-

Nagel: Highlighted gradual improvement in private consumption and exports, with strong wage growth and stubborn service inflation. Emphasized data-driven rate decisions and maintained that recent rate cuts were logical and not premature.

-

Kazaks: Emphasized that future decisions will be data-driven and gradual, indicating that victory over inflation is not yet achieved.

-

Muller: Urged caution and advised against rushing to cut interest rates.

-

Vasle: Stressed that the path of ECB interest rates cannot be predetermined.

-

Rehn: Expected declining inflation, supporting economic recovery, with a target of 2% inflation by 2025 assuming no surprises. Stressed the importance of evaluating policy restrictiveness.

-

Makhlouf: Acknowledged uncertainty in the disinflation pace but expressed confidence in its effectiveness, unsure about the speed of future actions.

-

Simkus: Noted clear disinflation with a challenging path ahead, suggesting more than one rate cut this year is possible if economic data remains in line with current forecasts.

-

de Guindos: Expressed concerns about economic uncertainty and projected inflation around 2% next year.

-

Holzmann: Indicated a cautious approach, with CPI risks outweighing growth risks from rate holds.

-

Schnabel: Warned about the lack of fiscal consolidation and its impact on monetary policy, emphasizing uncertainty in future inflation outlook.

-

Villeroy: Confident that inflation will return to 2% by 2025 assuming no unexpected shocks, with a balanced approach to rate cuts, ensuring appropriate pacing.

-

Centeno: Stated there is no fixed commitment on rate trajectory, noting the disinflation process is becoming clearer.

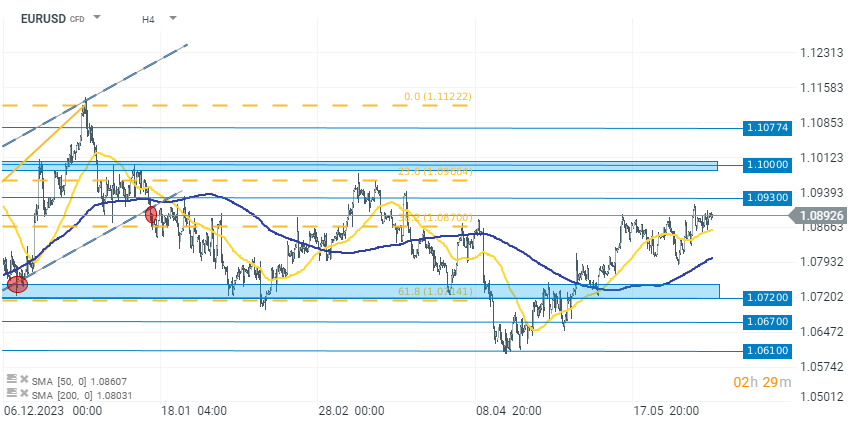

Statements from ECB representatives focused on justifying yesterday's decision to cut interest rates by 25 basis points. The overall message indicates a continuation of a cautious, data-dependent approach in the coming months. Many representatives confirmed the declining inflation dynamics in the Eurozone, while simultaneously expressing slight concerns about persistent inflation in the services sector. The ECB's stance remains unchanged. At the time of publication, a rate cut in July is unlikely, or even ruled out. Investor speculation is more likely to focus on a potential cut in September this year, along with a possible cut in the US.

Source: xStation 5

Source: xStation 5

عاجل: مبيعات التجزئة الأمريكية أقل من التوقعات

المركزي: التحويلات المالية المصرفية تجاوزت 24.4 تريليون درهم في 2025

«مبادلة» و«الدار»: 60 ملياراً لتوسعة المنطقة المالية في «المارية»

تأسيس شركة “طيران ناس سوريا” بملكية مشتركة مع السعودية