US Conference Board Consumer Confidence came in 100.4 vs 100 exp. and 102 previously

- According to Conference Board, average 12-month US consumers inflation expectations ticked up to 5.4% from 5.3%

Richmond Fed came in -10 vs -3 exp. and 0 previously

According to Conference Board research, US consumers expectations fell, holiday plans increased, and households opinion of the labour market and business conditions remained unchanged on the monthly basis. Futures contracts on US dollar (USDIDX) gains slightly after today reading which showed higher inflation expectations and little higher consumer's confidence. Investors are ignoring the much weaker Richmond Fed.

Source: xStation5

Source: xStation5

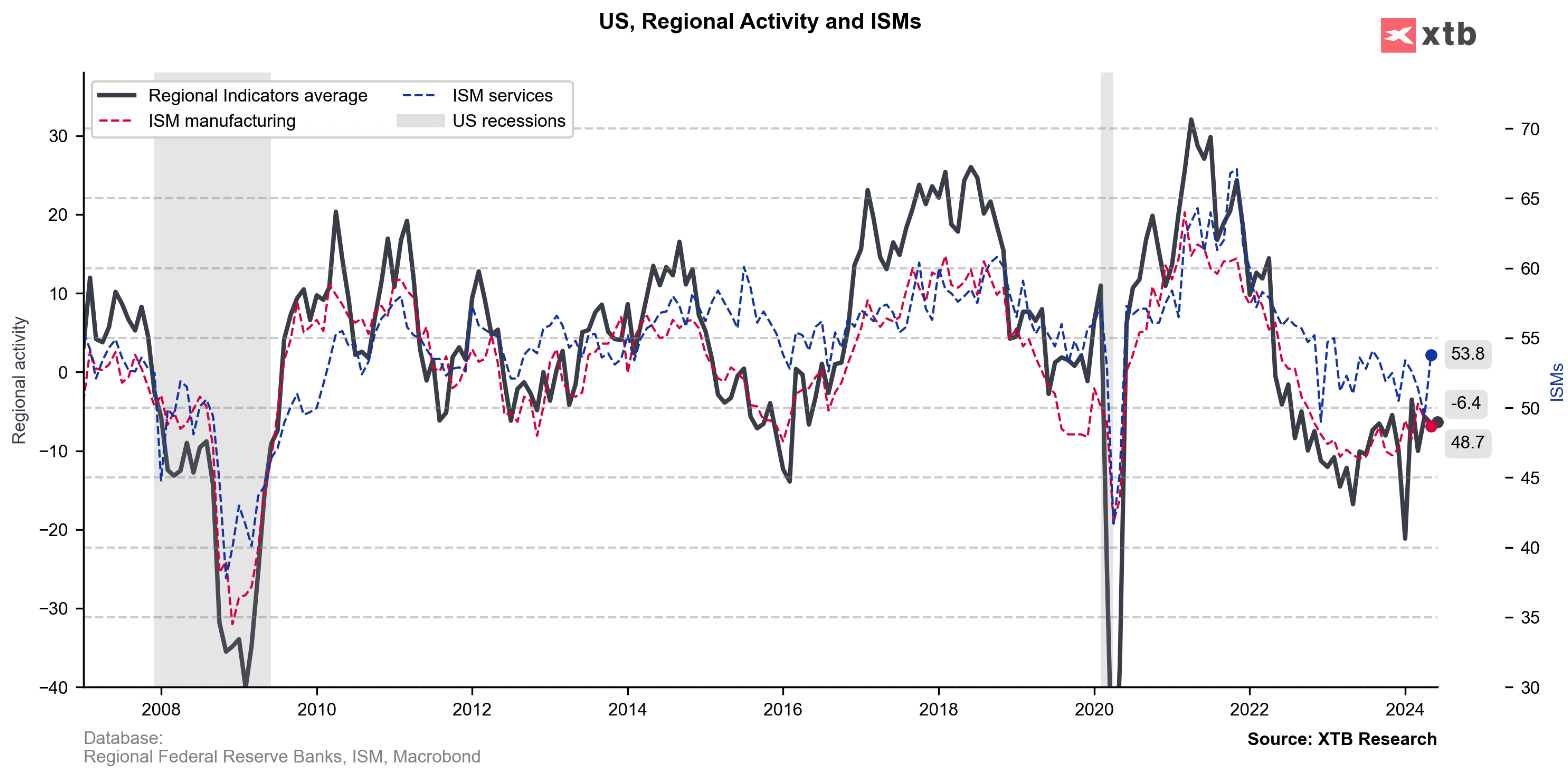

Source: Fed, ISM ,Macrobond, XTB Research

Source: Fed, ISM ,Macrobond, XTB Research

BREAKING: US100 พุ่งแรง หลังรายงาน NFP สหรัฐแข็งแกร่งกว่าคาด

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

สรุปตลาดเช้า: ดอลลาร์ติดกับดัก ตลาดจับตา NFP คืนนี้ 🏛️

BREAKING: ยอดขายปลีกสหรัฐฯ ต่ำกว่าคาดการณ์