Oil is continuing its rally triggered by OPEC+ actions, especially supply cut extensions from Saudi Arabia and Russia. Both countries announced 2 weeks ago that they will extend output and export cuts through the end of the year, catching markets off guard as a 1-month extension was widely expected.

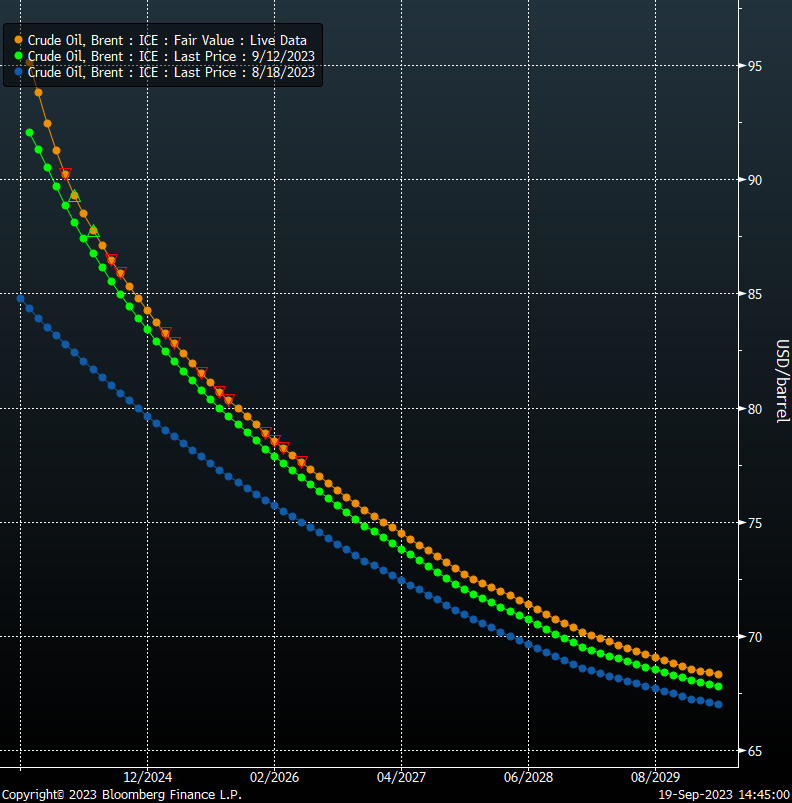

Changes in the crude oil futures curve highlight that the market may be undersupplied in the short-term and that the physical oil market is getting tighter. Taking a look at the chart below, plotting current futures curve as well as week- and month-ago curves, we can see a strong increase in the near-term contracts. Such a situation signals that either short-term demand is very strong, or short-term supply is constrained. The latter seems to be the case as there are still a number of questions around Chinese demand growth. Spread between 1st month Brent contract and 4th month Brent contract is approaching $4 per barrel - levels not seen since mid-November 2022.

Source: Bloomberg Finance LP

Source: Bloomberg Finance LP

Source: Bloomberg Finance LP

Source: Bloomberg Finance LP

Taking a look at Brent (OIL) chart at D1 interval, we can see that price is at daily highs, just a touch below $95.50 mark. Oil prices are up over 15% since late-August low and market analysts as well as oil industry insiders saying that $100 per barrel may soon be reached. However, while consensus seem to be build around forecast that $100 will be breached, it is almost equally accepted that any such breakout will be short-lived given how quick recent gains were, how strongly overbought the market is and how fundamentals does not justify such price levels. The near-term resistance to watch can be found in the $98 per barrel area - around 2.5% above current market price - and is marked with local highs from the second half of 2022.

Source: xStation5

Source: xStation5

น้ำมันถูกกดดัน ตลาดรอการตัดสินใจจาก G7

🔴LIVE: เทรดท่ามกลางสงคราม

3 ตลาดที่น่าจับตาสัปดาห์นี้

น้ำมันทะลุ $100 วิกฤตอุปทานพลังงานกดดันตลาด