The press conference of FED chairman Jerome Powell is nearing its end and its course was in line with market expectations.

Here are they key takeaways from the opening statement:

- There is still a long way to go until the labor market returns to pre-pandemic levels

- Household spending rising at an especially rapid pace

- Special factors appear to be weighing on labor force participation but those should wane in coming months

- Supply bottlenecks have been larger than anticipated

- Inflation still expected to fall back to longer run goals

- Housing remains strong and business investment rising at a solid pace

- Inflation could turn out to be higher and more persistent than we expect

- If we saw signs of material and consistent rises in medium-term inflation beyond target, we would respond

- The timing of any taper will depend on incoming data and we will provide advance notice before any changes

Below we present some key takeaways from the Q&A session:

- 'some ground to cover' before substantial further progress achieved

- It is clear inflation will be running at 2% for the months ahead

- Fed is clearly ways away' from raising interest rates; it's not on central banks radar now

- FED has 'some confidence' that medium term inflation will fall back

- Bond moves might be related to delta. Powell also cites technical factors and fall in expected inflation compensation

- US clearly on the path to a very strong labor market

- It's unusual to have such a high rate of vacancies to workers

- Fed chair suspects impacts of delta wave will be lower than expected

- Delta could slow the economy down for a period of months or not

- There's a range of views on what timing will be appropriate

- Today was the first deep dive on the timing

- I'm not meaning to suggest anything on the timing of taper; there's a range of views

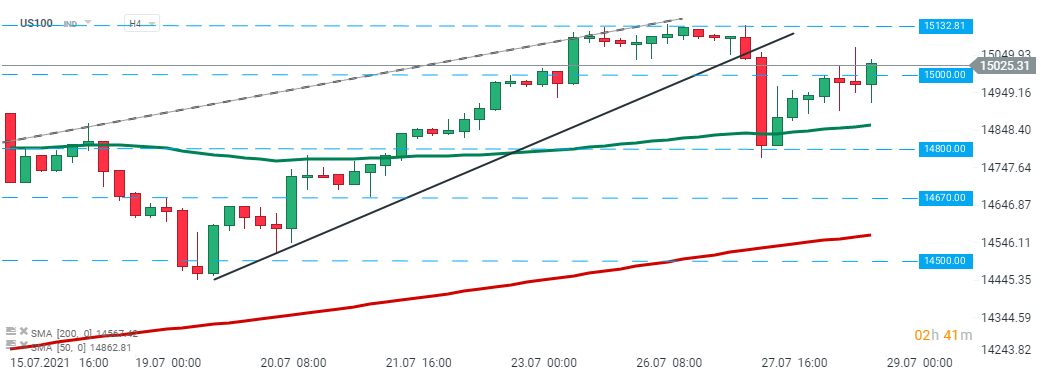

US100 broke above major resistance at 15,000 pts. Should current sentiment prevail, upward move may accelerate towards all-time high at 15,132 pts. Source: xStation5

المركزي: التحويلات المالية المصرفية تجاوزت 24.4 تريليون درهم في 2025

«مبادلة» و«الدار»: 60 ملياراً لتوسعة المنطقة المالية في «المارية»

تأسيس شركة “طيران ناس سوريا” بملكية مشتركة مع السعودية

«استثمارات استراتيجية جديدة» إس تي سي تعلن ترسية مشروع مع الصندوق السيادي السوري بقيمة 3 مليارات ريال