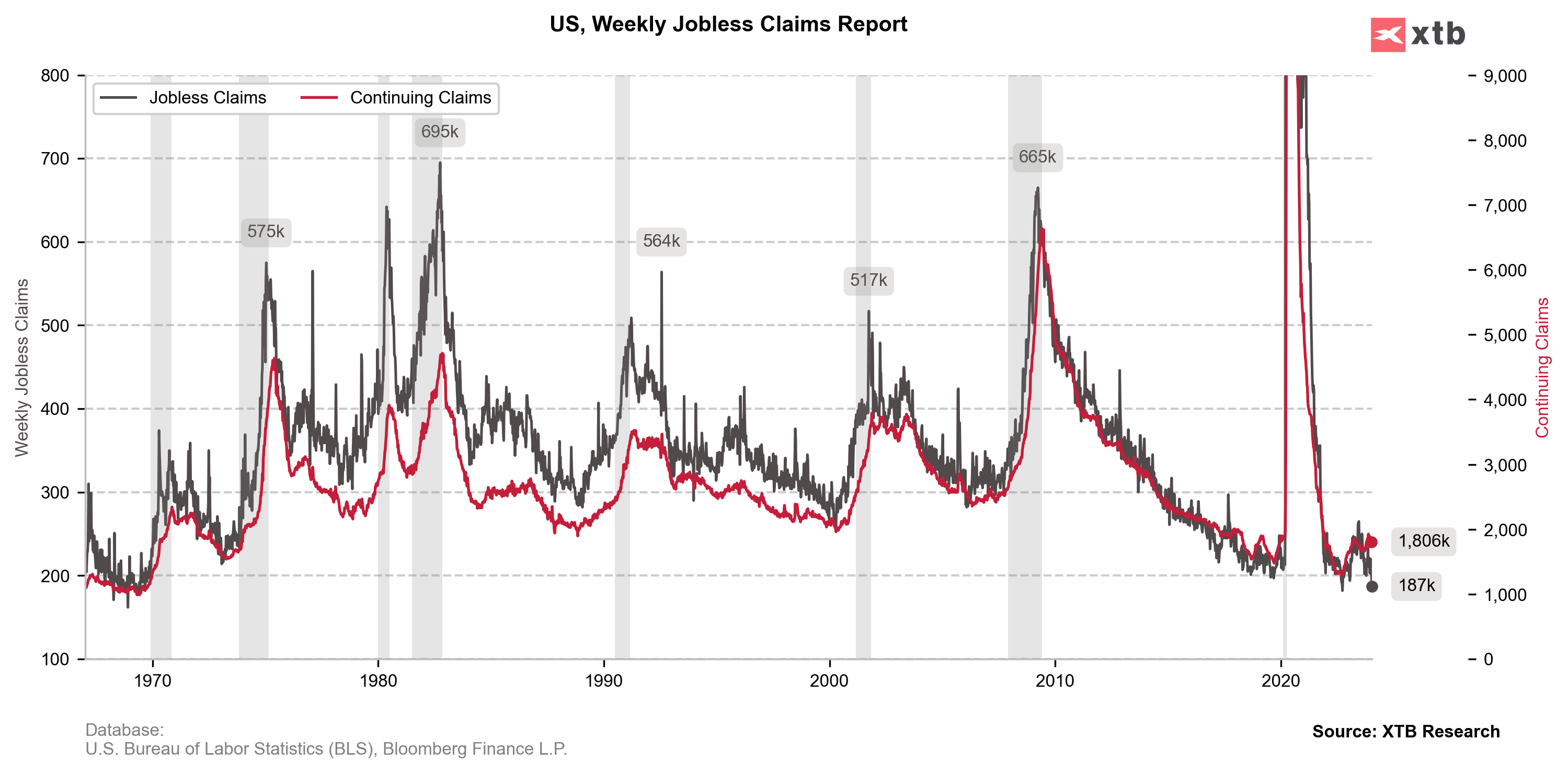

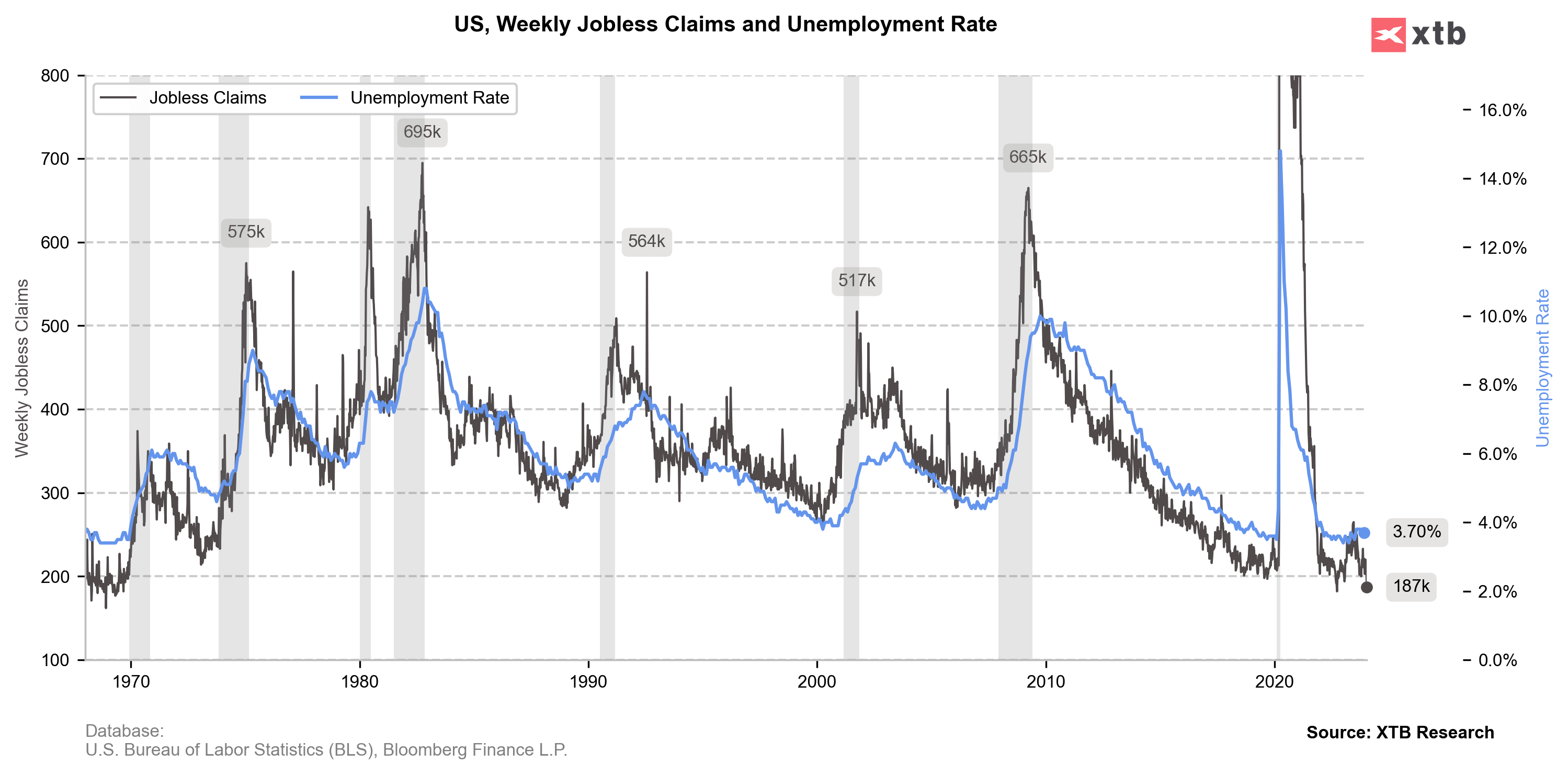

US jobless claims reading (1:30 PM GMT): 187 k vs 205 k exp. and 202 k previously

- Jobless claims (continued) 1.806M vs 1.842M exp. and 1.834M previously

US Housing starts: 1.46M vs 1.425M exp. and 1.56M previously (-4.3% MoM vs -8.7% exp. and 14.8% previously)

US Building permits: 1.495M vs 1.476M exp. and 1.467M previously (1.9% MoM vs 0.6% exp. and -2.1% previously)

US Philly Fed Index: -10.6 vs -6.7 exp. and -10.5 previously

Data showed much lower numbers of jobless claims, while Wall Street expected a slightly higher number than previously. What's more, continued claims data are also much lower than anticipated. Today's reading signals that the US job market is in very good shape, which may signal higher risk of another inflation wave, if any supply shocks occur. In the result, Fed may want to hold interest rates higher and will not cut in January, nor in March. Also, data of housing starts and building permits came in stronger than expected, despite very high real rates in US economy.

The reading of the regional Philadelphia Fed index came in lower than expected, but markets ignored those data and probably read them as less important, especially from the Fed point of view. At the same time, it's another weak, regional reading after 'tragic' NY Empire State.

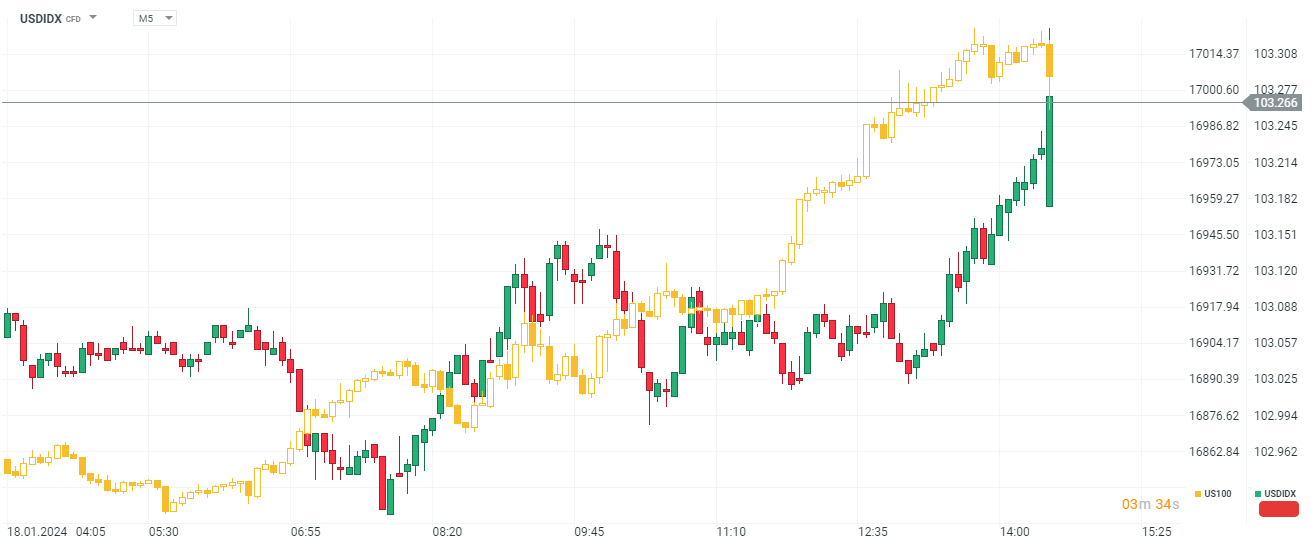

We can see that US100 loses after US job market data and US dollar (USDIDX) strengthened after huge rally in 10 year treasuries bonds which increased from 4,09 to 4.12% after today strong macro readings. Also, Fed Bostic commented that if inflation progress slows, the hawkish higher for longer policy will be justified.

Source: xStation5

Source: xStation5

Source: BLS, Bloomberg Finance LP, XTB Research

Source: BLS, Bloomberg Finance LP, XTB Research

Source: BLS, Bloomberg Finance LP, XTB Resarch

Source: BLS, Bloomberg Finance LP, XTB Resarch

ปฏิทินเศรษฐกิจ: จับตาเงินเฟ้อ CPI สหรัฐฯ เป็นไฮไลต์หลัก 📊

ข่าวเด่นวันนี้

BREAKING: จำนวนผู้ยื่นขอสวัสดิการว่างงานในสหรัฐฯ ปรับตัว สูงกว่าที่คาดเล็กน้อย

ปฏิทินเศรษฐกิจ: จำนวนผู้ขอรับสวัสดิการว่างงานสหรัฐฯ และคำกล่าวของ ECB ช่วยให้ตลาดผ่อนคลาย