US500 and US100 are paring back yesterday's losses, EURUSD is bouncing back, and gold is trading near yesterday's open, following Powell's comments that are giving more confidence about possible rate cuts this year.

Powell indicates that the chances of any potential hikes are very low and still the Fed expects that the normalization of policy is coming. Of course, the Fed does not see progress in reaching the inflation target now, but inflation remains below 3%, causing the Fed's focus to shift more towards the labor market objective. The Fed believes that the level of interest rates is sufficiently restrictive and that their high level has caused a clear slowdown in economic growth and demand.

The market is already pricing in the chances of a rate cut in September, although earlier during the start of the speech the market was pricing in November or no cut this year at all. Powell indicates that the Fed is still confident that it will be able to bring inflation down to target, but it will be a more bumpy road than previously expected.

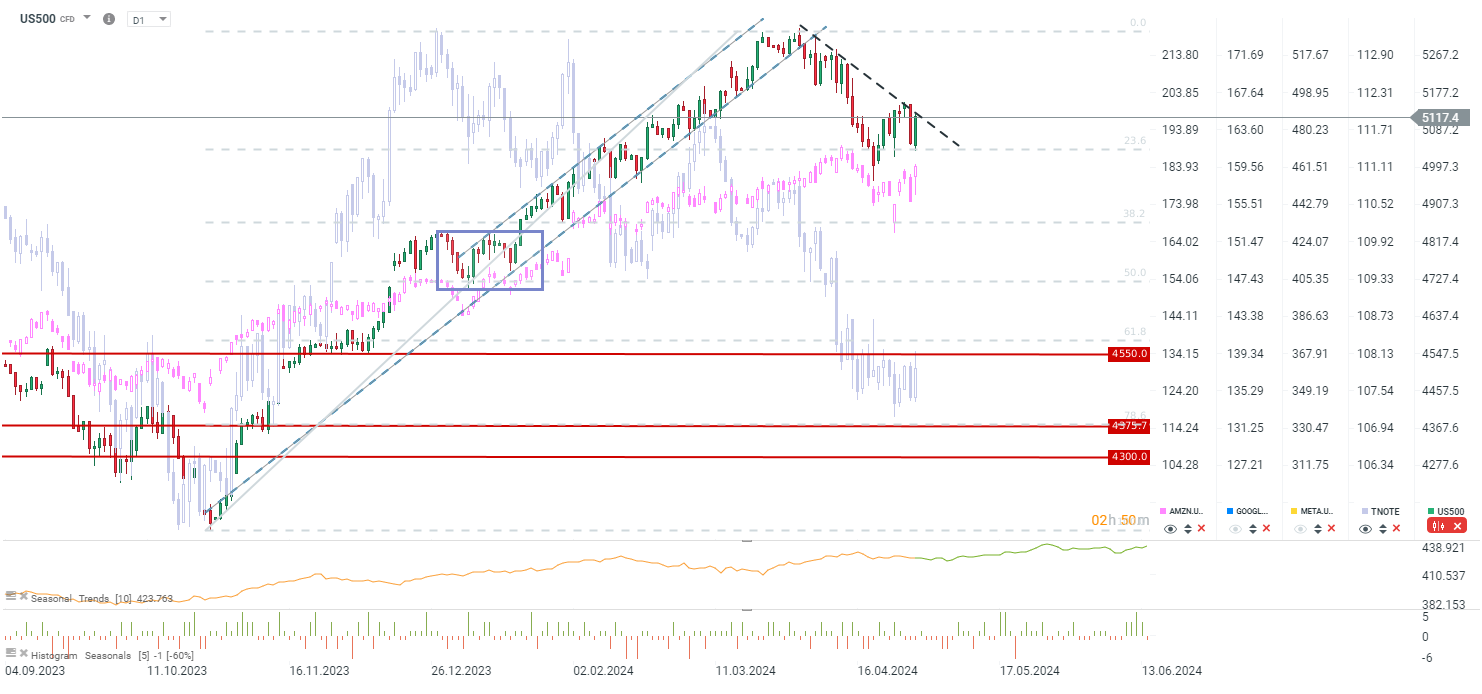

US500 is testing downward trend line and it is close to resistance close to local high at 5150. The next possible target for bulls is located at 5200 points. On the other hand the key local support is at 5040. Source: xStation5

ملخص اليوم: بيانات أمريكية ضعيفة تُؤدي إلى انخفاض الأسواق، والمعادن الثمينة تتعرض لضغوط مجدداً!

الولايات المتحدة: ارتفاع وول ستريت رغم ضعف مبيعات التجزئة

مؤشر US2000 يقترب من مستويات قياسية 🗽 ماذا تُظهر بيانات NFIB؟

مخطط اليوم 🗽 استمرار انتعاش مؤشر US100 مع انطلاق موسم أرباح الشركات الأمريكية