The USDJPY pair is testing a key resistance and has once again risen above the level of 150 JPY per USD. Today, the Japanese yen has halted its decline, but the losses are currently not being recovered. The Japanese currency is consolidating before the next move. Today, in the first part of the day, leading officials in Japan commented about the current state of the market. However, the verbal intervention was not aimed at strengthening the currency, and politicians seem to be increasingly accepting the extremely weak yen.

Japanese Finance Minister Shunichi Suzuki refused to comment on the rapid weakening of the JPY in the market and possible BoJ intervention. The Deputy Minister of Finance for International Affairs Masato Kanda was somewhat more hawkish, noting that part of the current movements in the forex market is clearly speculative and undesirable. The statements of both politicians were rather mild and did not suggest a desire for immediate currency strengthening.

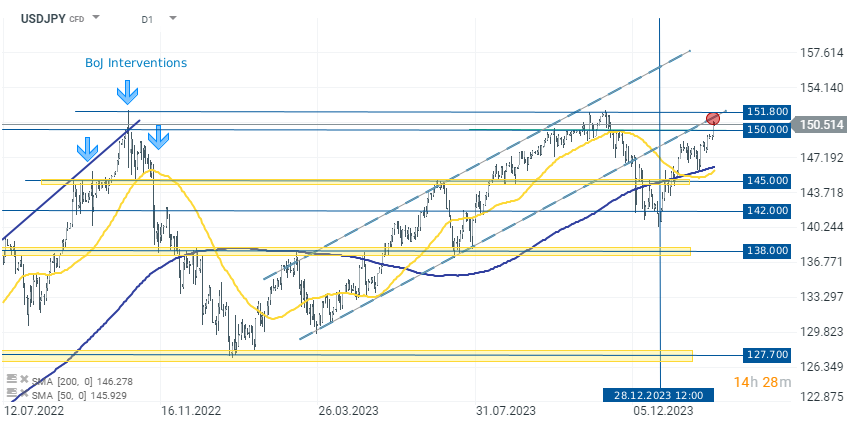

Technical Analysis of USDJPY (D1)

USDJPY has returned above the key level of 150, which, as late as the end of 2022, caused serious reactions from politicians and the BoJ. Although we do not observe such a reaction now, on the chart, we can notice testing of key levels that historically started corrections. Moreover, at the moment, USDJPY is testing from below the lower limit of the last uptrend. This zone coincides with the resistance area at levels 150,000-151,800, and if we see a stronger downward reaction here, we can expect a correction at least in the short term. For this reason, it is worth keeping an eye on the level of 151,800 as a critical point for the continuation of the upward movement and the level of 145,000 as a potential range for a possible correction.

Source: xStation 5

BREAKING: US100 พุ่งแรง หลังรายงาน NFP สหรัฐแข็งแกร่งกว่าคาด

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

สรุปตลาดเช้า: ดอลลาร์ติดกับดัก ตลาดจับตา NFP คืนนี้ 🏛️

ข่าวเด่นวันนี้