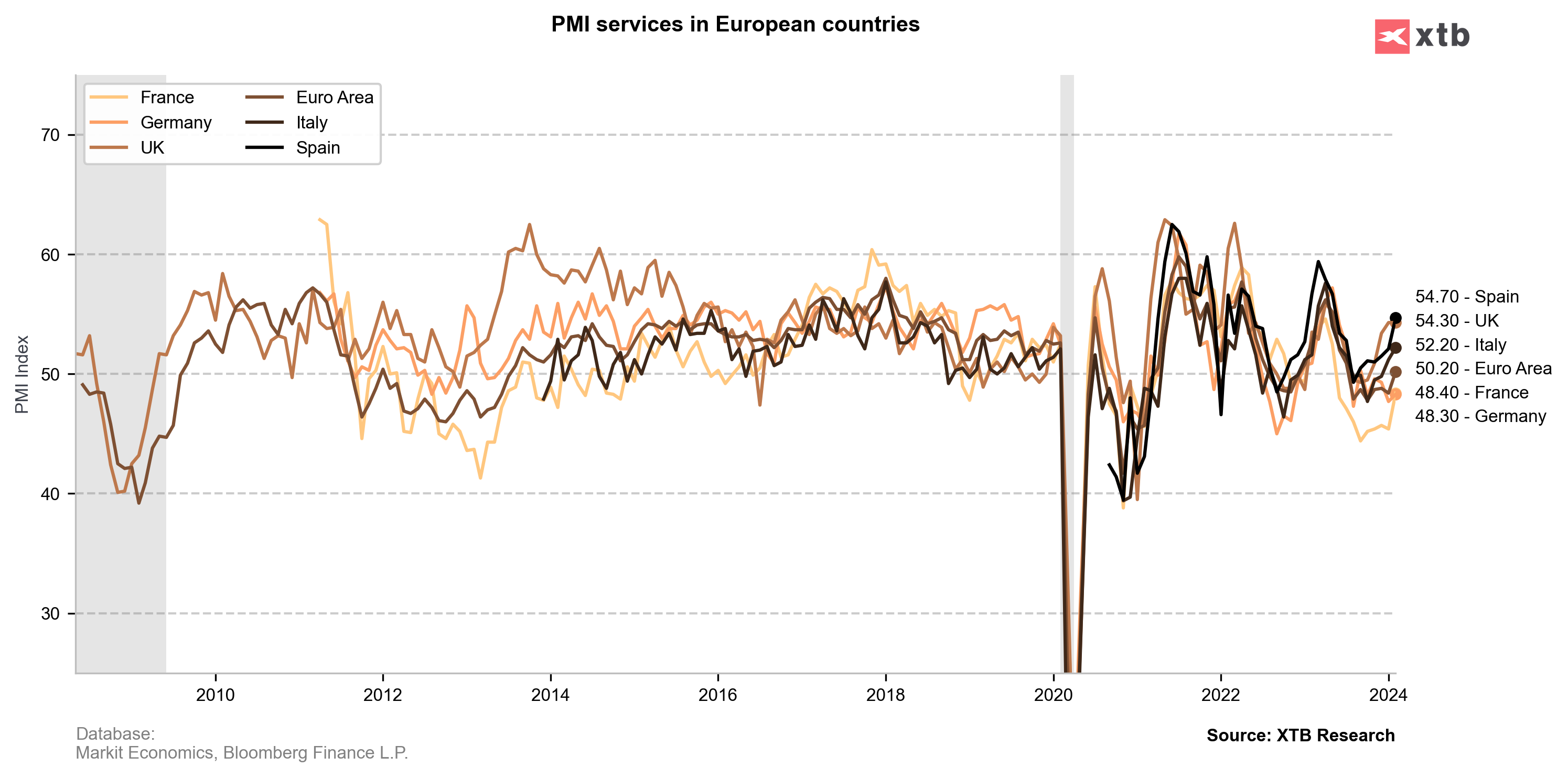

Services PMI indices for February from European countries were released this morning. However, the majority of the releases were revisions to an already-released flash data and were not expected to offer any major surprises.

Report from Spain turned out to be better-than-expected, while Italian data more or less came in-line with expectations. When it comes to revisions, indices from France, Germany and euro area were revised slightly higher compared to preliminary readings. Nevertheless, sub-50 readings from France and Germany signal that situation in services sector in those countries deteriorated compared to January 2024. On the other hand, the reading for the whole euro area came in at 50.2, indicating a small expansion of the sector.

Services PMIs for February

- Spain: 54.7 vs 53.3 expected (52.1 previously)

- Italy: 52.2 vs 52.3 expected (51.2 previously)

- France (final): 48.4 vs 48.0 in first release (45.4 previously)

- Germany (final): 48.3 vs 48.2 in first release (47.7 previously)

- Euro area (final): 50.2 vs 50.0 in first release (48.4 previously)

EUR has been muted at first but began to gain following release of French data. Taking a look at EURUSD chart at H1 interval, we can see that the pair bounced off the 50-hour moving average (green line) and climbed back above 1.0850 mark. A key near-term resistance zone to watch can be found in the 1.0865 area.

Source: xStation5

Source: xStation5

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

عاجل: مبيعات التجزئة الأمريكية أقل من التوقعات

المركزي: التحويلات المالية المصرفية تجاوزت 24.4 تريليون درهم في 2025

«مبادلة» و«الدار»: 60 ملياراً لتوسعة المنطقة المالية في «المارية»

تأسيس شركة “طيران ناس سوريا” بملكية مشتركة مع السعودية