01:30 PM GMT, United States - Inflation Data for June:

- Real Personal Consumption: actual 0.2% MoM; previous 0.4% MoM;

- Personal Income: actual 0.2% MoM; forecast 0.4% MoM; previous 0.4% MoM;

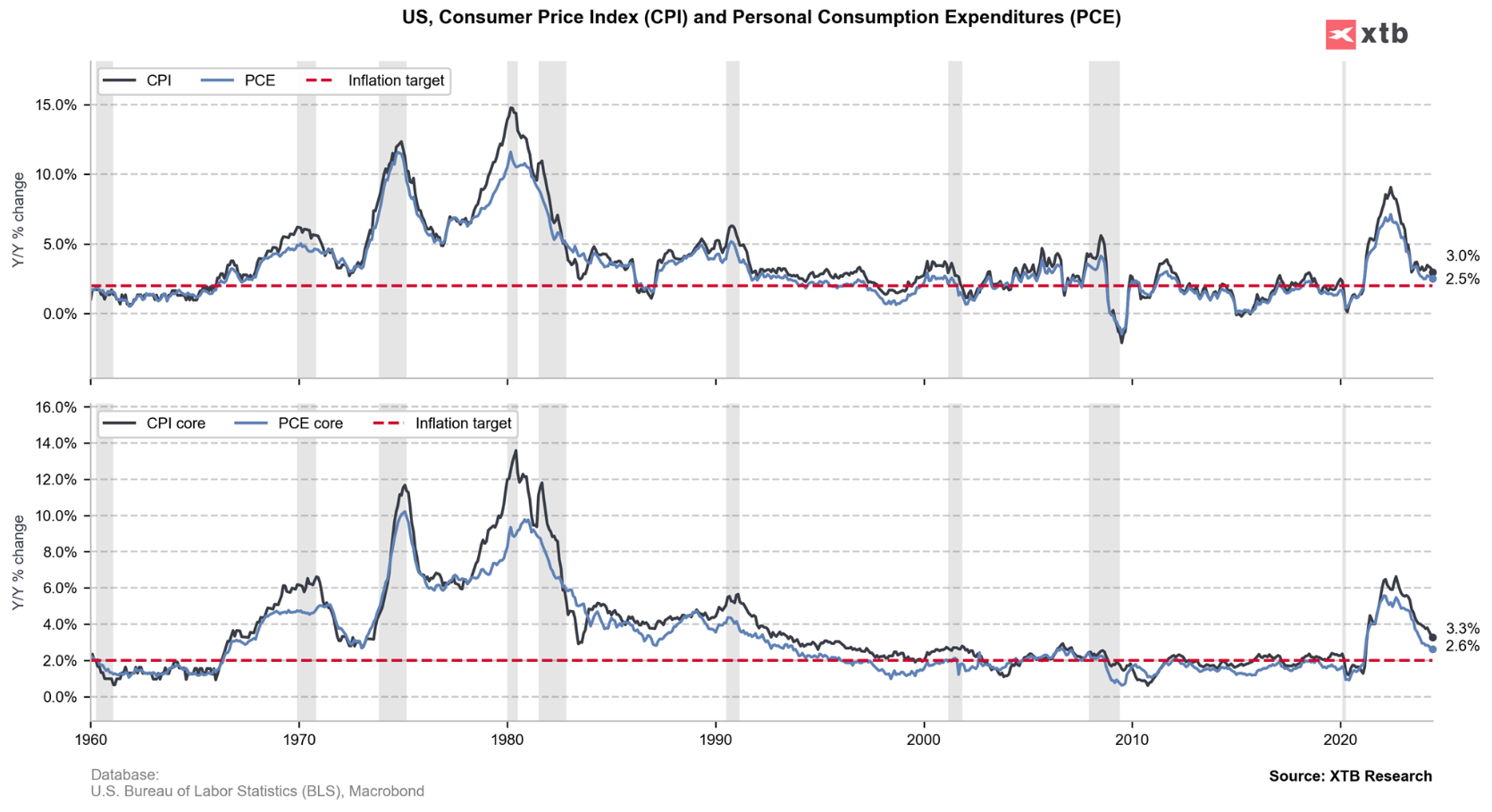

- PCE Price index: actual 2.5% YoY; forecast 2.5% YoY; previous 2.6% YoY;

- PCE price index: actual 0.1% MoM; forecast 0.1% MoM; previous 0.0% MoM;

- Core PCE Price Index: actual 0.2% MoM; forecast 0.2% MoM; previous 0.1% MoM;

- Core PCE Price Index: actual 2.6% YoY; forecast 2.5% YoY; previous 2.6% YoY;

In June, U.S. personal income rose, driven by increased compensation and transfer receipts, while disposable income also saw growth. Consumer spending climbed, particularly in services such as international travel and housing, though it was partially offset by declines in motor vehicle and gasoline expenditures. The overall price index saw a modest increase, with food prices slightly up and energy prices down. Over the past year, the PCE price index rose 2.5%, reflecting stable but modest inflation, which is relatively favorable for the Fed.

ECB Minutes: ผลกระทบเต็มที่จากความแข็งค่า ยูโร ต่อเงินเฟ้อยังมาไม่ถึง 🇪🇺

ปฏิทินเศรษฐกิจ: ธนาคารกลางปะทะความเสี่ยงเงินเฟ้อทั่วโลก

ดัชนีภาคบริการ ISM ออกมาแข็งแกร่ง กิจกรรมทางเศรษฐกิจขยายตัวมากที่สุดนับตั้งแต่ปี 2022

ตัวเลข ADP ออกมาสูงกว่าคาด แต่ไม่สามารถหนุนดอลลาร์ได้ 🇺🇸