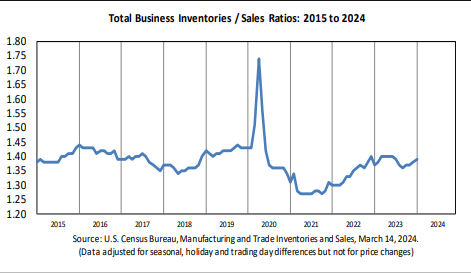

The EURUSD currency pair loses nearly 0.6% today, after PPI inflation and jobless claims data supported the U.S. dollar. ECB member Luis de Guindos indicated today that by June, the ECB will have a complete set of data enabling it to make decisions. He pointed out that although inflation is on track to meet the 2% target, wage dynamics still pose a risk. De Guindos suggested that the eurozone economy's dynamics will accelerate in the second half of 2024. Data published today on U.S. business inventories showed a 0% month-over-month growth compared to the 0.2% m/m forecast and 0.3% previously. The U.S. inventory-to-sales ratio has been steadily improving since the last quarter of 2023.

EURUSD (H1)

The Eurodollar came under significant selling pressure after U.S. 10-year bond yields increased from 4.1% to nearly 4.3%. The rate plunged today below the 200-day SMA (in red), and the hourly RSI suggests extreme oversold levels, below 20 points.

Source: xStation5

ملخص اليوم: تراجعت المكاسب الهائلة في المؤشرات الأمريكية بشكل كامل

ثلاثة أسواق تستحق المتابعة الأسبوع المقبل (02.01.2026)

عاجل: مؤشر مديري المشتريات التصنيعي الأمريكي لشهر ديسمبر يستقر عند 51.8، متراجعًا من 52.2 في نوفمبر 📌

عاجل: بيانات مؤشر مديري المشتريات التصنيعي من ستاندرد آند بورز في المملكة المتحدة أضعف من المتوقع