Chilean peso is gaining today, with the move being triggered by release of a quarterly monetary policy report by Chile's central bank. To be more precise, a new set of economic forecasts can be named as a reason behind the move. Inflation forecast for end-2024 was boosted from previous 3.8% to 4.2%, while forecast for end-2025 was boosted from 3.0% to 3.6%. GDP forecast for 2024 was narrowed from 2.00-3.00% to 2.25-3.00%, while 2025 forecast was left unchanged at 1.50-2.50%. Domestic demand as well as investment and consumer spending forecasts for 2024 and 2025 were improved as well.

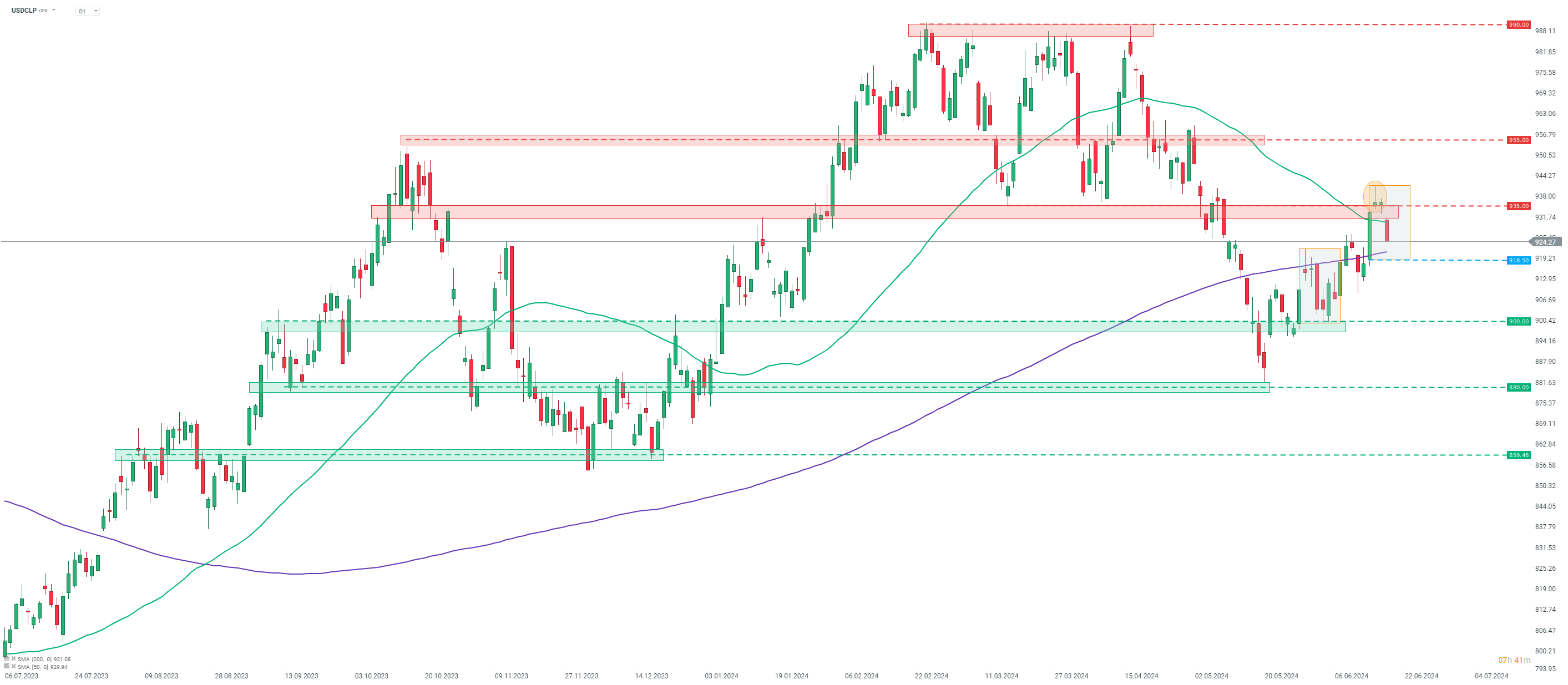

USDCLP is dropping over 1%, with the move likely being supported by limited USD-liquidity due to US holiday today. Taking a look at USDCLP chart at D1 interval, we can see that the pair has recently attempted to break above the 935 resistance zone, but failed to do so, painting a potentially bearish candlestick pattern (orange circle). Pair is dropping back below 50-session moving average today. However, it is too soon to be talking about the end of the ongoing upward correction and a potential short-term trend reversal, as a break below the lower limit of a local market geometry at around 918.50 would be needed.

Source: xStation5

Source: xStation5

ملخص اليوم: بيانات أمريكية ضعيفة تُؤدي إلى انخفاض الأسواق، والمعادن الثمينة تتعرض لضغوط مجدداً!

عاجل: مبيعات التجزئة الأمريكية أقل من التوقعات

فوز حزب تاكايتشي في الانتخابات اليابانية – هل يعود القلق بشأن الديون؟ 💰✂️

ثلاثة أسواق تستحق المتابعة الأسبوع المقبل (09.02.2026)