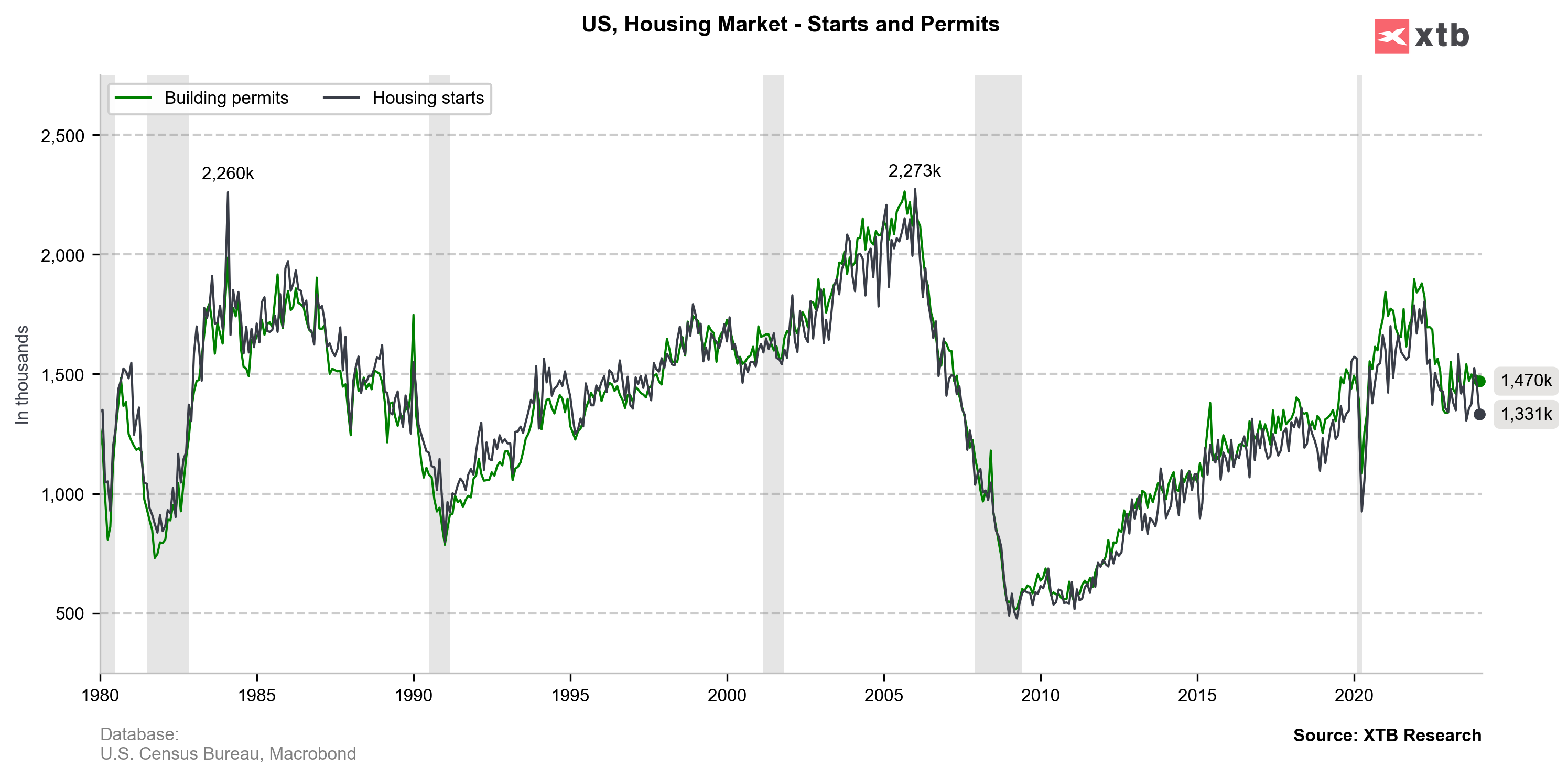

US, housing market data for January

- Building permits: 1470k vs 1510k expected (1493k previously)

- Building permits: -1.5% MoM vs +1.3% MoM (+1.8% MoM previously)

- Housing starts: 1331k vs 1460k expected (1460k previously)

- Housing starts: -14.8% MoM vs 0.0% MoM expected (-4.3% MoM previously)

EURUSD slumps below 50- and 200-hour moving average following a higher-than-expected PPI reading for January. Source: xStation5

EURUSD slumps below 50- and 200-hour moving average following a higher-than-expected PPI reading for January. Source: xStation5

ملخص السوق: نوفو نورديسك تقفز بأكثر من 7% 🚀

التقويم الاقتصادي: بيانات سوق العمل المتأخرة هي التقرير الرئيسي لهذا الأسبوع 🔎

حصاد الأسواق (09.02.2026)

التقويم الاقتصادي: سوق العمل الكندي وبيانات ميشيغان (06/02/2026)