Pfizer showed better-than-expected results for 2Q24, and raised its outlook for the full year 2024. After peaking at 4% in pre-market trading, the company is currently gaining just less than 0.5%.

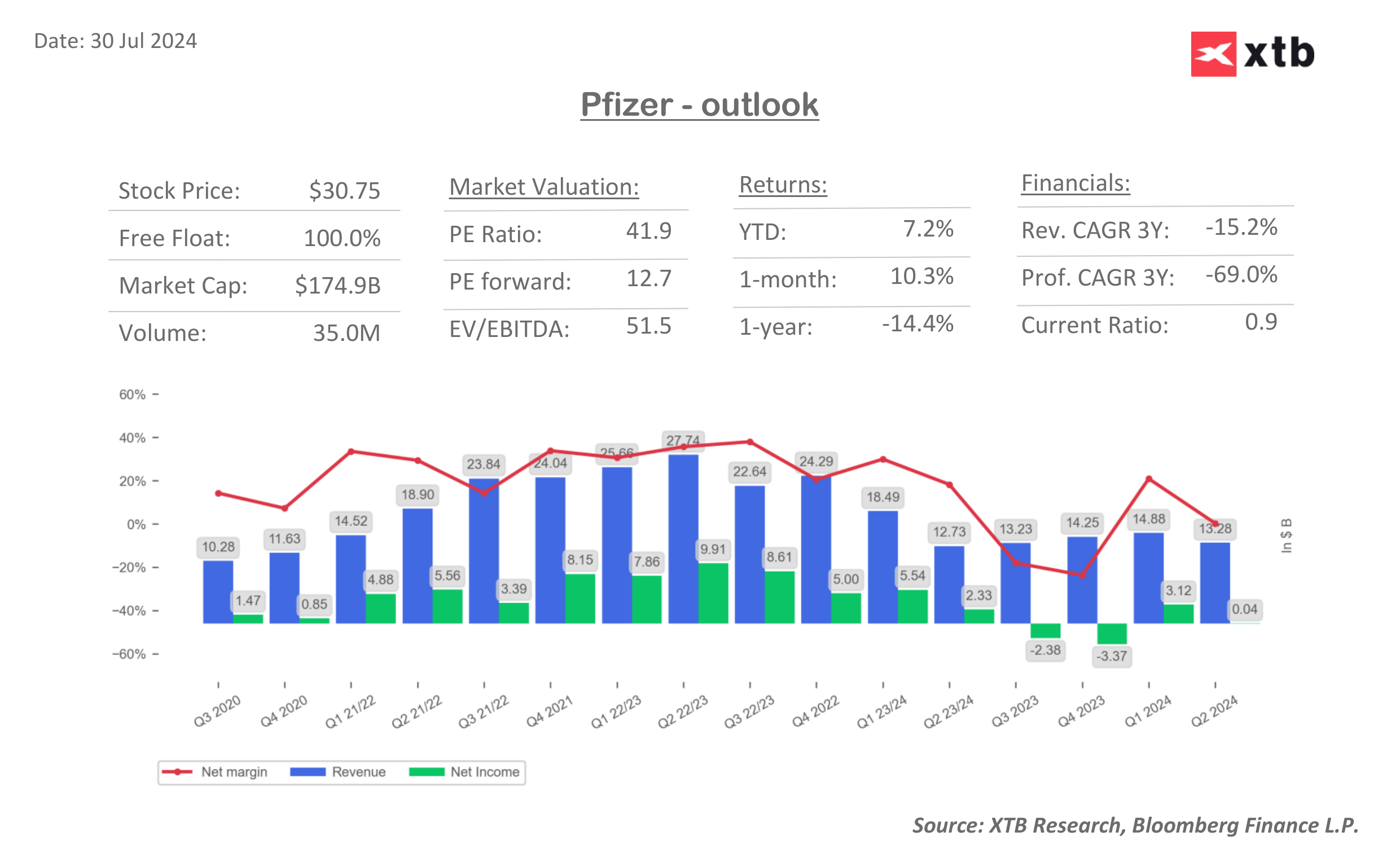

2Q24 was the first quarter since the record second quarter of 2022 (when revenues peaked thanks to sales driven by the COVID-19 pandemic) in which the company managed to achieve positive year-on-year revenue growth. Revenues rose to $13.28 billion (+3% y/y), despite a decline in revenues generated in the COVID-related segment (sales of the Comirnata vaccine fell 87% y/y). Excluding this segment, revenues grew 14% y/y.

Currently, Pfizer's results are most strongly influenced by the anticoagulant drug Eliquis, with sales of $1.88 billion. The company also achieved strong growth in its oncology segment and has plans to continue its strong growth.

Strong results for 2Q24 led the company to raise its forecast for the full year 2024, with revenue estimates rising to $59.5-62.5 billion (vs. $58.5 - $61.5 billion previously) and adjusted earnings per share projected by the company at $2.45 - $2.65 (vs. $2.15 - $2.35 previously). Excluding the COVID-19 segment, this implies a sales growth rate of 9-11%.

2Q24 RESULTS

- Revenue $13.28 billion, estimates $13 billion

- Adjusted earnings per share: $0.60, estimates $0.46

- Comirnata revenues $195 million, estimates $216.6 million

- Paxlovid revenues $251 million, estimates $244.7 million

- Ibrance revenues $1.13 billion, estimates $1.14 billion

- Eliquis revenues $1.88 billion, estimates $1.89 billion

- Vyndaqel family revenues $1.32 billion, estimates $1.11 billion

- Enbrel revenues $179 million, estimates $181 million

- Xeljanz revenues $303 million, estimates $406.9 million

- Inlyta revenues $252 million, estimates $256.2 million

- Adjusted R&D: costs $2.67 billion, estimates $2.83 billion

- Adjusted SI&A: $3.67 billion, estimates $3.48 billion

2024 OUTLOOK:

- Revenues: $59.5-62.5 billion (previous: $58.5-61.5 billion); estimates: $61 billion

- Adjusted R&D costs: $11-$12 billion

- Adjusted SI&A: $13.8-$14.8 billion

- Adjusted earnings per share: $2.45-$2.65 (previously $2.15-$2.35)

Pfizer continues gains today, approaching the resistance level near $31.41. Source: xStation

ملخص السوق: ارتفاع أسعار النفط وسط التوترات الأمريكية الإيرانية 📈 مؤشرات أوروبية هادئة قبل صدور تقرير الوظائف غير الزراعية الأمريكية

التقويم الاقتصادي: بيانات الوظائف غير الزراعية وتقرير مخزونات النفط الأمريكية 💡

ملخص اليوم: بيانات أمريكية ضعيفة تُؤدي إلى انخفاض الأسواق، والمعادن الثمينة تتعرض لضغوط مجدداً!

شركة داتادوغ في أفضل حالاتها: ربع رابع قياسي وتوقعات قوية لعام 2026"