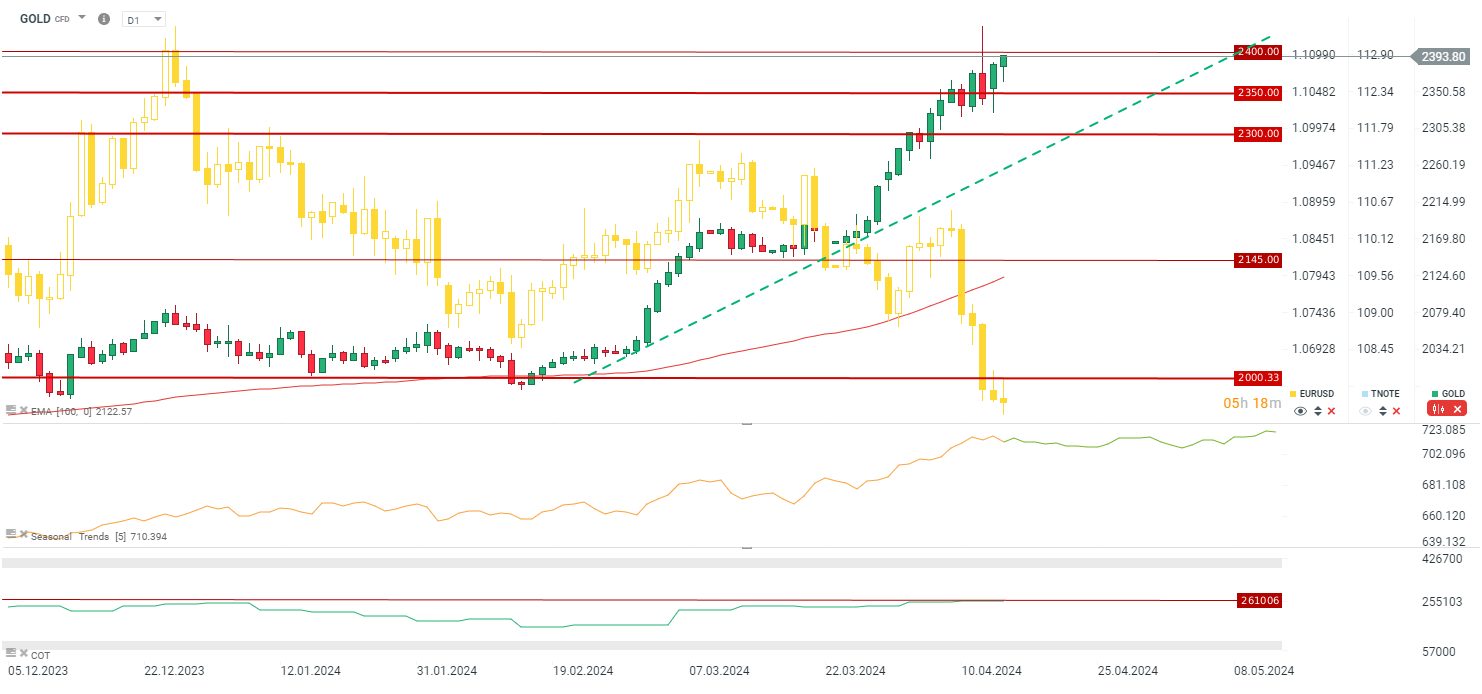

In the last few minutes, we're witnessing a widening divergence between gold and the dollar. The metal is testing around $2400 per ounce following news that Israel intends to retaliate against Iran for the latest retaliatory attack. Just yesterday, it seemed that the situation would de-escalate, but it turns out that it may intensify even further. There's also much speculation about additional sanctions on Iran.

On the other hand, we're ahead of Powell's speech, which may incline investors towards buying the dollar. Today, we saw weak real estate market data and solid US industrial production data. Jefferson from the Fed indicated that interest rate cuts should occur this year, but the Fed won't be in rush. Meanwhile, Lagarde announced that interest rate cuts will come fairly quickly. Powell will begin his speech today at 6:15 PM BST.

عاجل: زيادة هائلة في احتياطيات النفط الأمريكية!

عاجل: بيانات الوظائف غير الزراعية من الولايات المتحدة

ملخص السوق: ارتفاع أسعار النفط وسط التوترات الأمريكية الإيرانية 📈 مؤشرات أوروبية هادئة قبل صدور تقرير الوظائف غير الزراعية الأمريكية

ديوا تستحوذ على حصة «دبي القابضة» في «إمباور» مقابل 1.4 مليار دولار