Qualcomm gains 6.50% after quarterly results that exceeded expectations, reflecting a revival in the smartphone market. The company reported adjusted revenues of $9.39 billion, up 1.3% year-over-year, surpassing the estimate of $9.32 billion. The adjusted earnings per share were $2.44, exceeding the estimate of $2.32.

Revenue:

- Q3 Revenue: $9.39 billion, up 1.3% year-over-year, exceeding the estimate of $9.32 billion.

- Comparison: The increase is a slowdown from the 16% year-over-year increase in the previous quarter.

- Q4 Forecast: Expected to range from $8.8 billion to $9.6 billion, compared to the consensus estimate of $9.08 billion.

Earnings Per Share (EPS):

- Q3 Adjusted EPS: $2.44, surpassing the estimate of $2.32 and marking a 6.1% increase year-over-year.

- Q4 Forecast: Expected to range from $2.15 to $2.35, with a midpoint above analyst estimates.

Qualcomm's board highlighted the company's diversification efforts and positive outlook. CEO Cristiano Amon expressed satisfaction with record QCT Automotive revenues for the third consecutive quarter. He also noted upcoming Snapdragon X launches and progress in AI capabilities across various product categories. The board also pointed out strong demand for premium Android phones in China, attributing Qualcomm's success to its competitive position. Despite challenges in the IoT sector, Qualcomm's strategic moves aim to reduce dependence on phone chips and strengthen growth in other markets, enhancing its resilience in a competitive industry.

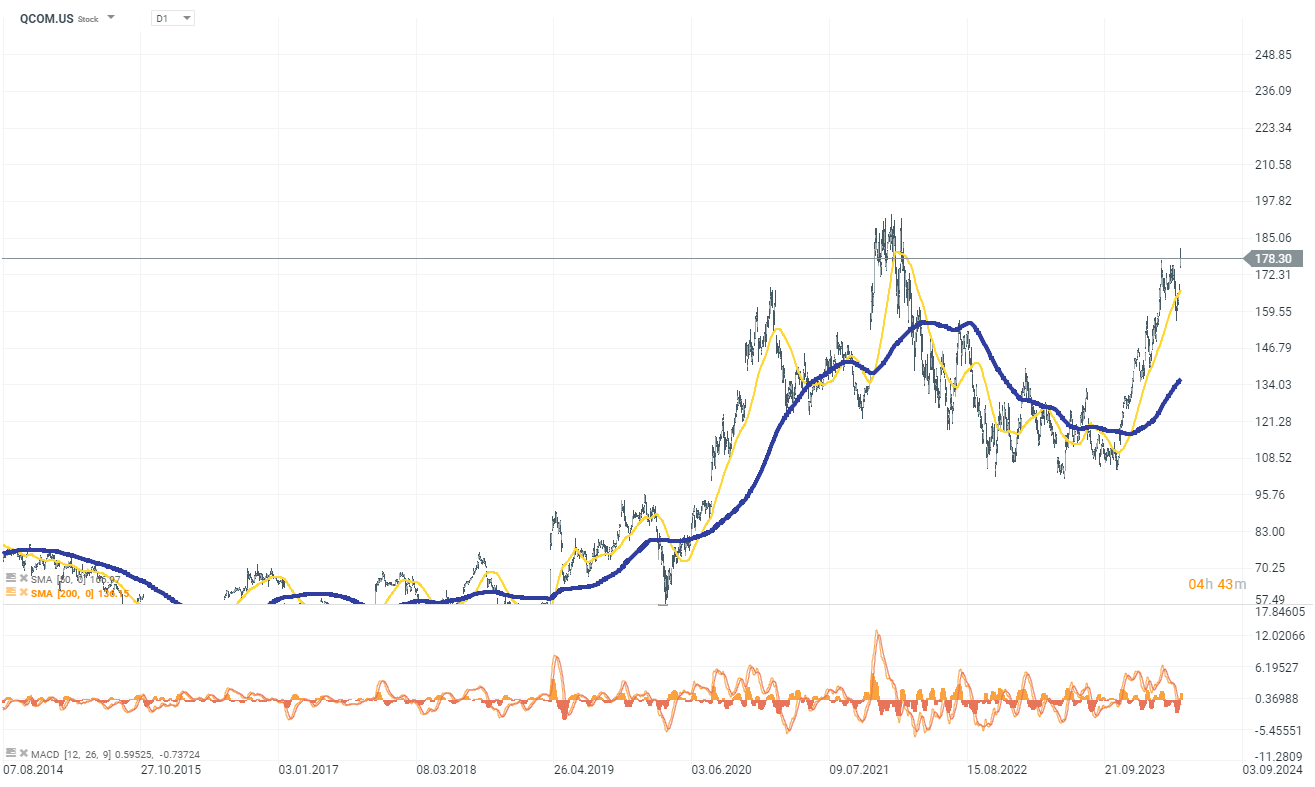

Qualcomm shares (QCOM.US) are gaining 6.50% today to $178, approaching historical highs from 2022 at around $192.

Source: xStation 5

أسهم باراماونت سكايدانس تتعرض لضغوط بعد تحذير من وكالة ستاندرد آند بورز

برودكوم آخر شركات التكنولوجيا الكبرى. ما الذي يمكن أن تتوقعه الأسواق من أرباحها؟

تواجه شركة Nvidia قيودًا جديدة على معالج H200 في الصين

إفتتاح الأسواق الأمريكية : وول ستريت في حالة نزيف