The UK economy saw faster-than-expected growth in May, with a 0.4% m/m increase in GDP, driven by strong performances in some sectors. This was higher than analysts expectations at 0.2%. Strong rebound from April's flat growth was highlighted by the construction sector, which grew at its fastest rate in almost a year, largely due to house building and infrastructure projects. On the other hand, manufacturing production rose by 0.4% m/m (in line with expectations), while industrial production saw a modest increase of 0.2% m/m (forecast 0,3%), reflecting a positive shift in overall economic activity.

07:00 AM BST, United Kingdom - GDP data for May:

- GDP: actual 0.4% MoM; forecast 0.2% MoM; previous 0.0% MoM;

- GDP: actual 1.4% YoY; forecast 1.2% YoY; previous 0.7% YoY;

- Monthly GDP 3M/3M Change: actual 0.9%; forecast 0.7%; previous 0.7%;

07:00 AM BST, United Kingdom - Manufacturing Production for May:

- actual 0.4% MoM; forecast 0.4% MoM; previous -1.6% MoM;

- actual 0.6% YoY; forecast 1.2% YoY; previous -0.4% YoY;

07:00 AM BST, United Kingdom - Industrial Production for May:

- Industrial Production: actual 0.2% MoM; forecast 0.3% MoM; previous -0.9% MoM;

- Industrial Production: actual 0.4% YoY; forecast 0.6% YoY; previous -0.7% YoY;

This unexpected growth adds more complexity to the Bank of England's (BoE) monetary policy decisions. With recent comments from BoE policy makers suggesting caution, the decision on whether to cut interest rates next month remains uncertain. Despite headline inflation falling back to the BoE's target of 2%, core inflation remains at 3,5% y/y still significantly above target. Concerns about persistent inflationary pressures and robust economic performance could delay any rate cuts. Analysts note that the strong economic data may lead the BoE to maintain its current rate to ensure inflation is fully under control.

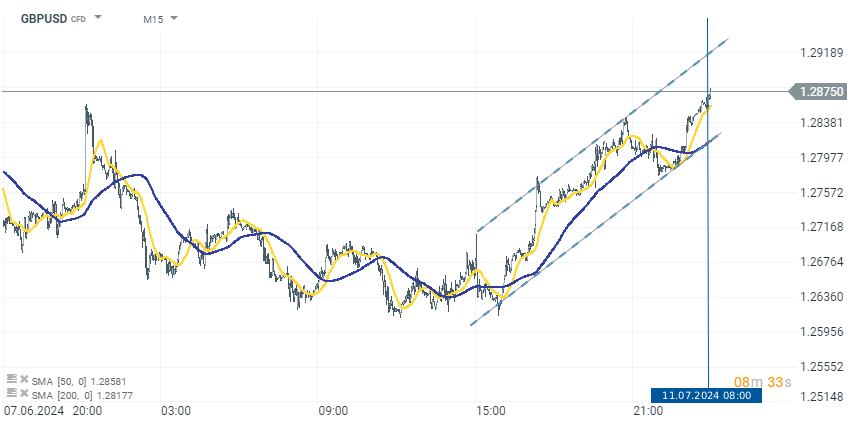

GBPUSD (M15)

The British pound responded positively to the economic data, reaching a four-month high against the US dollar. The strong GDP figures and reduced expectations of an imminent BoE rate cut have boosted investor confidence in the pound. As investors await further US economic data, particularly the CPI report on 17th of July, the pound's strength reflects optimism about the UK's economic recovery and stability in its monetary policy outlook.

Source: xStation 5

Source: xStation 5

ملخص اليوم: بيانات أمريكية ضعيفة تُؤدي إلى انخفاض الأسواق، والمعادن الثمينة تتعرض لضغوط مجدداً!

عاجل: مبيعات التجزئة الأمريكية أقل من التوقعات

المركزي: التحويلات المالية المصرفية تجاوزت 24.4 تريليون درهم في 2025

«مبادلة» و«الدار»: 60 ملياراً لتوسعة المنطقة المالية في «المارية»