Coca-Cola, the famous soft drinks manufacturer, delivered a strong performance in the second quarter of 2024, exceeding expectations on both earnings and revenue. The company's ability to navigate inflationary pressures and maintain consumer demand is particularly impressive, especially considering the weaker performance of its main rival, PepsiCo.

Strengths:

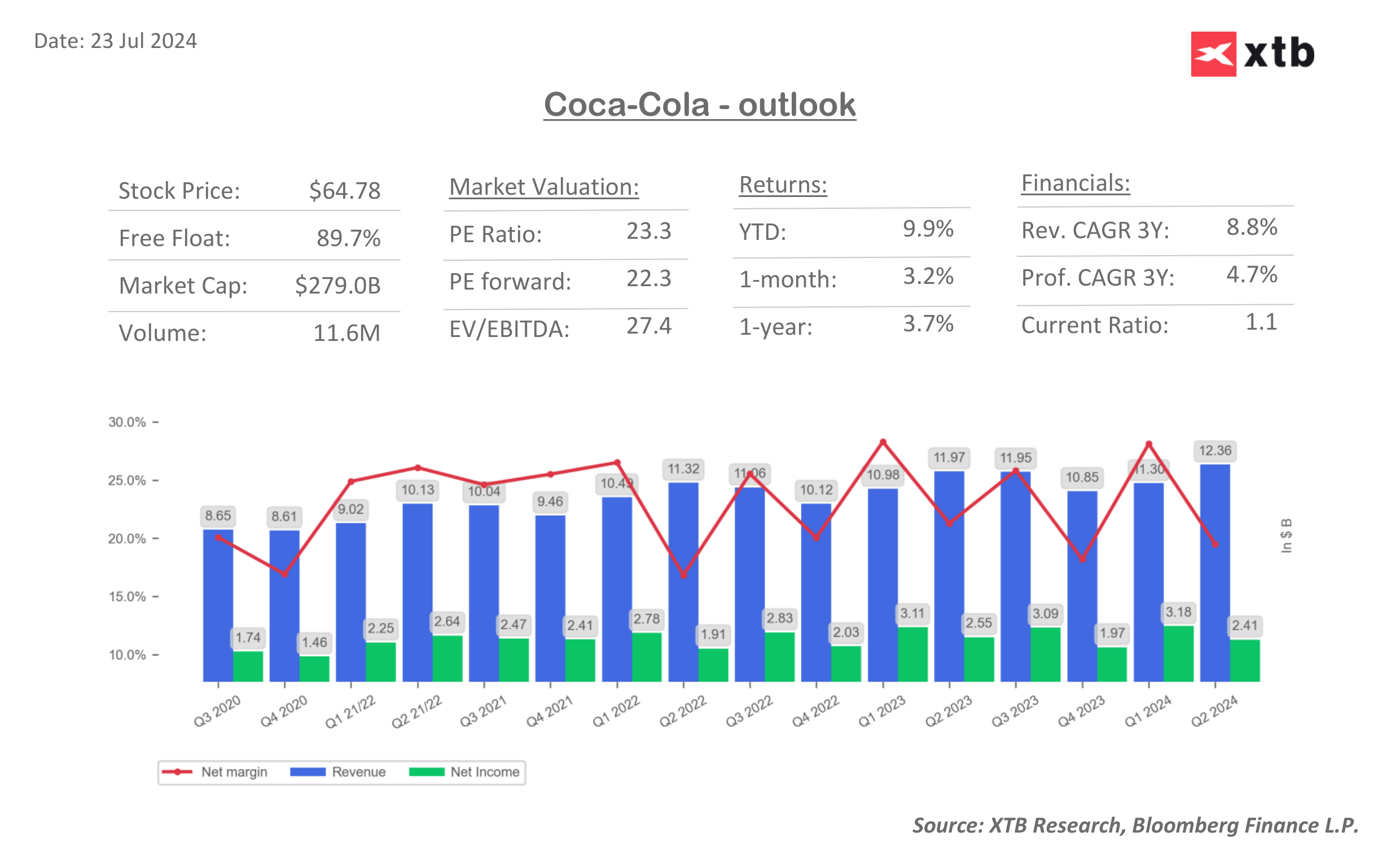

- Strong revenue growth: Organic revenue surged 15%, significantly outperforming analyst estimates that pointed at 9.37% growth. This indicates that Coca-Cola effectively managed pricing and product mix to offset inflationary costs.

- Global volume growth: While North America experienced a slight decline, the company's international markets drove overall volume growth. This highlights the importance of Coca-Cola's global footprint and its ability to capture growth opportunities in emerging markets.

- Profitability: Adjusted EPS surpassed estimates, demonstrating the company's focus on cost control and operational efficiency. EPS came at 0.84 USD with estimates at 0.81. The company expects comparable EPS growth for the fiscal year at 5-6% (saw 4-5% prior). Operating margin was at 21.3% versus 20.1% in the prior year.

- Upbeat outlook: The raised full-year guidance for organic revenue and comparable EPS reflects Coca-Cola's confidence in its ability to sustain growth momentum. The company sees organic revenue growth for the fiscal year at 9-10%, while analysts saw 9%

Challenges:

- North American weakness: The decline in North American volume is a concern, especially given PepsiCo's similar challenges. This suggests a potential slowdown in the overall U.S. beverage market.

- Currency headwinds: The anticipated foreign exchange impact on Q3 results could dampen overall performance. Coca-Cola sees 8% currency headwind in the current quarter.

Overall Assessment:

Coca-Cola's Q2 results and revised guidance underscore its position as a resilient and adaptable company. The ability to deliver strong top-line growth while managing costs effectively is commendable. While challenges persist, the company's global diversification and robust brand portfolio provide a solid foundation for future growth.

When the market will open, the price will be only about 2% off to the all-time high that was marked in April 2022. However, it is worth to see that the S&P 500 is much higher now than it was more than 2 years ago. On the other hand, the company may be in the group that will benefit in the potential "Trump trade". Source: xStation5

هل سينفد الوقود في أوروبا؟

الولايات المتحدة: الحرب في إيران تؤثر على الأسواق

تراجع المعنويات في وول ستريت 📉 أبرز أحداث موسم أرباح مؤشر ستاندرد آند بورز 500

ملخص اليوم: هل هذه بداية نهاية انخفاض التضخم؟