WTI crude prices rose over 2% during today's session despite lingering concerns regarding lower demand, caused by the omicron variant. In the US, almost 2,400 flights were cancelled over Christmas, with major airlines citing the spread of omicron among crews as a reason for the disruption. In Asia, China reported its highest daily rise in local cases in 21 months over the weekend as infections more than doubled in the city of Xian and many investors fear that this may lead to introduction of further restrictions. At the same time, talks on reviving Tehran's 2015 nuclear deal resumed today, while traders also await the OPEC+ meeting on January 4th, as the group is set to decide whether to go ahead with a planned 400,000 barrels per day production increase in February.

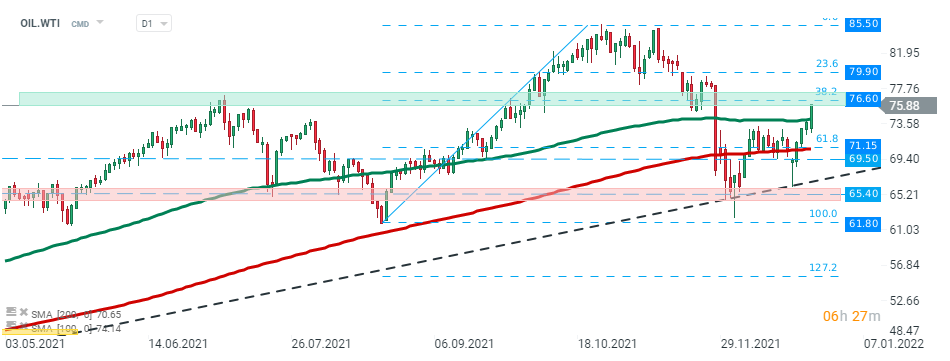

WTI crude oil price (OIL.WTI) fell sharply at the beginning of the previous week, however sellers failed to break below the long-term downward trendline and price rebounded sharply. During today’s session price broke above the 50 SMA ( green line) and psychological $75.00 level and is currently approaching resistance at $76.60 which coincides with 38.2% Fibonacci retracement of the last upward wave. Source: xStation5

ข่าวเด่นวันนี้

🚨 ทองคำร่วง 3% ขณะที่ตลาดเตรียมตัวเข้าสู่ช่วงหยุดตรุษจีน

ราคาช็อกโกแลต (Cocoa) ร่วง 2.5% แตะระดับต่ำสุดตั้งแต่ตุลาคม 2023 📉

ก๊าซธรรมชาติ (NATGAS) ผันผวนน้อย หลังรายงานการเปลี่ยนแปลงสต็อกของ EIA